In this article, you'll learn:

- The current crisis in commercial real estate and its potential impacts.

- Key factors driving devaluations, high vacancies, and bank bailouts.

- Insights from Elon Musk and Jerome Powell on the unfolding situation.

- Essential advice for tenants in navigating the evolving CRE landscape.

“We really haven’t seen the commercial real estate shoe drop. That’s more like an anvil, not a shoe…So the stuff we’ve seen thus far actually hasn’t even — it’s only slightly real estate portfolio degradation. But that will become a very serious thing later this year, in my view.”

How’s that for ominous?

Serial entrepreneur and revolutionary businessman, Elon Musk recently drew the curtain back for how investors are viewing the possible demise of the commercial real estate industry. Because it’s appearing more and more certain that severe property devaluations, high interest rates, record low-vacancies compounded by even lower occupancies are hinting at an unpleasant reality: a bank bailout.

Let’s discuss the tectonic shifts in commercial real estate demand and why this situation has the potential to be worse than 2009.

“Commercial Real Estate is Melting Down Fast”

Elon Musk isn’t beating around the bush. He is sounding the alarm over the 63 billion dollars entangled in distressed properties and claiming that the pressure will melt down the industry.

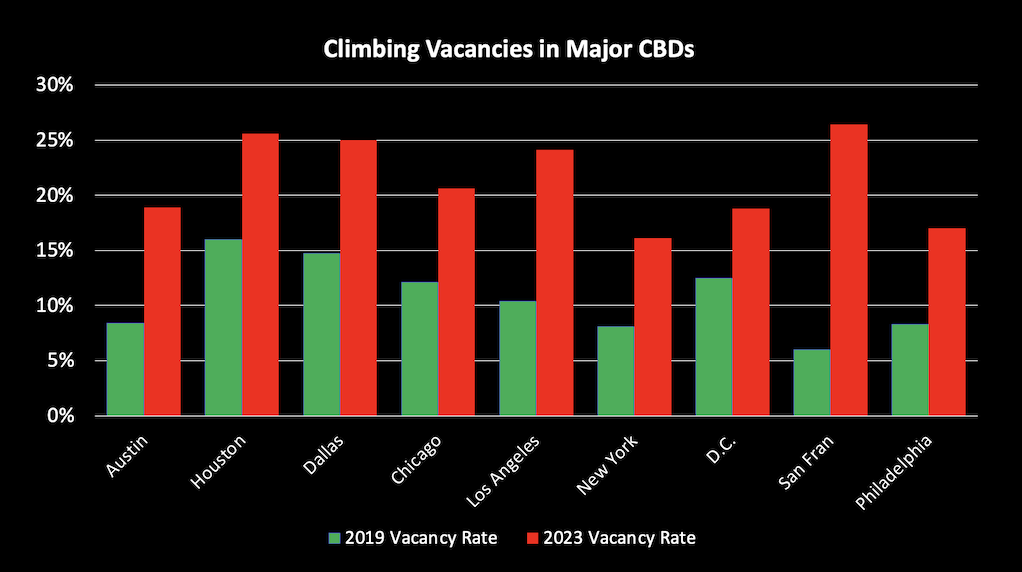

Because at this point, nearly every American city is dealing with record vacancies, specifically in office space. And with even lower occupancy rates its appearing that hybrid work, pressure building with economic uncertainty, and rampant layoffs have irreparably stunted demand for office space.

Because of widespread climbing vacancies, commercial landlords are suffering against a backdrop of oversaturated market. Their profit margins are weakening as they have been forced to become more competitive to attract long-term tenants. Because, even if they manage to secure a reliable tenant with a good credit history, they have to dramatically reduce their ROI with a generous concession package and/or lower base rent to entice them to sign a lease.

|

For many property owners, commercial buildings have transformed into potential liabilities. |

This has caused some property owners to take on more debt than they can handle. In an unprecedented situation, some major real estate holders are now defaulting on their loans, and investors are exploring more viable investment opportunities.

And thus, we are seeing a decline in the evaluation of all major property types. According to the CRE Property Price Index data by MSCI, overall CRE has been devalued 9.4% over the past year, when office is estimated at a 6.9% drop in the same time frame.

So not only are office landlords defaulting but, there is intense pressure mounting in the entire industry. Prices are falling twice as fast as they did in 2008.

Commercial Property Price Index, MSCI

And this shows that we are due for quite a lot of prospective trouble on the horizon because while 2008 entering 2009 represented an outright crisis, every issue they experienced then is compounded now by hybrid and remote work.

If too many landlords hand over the keys banks will go under. And right now, we may be witnessing the quiet before the storm. The water is being swept from the shoreline and mounting beyond the horizon where we can see. Before we know it: a tsunami will come to wipe everything out.

Bank Bailout on the Horizon?

Elon Musk isn’t the only thought leader raising the alarms.

Jerome Powell on behalf of the federal reserve recently admitted that they were monitoring the situation and concerned about CRE as the industry is poised to undergo dramatic losses as borrowing skyrockets.

|

"We do expect they’ll be losses." -Jerome Powell |

“We are watching that situation very carefully. There’s a substantial amount of commercial real estate in the banking system and a large part is in the smaller banks. It’s well distributed- to the extent its well distributed that the system could take losses. We do expect they’ll be losses. But they’ll be banks with larger concentrations and those banks will experience larger losses. So, we’re well aware of that and monitoring it carefully."

What’s concerning, is that this is the first time the Fed has released any public sentiment regarding their surety in CRE. And this is because there is now irrefutable data that the bank situation since the failing of SVB hasn’t been as stable as it’s been made out to be.

In a new emergency lending facility, the Fed constructed after the fall of SVB in March, The Federal Reserve Emergency Lending Provisions, the borrowing is rising dramatically. This program is solely intended for emergency purposes and in the past 4 weeks alone, emergency loans increased by $15 billion.

In a little over a month, the Fed has funneled in over $15 billion to avoid collapse. But it has done so without making the knowledge. Banks are anonymously triggering fed relief, well anonymous to the public at least.

But, with a tsunami of loans approaching in the next few years, more bank failures are on the horizon, and they likely won’t be so discreet. Because they are likely to be sweeping. And right now, small regional banks are in the hot seat. Get this:

|

5.3 trillion of are loans expire in the next three years, 30-35% are held by small regional banks |

If that doesn’t scare, you I don’t know what will. Small regionals are so much more vulnerable because they hold the vast majority of approaching loans. And if the recent joint bailouts taught us anything it’s that it takes a village.

A joint force comprised of the 11 largest banks in the country, Bank of America, Citigroup, JPMorgan Chase, Wells Fargo, Goldman Sachs Morgan Stanley, BNY-Mellon, PNC Bank, State Street, Trust and U.S. Bank, pooled resources to avoid a catastrophic scenario. Each put in from $1 billion to $5 billion to total a $30 billion deposit to avoid the possibility of a bank run and support any withdrawals of deposits.

How many more comparable situations can the system take before it gives?

What Tenants Should Know

The truth is, we're in uncharted territory right now. The current situation is unlike anything we've experienced before. It's a unique blend of challenges, even more complex than those during the 2008-2009 crisis, as they are amplified by the rise of hybrid and remote work.

But what is certain is that there is likely more trouble coming for the commercial real estate industry (needless to say the economic condition in general) and smart moves in your commercial real estate are even more critical. Because in some respects, it’s great to be a tenant. Whopping vacancies still empower tenants to drive once-on-a-lifetime good deals. But on the other hand, there is now a new responsibility to ensure that those deals are not too good to be true.

For tenants, more due diligence is required on their behalf to gauge their landlord’s financial standing, negotiate favorable lease terms, and navigate the complexities of lease renewals and potential landlord defaults.

But there’s quite a lot of landmines to look out for now. Especially, when it comes to your current or prospective landlord. That’s why nothing should be left to chance and an unbiased Tenant Representative is an especially valuable ally. And as the office market evolves, it's crucial for tenants to stay informed and conduct thorough due diligence. Subscribe to our blog for exclusive insights and expert advice, as our True Tenant Reps™ prioritize your interests and empower you to navigate the changing world of commercial real estate.