There are direct deals, and there are subleases, but can a sublease ever turn into a direct deal? This rarely seen commercial real estate move is more than a myth. If properly done, the sublease to direct deal can bring on a windfall of success for every party involved.

How do we know this? As tenant reps, we have over three decades of protecting the interests of our corporate clients in their leases. By working among tenants and landlords daily, we have seen it all (and we mean it all). As a result, we know how to skillfully leverage the value of your tenancy in every circumstance- even the rare ones. This thorough market knowledge empowers us to work on your behalf to find the most advantageous deal.

So to learn about a rarely seen yet greatly beneficial deal – read on. We will be giving away a trick of the trade that will leave both landlords and tenants satisfied.

- Subleasing basics

- How a sublease can turn into a direct deal

- Why a landlord would work directly with the new tenant

- The logistics of the direct deal

- Who benefits from the direct deal

- How a direct deal is different than an assignment

Let’s Start With Subleasing

As you know, the sublease occurs when an original tenant wishes to discard some or all their commercial space. Due to their lease’s stipulations, remaining term, and market conditions, they likely cannot find a party to assign the lease.

Therefore, they must take a loss and market the subleased space for rates far below the value of other comparable properties.

Upon finding a subtenant, the original tenant retains the legal responsibilities and financial responsibilities of the lease, regardless of whether they still inhabit the property or not. As a result, they usually act as a middleman between the landlord and subtenant. The subtenant can remain in the property for the remainder of the original lease’s lifespan.

How Would a Sublease Turn Into a Direct Deal?

Traditionally the sublease will require the landlord’s reasonable consent. This means that the original tenant must submit the information and financial statements of the subtenant. Upon learning of the subtenant, the landlord may find it more advantageous to work directly with them in some cases.

Why Would the Landlord Want to Work with the Subtenant?

The landlord must consider what is in their best interest. They are constantly evaluating the potential net value of their leases in conjunction with their sustained relationship with the bank. Therefore, if they see these green flags in a subtenant, it may cause them to rip up the old lease and start (mostly) fresh:

- The subtenant is of (substantially) greater credit than the original tenant

- The subtenant is a household name

- The subtenant wants a much longer lease than the remainder of the existing term

| The circumstances must promise a more financially beneficial arrangement for the landlord than the current lease. |

For example, let’s say that the subtenant is a name brand like Amazon. Not only would signing a direct deal with Amazon bring prestige to the landlord, but it also opens the door to more substantial future deals.

The other circumstance that may cause a landlord to start a direct deal with the subtenant is if they want a significantly longer term than the original tenant.

If the original tenant has three years remaining on their lease, but the subtenant is looking to sign for ten years, it would likely be in the landlord’s best interest to go for the more extended option. That way, they have the security of a reliable cash flow for a longer period.

So the Landlord is on Board...What’s Next?

Once the landlord identifies that a direct deal with the subtenant is a wise move for them, then negotiations can start. The two leading players in this deal are the landlord and the subtenant. The original tenant is a beneficiary of the direct deal because they can get off the hook of a lease that does not suit them.

With the understanding that a subtenant is open to a direct deal, the landlord may approach the original tenant with a proposition. They may offer to “rip up” the old lease, voiding the tenant of any of their financial or legal responsibilities in exchange for a buyout.

The buyout amount will be largely dependent on the unique circumstances of the deal at hand. However, a good rule of thumb to use is the Net Present Value (NPV) of the remaining rent obligation. The key thing to be negotiated between the landlord and the original tenant would then be the discount rate.

| The original tenant's buyout can be used to create incentives that lower the cost of the direct deal. |

The new tenant may have been initially interested in the sublease because of the below-market rent payments. Since they are forging their own, longer deal without the partial funding of the original tenant, they will likely not be able to receive the sublease’s extremely low rates. However, the new tenant can also leverage the sublease’s rates for lower rent or other concessions. The landlord also may devote the buyout fund to lower rent payments or a more significant tenant improvement allowance for the new tenant.

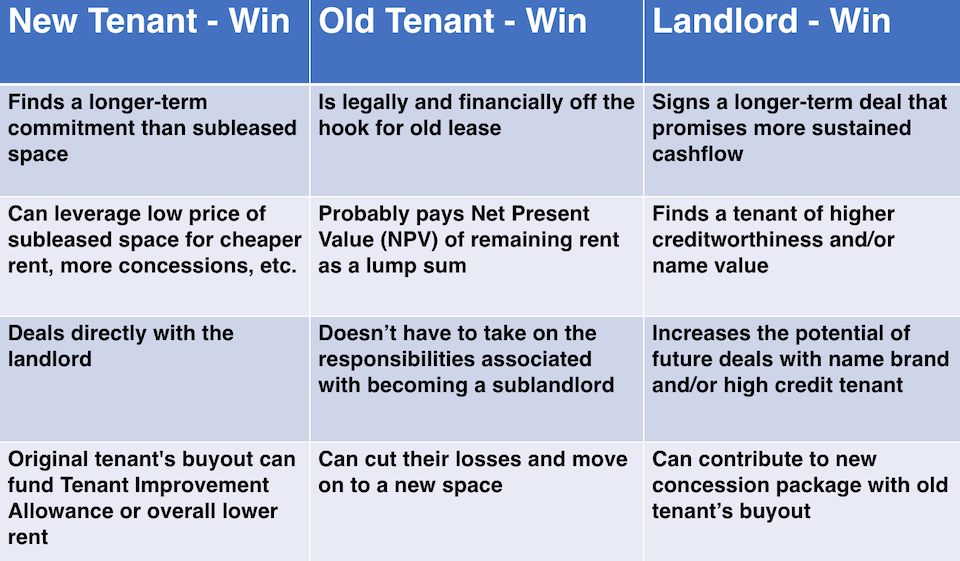

Who Benefits from a Direct Deal?

Under the right circumstances, the sublease to direct deal is a match made in heaven. If each party is willing, they will find a win-win-win situation. Here’s why each party should consider this arrangement.

The Prospective Tenant

The would-be subleaser can leverage the sublease’s low rates for lower rent and/ or more landlord concessions like TI dollars. So while they may not get the meager sublease price (which could range from ten to fifty cents on the dollar), they can still receive a below-market deal or better.

They also greatly benefit from the original tenant’s buyout. Those funds can be used to build out the space to the specifications of the prospective tenant or budget for more landlord concessions.

The Original Tenant

The main benefit for the original tenant is that they are no longer liable for the lease. When subleasing, they are still legally responsible for the space. This means they must cover the finances or any other matters associated with leasing space (regardless of whether they are still in occupancy).

When subleasing, they also take on the responsibility of acting as a sublandlord. They must act as an intermediary between the landlord and subtenant, which is a time-consuming and expensive commitment.

With the direct deal, the original tenant gets an out. Even though it will cost them initially, they can cut their losses on a space that no longer fits them and be free of a binding legal document. There is hardly a CFO who would not see the benefit from getting out of a lease that is bleeding their budget dry.

The Landlord

The landlord benefits by forging a more financially advantageous lease for them. Whether the term is longer or the new tenant is of higher creditworthiness, the landlord’s investment pays off as the lease’s net value increases.

Leases are usually hard to break. An original tenant forged a longstanding monetary commitment with the landlord. Relying on that cash flow, the landlord will likely not be willing to end the agreement. It has to be in their best interest to sign a direct deal (which is why they are so rare).

For the landlord to concede to a direct deal, you know that the new lease is also working for them. They have to get the prestige and cash flow of new, sustained tenant relationship.

Is a Direct Deal the Same Thing as an Assignment?

This direct deal is different than the assignment clause. Depending on how the assignment clause was drafted within the original lease, the original tenant may have to act as the guarantor of the new tenant.

In a direct deal, once the tenant is out, they are out. The original tenant is relieved of all responsibilities. An entirely new document is made between the landlord and the new tenant.

The landlord and new tenant will also determine the length of the new lease’s term. This also means that new clauses, stipulations, or prices can be negotiated. With the assignment clause, the existing lease is transferred to a new party as is. All clauses and prices are already set in stone.

| The direct deal allows the new tenant more freedom to outline an agreement that works for them rather than adopting an existing lease, which might not meet there needs. |

How a Tenant Rep Can Help Your Deal

As you now know, the sublease to direct deal is an exceptionally beneficial relationship in CRE. Rarely does a deal suit the needs of each party so precisely, but the sublease to direct deal covers all the bases.

If you feel that you could benefit from a similar arrangement, tenant reps are there to help. As CRE experts, we are fully prepared to serve your unique situation. Whether this means finding you sublease space, negotiating with your landlord, or walking you through lease jargon- you can be ensured that a tenant rep has the answers. Even if you don’t think a sublease to direct deal is right for you, a tenant rep is a powerful resource in finding you the best properties at the lowest prices.

Check out this article to learn more about the benefits of working with a tenant rep!