As of December 2021, Elon Musk moved the Tesla headquarters from Palo Alto, California to Austin, Texas, and it doesn’t take a rocket scientist to understand why.

In recent years, the rising cost of business operations in blue states and cities has driven owners like Musk to seek solutions that benefit their companies' financial longevity.

This mass corporate migration to business-friendly areas has changed the landscape of industry.

How does this affect you?

If you and your business suffer from high taxes and living costs, it may be time to consider joining this exodus. Picking up and moving your operations can seem like an overwhelming pill to swallow. However, as you will find, the long-term benefits of moving to a business-friendly area greatly outweigh the negatives.

As tenant representatives, at iOptimize Realty®, we have witnessed firsthand how a simple geographic change can save you significantly in business expenses. As real estate experts, we have studied how different cities and regions differ in certain costs and how this may affect you. We have found that business-friendly red states can increase your overhead by removing considerable costs associated with extra taxes and a high cost of living.

There are many factors to consider if you are thinking about moving your business to the sunbelt. This article aims to outline the main points of consideration, including expenses like taxes, cost of living, and rent. By highlighting the costs of certain cities and hotspots to move, you will find that business-friendly red states will provide you with savings on every front.

1. Lower Corporate Income Tax

Let’s talk about taxes.

Benjamin Franklin himself declared that, “In this world, nothing is certain except death and taxes." So maybe we can’t escape them entirely, but moving from one state to another can significantly decrease your average expenses in taxes.

If you’re in California or New York, you have the most to gain by moving. According to the tax foundation, you could be saving almost nine percent in corporate income tax if you shift operations to Texas.

Large corporations have already started trickling into the Lone Star State. Software giants, Oracle and Hewlett Packard, have begun moving their headquarters to Texas, reflecting a grander shift away from Silicon Valley’s regulations.

This number is only going to increase with the introduction of legislature like the Build Back Better Act. Under one of its provisions, a minimum tax of 15% will be imposed on corporations reporting over $1 billion in profits to shareholders.

Average Corporate Income Tax of Different Cities

Data According to the Tax Foundation

As you can see, Houston has much lower corporate income tax rates. Not so coincidentally, it exists within a red state. Consider how much you could be saving in yearly expenses if your corporate tax rates decrease from almost nine percent to zero percent!

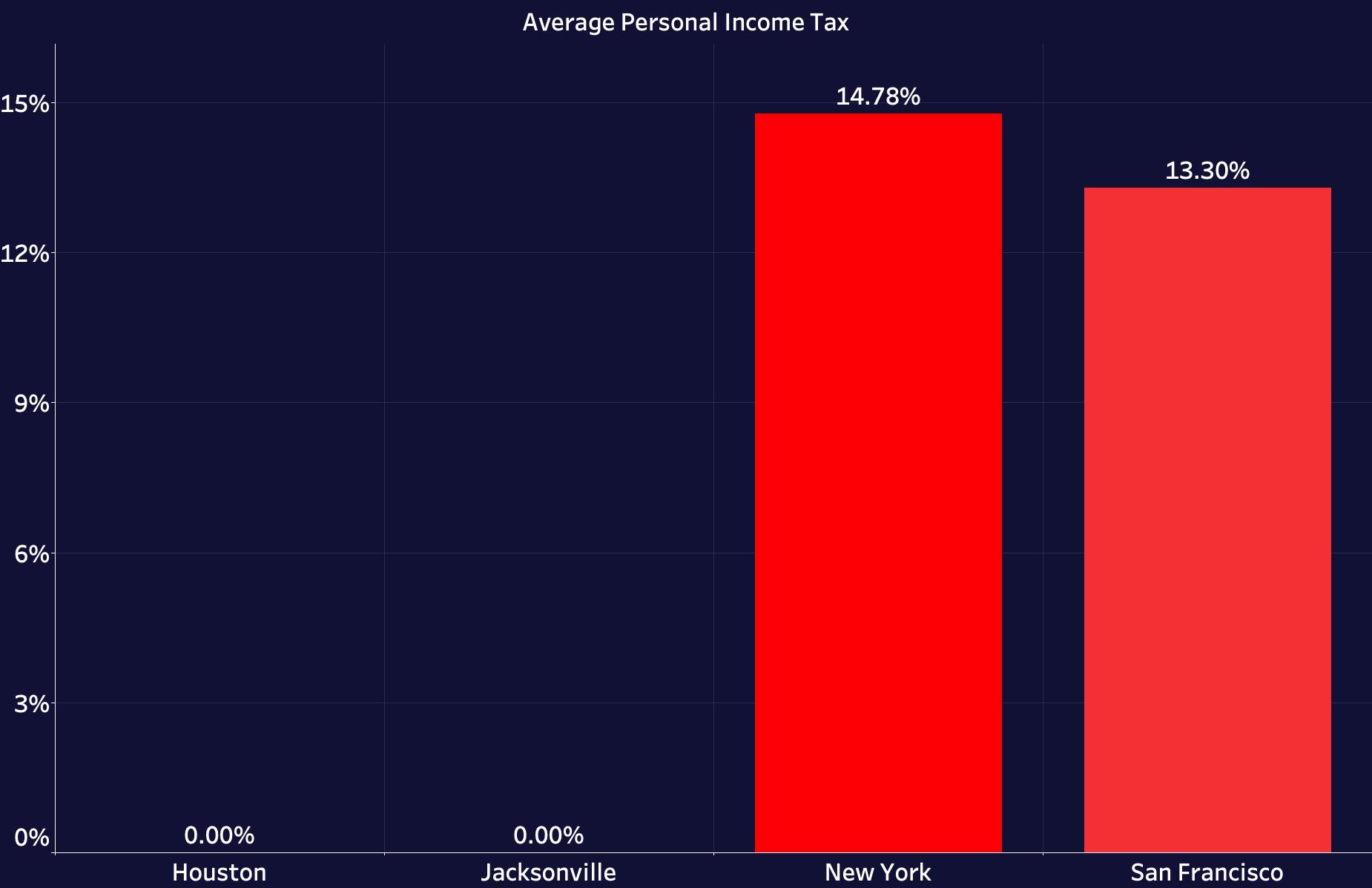

2. Less Taxes for Top Bracket of Personal Income

California’s skyrocketing corporate income tax costs have sent Fortune 500 companies packing. But, how are things looking on more personal fronts?

The Texas Constitution has barred any degree of state income tax. This has initiated a mass movement of professionals from the North to the Sun-Belt.

Similar-minded individuals looking to preserve their earnings should take advantage of this opportunity to save. The comparison of tax rates across blue to red states in this instance is astronomical.

While Californian ex-pats like Musk stand to save almost 14 percent moving to Texas or Florida, New Yorkers stand to save a degree more. According to the Tax Foundation, personal income tax in NY is nearly 15 percent.

Average Income Tax Percentage of Different Cities

Data According to the Tax Foundation

Again, the cities within blue states have dramatically increased income tax rates. Consider how different your personal overhead could look after moving from New York where you lose almost 15 percent of your income to taxes to Jacksonville where nothing gets taken out!

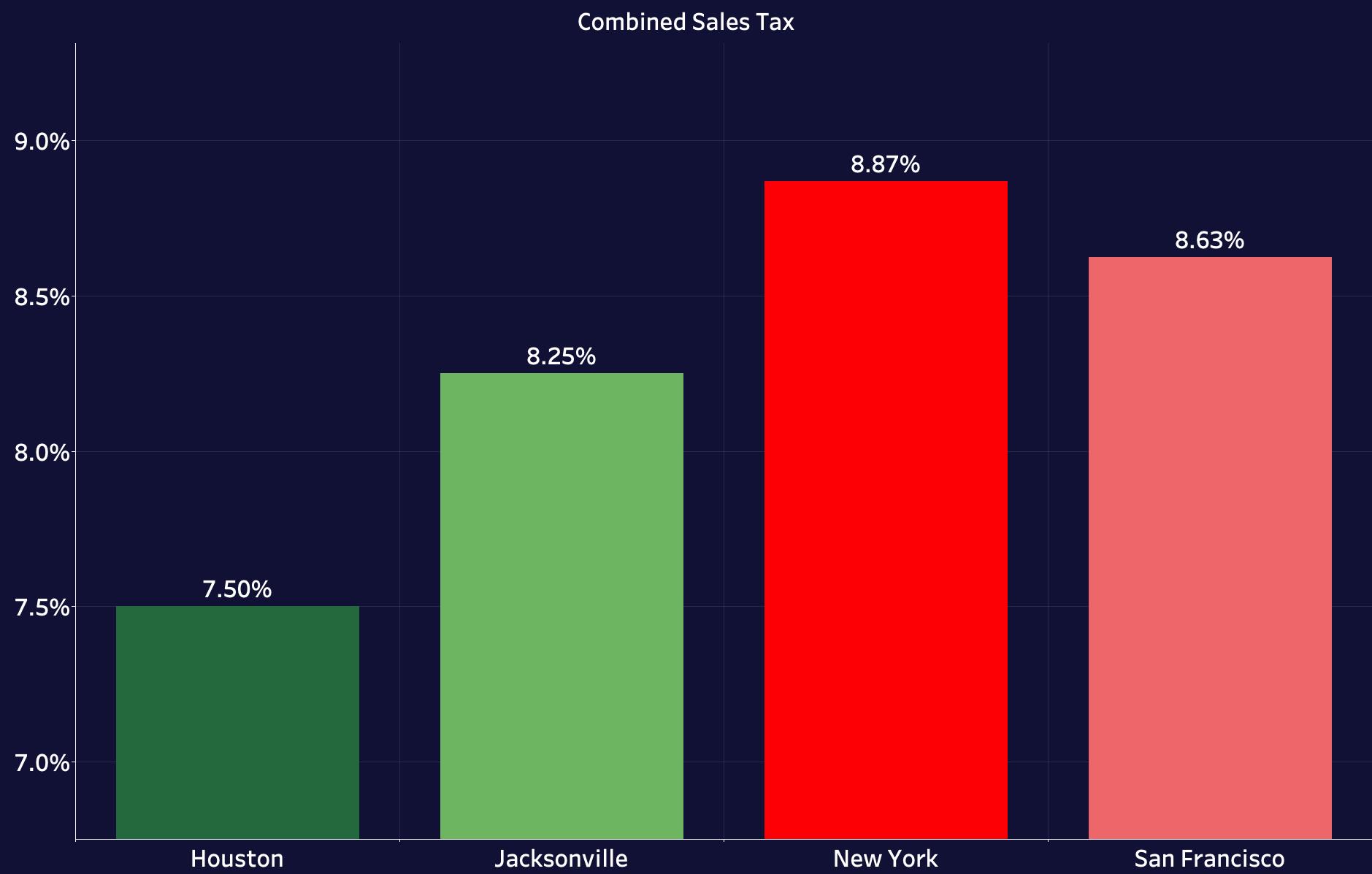

3. Lower Combined Sales Tax

Many things contribute to an area’s overall cost of living. One of the factors you must consider is the percentage of taxes that are associated with any purchase. Once again, you are going to be suffering from higher taxes in New York and California. However, the standout location with the highest rates, in this case, is Chicago. It would be neglectful not to mention its staggering 10.25% in combined sales tax.

This observation speaks to a greater phenomenon. No matter where you go, cities have considerably higher tax rates than suburbs. There are cities where the degree is lower, as you can see below, but the overall trend is that citizens of red states pay less in taxes. This is not a politically leaning statement, but a conclusion gathered from data.

Therefore, if you’re looking to cut costs in taxes, you have certain opportunities to do so. If you are not ready to make the move from blue to red states, consider shifting from cities to suburbs, where you can save in additional taxation rates. However, if you are looking for more significant, long-term savings, the data does not lie. People and corporations moving to red states are benefiting from lower taxes; why not join them?

Combined Average Sales Tax Rates of Different Cities (Percentage)

Data According to the Tax Foundation

Cities within blue states are once again suffering from added taxation rates. It may not seem like much, but going from around 7 percent tax to 10 percent for each purchase will quickly add up! That means your dollar goes further in red states because you have more money to freely spend.

4. Reduced Gas Prices

Another consideration for an area’s overall cost of living and operation is the price of gas. For the average person, gas is a considerable cost. However, for the business owner, the fluctuating cost of gas is potentially a more significant concern. This is especially true for transportation-based industries like trucking and airlines, where volatile gas prices can really make profits suffer.

Gas prices also have broader implications on the nation’s economy. When prices are higher, it decreases overall consumer spending in other realms. Therefore, if you operate in a state or region with lower gas prices, more capital is circulated throughout the market. Other than saving in cost of living, you stand to financially benefit when people have more economic freedom to spend their money as they please.

Average Gas Price Per Gallon as of 12/10/21

Data According to AAA

Gas prices influence everything from shipping costs to production rates. In blue states with higher gas prices, the subsequent supply chain will suffer, making everything more expensive. Therefore, although a dollar or two extra per gallon may not seem like much at first, consider this change on a grand scale. Blue cities like New York and San Francisco experience higher costs of living as a direct result of higher gas prices.

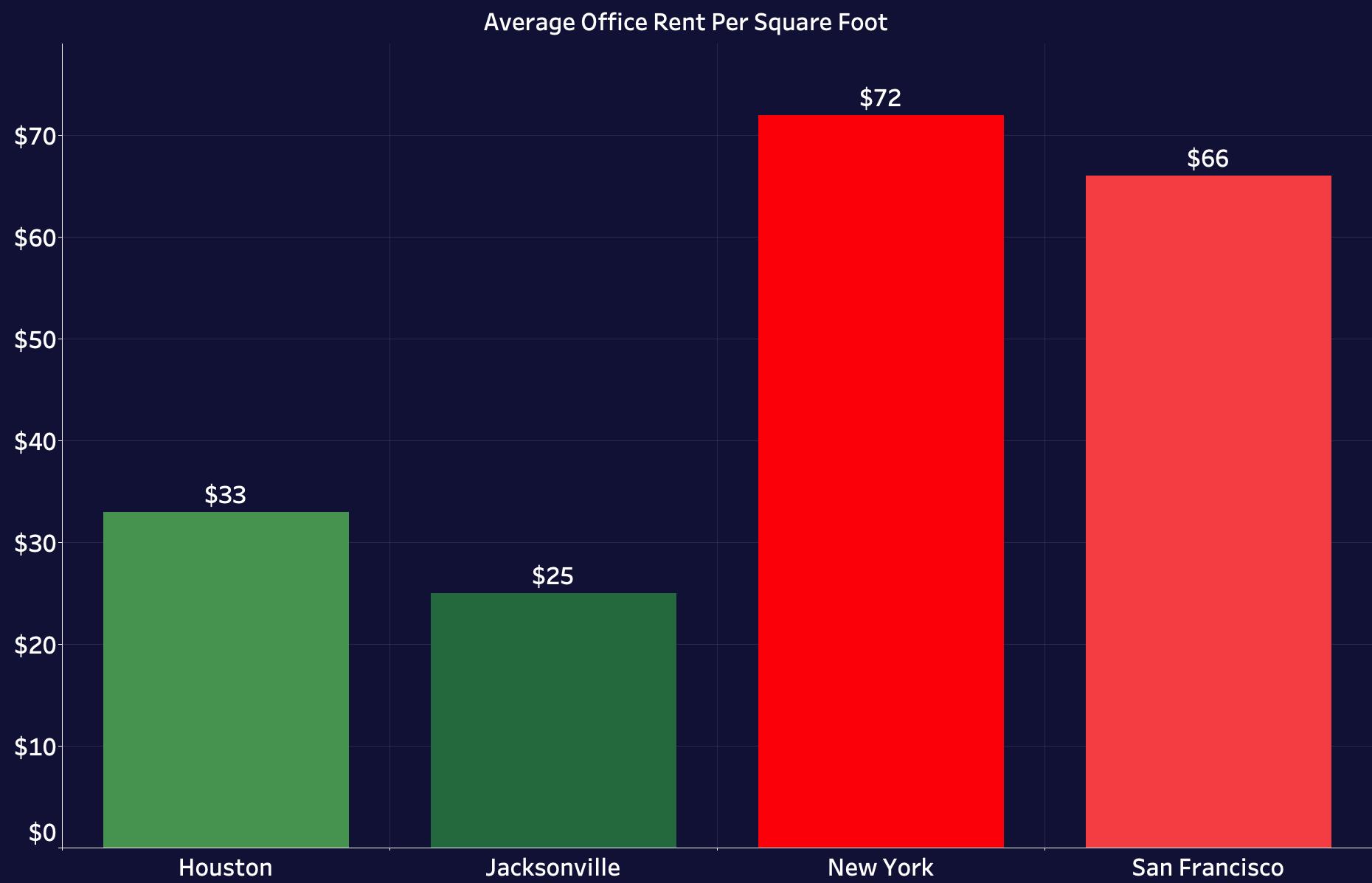

5. Cheaper Office Rent

The real estate market is going to differ greatly across regional lines. Everything is connected from an area’s average cost of living, to its gas prices, taxes, and rent. Therefore, we are going to witness rent rates in accordance with the data discussed above. Of course, you stand to save in office rent when comparing Houston to San Francisco. But do you know just how much?

Let’s break it down.

In the past, the average North American office space per employee was around 150 square feet. However, since social distancing edicts have been put into practice, the average area per employee has expanded to around 250 square feet.

Depending on your business, need, and the type of space the average square footage could vary. It could increase in executive suites or according to the floorplan. For example, there are different standard rates for open spaces versus cubicles.

For the purpose of understanding the difference in price for the same square footage in different states, we will use the iOptimize Realty industry standard of 250 feet to undergo some calculations.

If your company has 25 employees, this necessitates an office that is 6,250 square feet. In an A or B class building, this would theoretically cost you $425,000 in San Francisco. However, in Houston, the same space would go for $212,500! In Jacksonville, the price for this square footage would further decrease to $156,250.

The numbers speak for themselves, and this quick math doesn’t consider necessary shared spaces like conference rooms, bathrooms, or other office features. When you take the additional space into account, you only stand to save more at the rates of red states.

The market is rooted in supply and demand. Therefore business hotspots like New York and Silicon Valley are always going to have higher rents. However, the landscape is changing. The shift towards remote working has opened our minds to new and flexible means of business. As major corporations pick up and move to places like Texas, it is only a matter of time before the market reflects this demand. It is up to you to strike while the iron is still hot and secure your advantageous move as prices are still low.

Average Rent Per Square Foot of Different Cities (Class A/B Buildings)

Data According to iOptimize Realty® Market Intelligence

Houston and Jacksonville, cities with red states, have dramatically decreased office rent. How is it possible that the same office building square foot in San Francisco will go for forty dollars more than it would in Jacksonville? This is a monumental jump directly related to the increased cost of living and operating in blue states.

Is Relocating Your Business to a Red State Right for You?

By now, you understand that the legal regulations of red states make them more business-friendly, and thus more attractive to entrepreneurs like Elon Musk. Shifting operations to places like Houston and Jacksonville will save you big in taxes, gas, and rent costs. This increases your overall profit margin and is better for your bottom line.

You have a lot of options. If you’re not looking to shift the entirety of your business’ operations to a red state, you can consider moving only your headquarters or satellite locations. You will receive the taxation rate of the location where the majority of your business is located. That is why Tesla’s headquarters are moving to Texas.

At iOptimize Realty® we are tenant reps who have decades of experience helping our clients decide the best case for their businesses and real estate needs. We have seen first hand how companies, like yours, benefit by moving to business- friendly states.

The best part? You don’t have to make this move on your own. Tenant representatives will be there to assess your needs and walk you through the process of shifting operations elsewhere.

Looking to learn more about tenant representation? Check out this article!

Wondering where to begin?

Related Content

- Should I Move My Business to Texas? 5 Key Considerations

- What To Do With Extra Office Space: A Guide For Corporate Tenants

- The Pros and Cons of Locating Your Business in NYC

- The Pros and Cons of Locating Your Business in the Suburbs

.jpg?width=1870&name=Average%20Gas%20Prices%20(121021).jpg)