In this article, you'll learn:

- Why checking a landlord's Debt Service Coverage Ratio (DSCR) is crucial.

- How to calculate DSCR by Net Operating Income (NOI) and annual debt service.

- The risks of a low DSCR, including potential service disruptions.

In the wake of the Office Apocalypse, there's been a shift in the office landlord-tenant dynamic. When leasing new space, tenants are now asking to see proof of healthy finances from landlords, rather than the other way around.

Because amidst a minefield of defaulting office buildings, no tenant wants to get caught up with a landlord on the brink of collapse. Sufficient cash flow is essential to the success of a commercial property because complications arise when financial obligations must be prioritized.

Therefore, many tenants are even refusing to negotiate with landlords until they have hard evidence that the property owner or their lender has the capability to carry out a long-term lease. And the premier metric used to gauge a commercial property’s financial stability is the Debt Service Coverage Ratio (DSCR). So read on to learn why you should absolutely check your landlord's DSCR before signing that new lease.

Don't miss any information critical to the success of your CRE portfolio. Subscribe to stay on top of the latest.

What is the DSCR in Commercial Real Estate?

Before entering into a lease agreement, tenants should have a comprehensive understanding of the building’s Debt Service Coverage Ratio (DSCR), otherwise known as Debt Coverage Ratio (DCR). It is the most pivotal measure of a commercial property’s financial stability. Not so coincidentally, it is the premier standard used by banks to evaluate whether to provide a commercial real estate loan for a property to begin with.

Essentially, the DSCR measures the property’s rental income against its debt obligations. It clearly shows whether the property generates adequate cash flow to cover its debt service payments. So, if you want to know if a prospective landlord is drowning in debt, this is the place to look.

A healthy DSCR reassures tenants of a landlord's ability to maintain property standards and meet obligations, underscoring the pivotal role financial stability plays in sustaining a successful landlord-tenant relationship.

How Do You Calculate the Debt Service Coverage Ratio (DSCR)?

To calculate the DSCR, you'll need to first gather specific financial figures. The starting point is determining the property's Net Operating Income (NOI), which is calculated by subtracting total operating expenses from the property's total income.

The formula for calculating NOI is:

|

|

Once you've determined the NOI, you can proceed to compute the Debt Service Coverage Ratio using the formula:

|

|

The Annual Debt Service refers to the total amount of money required to cover the property's total debt service obligations over a year. It includes all the annual debt payments on the property, such as loan payments or mortgage.

For instance, if the property generates $100,000 in NOI and the total annual debt payments amount to $80,000, the DSCR would be: DSCR = $100,000 / $80,000 = 1.25

This means that for every dollar of debt, the property generates $1.25 in operating income to cover the debt service.

What is a Good Debt Service Coverage Ratio (DSCR)?

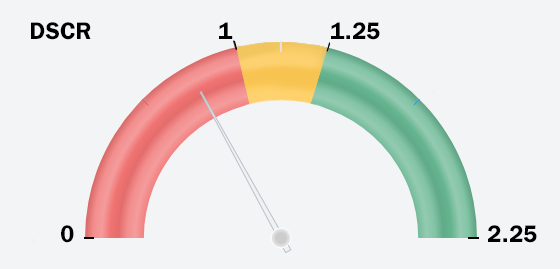

A DSCR above 1 indicates that the property's NOI is more than sufficient to cover its debt obligations. Lenders typically prefer higher DSCR values as it signifies a lower risk of default. A DSCR below 1 implies that the property's income is insufficient to cover its debt payments, which raises serious concerns for lenders and especially tenants regarding the property's ability to meet its financial commitments.

Lenders usually require a margin of at least 25% more NOI than the total Debt Service. Thus, a property must have a DSCR of at least a ratio of 1.25. Most lenders would prefer to have a ratio of 1.35 or better.

If the DSCR falls below the specified minimum, it may trigger a default event or require the borrower to take corrective actions, such as injecting more capital or increasing rents to improve cash flow.

What are the Risks of a Low DSCR?

A low Debt Service Coverage Ratio (DSCR) poses significant risks for a property's financial stability and operational capability. Failing to meet loan or mortgage payments promptly, can lead to financial distress and potential default on loans.

And in the case of a low ratio, the debt service obligations take precedence over maintaining building services. The landlords' first priorities are to pay the property taxes and the mortgage loan(s). Whatever funds, if any, are left over go to building services. That becomes a slow, painful ride for the tenants.

Because in almost all these cases, tenants bear the brunt as landlords sideline the property's everyday needs. They face a downturn in services, maintenance, and the overall experience. And this isn't just a day-to-day issue. A healthy debt service coverage ratio indicates a property's ability to handle ongoing operating expenses and plan for future capital expenditures.

Without sufficient income directed toward maintaining the property's operational integrity and ensuring future enhancements, the property risks falling into a cycle of declining standards and limited growth potential. This further compromises the property's upkeep, hindering essential improvements and tanking the valuation of the lease.

When services go down the chute, your employees lose any and all motivation they had to come in the office. Almost assuredly, this will harm your company's ability to recruit and maintain great talent. Therefore, if you are looking for a new property, ensure the landlord maintains a healthy debt service coverage ratio (something like 1.35 or better). This indicates that the property is financially stable, generating sufficient revenue to comfortably meet its debt obligations.

Why Reviewing the DSCR is Critical Today

In the current climate, the Debt Service Coverage Ratio (DSCR) holds immense importance, especially with numerous office buildings facing soaring vacancy rates. Because when a building's Net Operating Income (NOI) drops below the required DSCR due to these high vacancies, as discussed, it lacks sufficient rental income to cover mortgage payments. Consequently, this downward spiral can lead to a significant decline in property value, akin to being "underwater," reminiscent of the 2007 real estate crisis but this time specifically affecting office spaces.

When a building falls short of its DSCR, it faces the looming threat of foreclosure. If the bank doesn't receive full debt service payments, the property may be put into foreclosure, leading to the appointment of a special servicer or receiver by the court.

This scenario underscores the critical role the DSCR plays in determining the financial stability of office buildings and the potential ramifications of failing to meet this crucial financial metric. Because without including provisions like "right of offset" or other self-help rights in their lease agreements, tenants could find themselves responsible for funding additional services that the landlord ceased to provide.

These clauses empower tenants to act, such as deducting costs for necessary services from their rent or performing the services themselves if the landlord fails to fulfill their obligations. Therefore, having these protective clauses in lease agreements is crucial for tenants to mitigate potential disruptions in essential services due to financial instability on the landlord's end. But has your broker told you that? Disruptions due to landlord defaults are more common than ever since one-in-three tenants are currently at risk. So the time for safeguards is now.

Safeguard Your Interests as a Tenant

Landlords might be hesitant to disclose their Debt Service Coverage Ratio (DSCR) or agree to tenant-favored terms like the "right of offset" in lease negotiations. This reluctance can pose challenges for tenants aiming to secure advantageous terms. This is precisely where the expertise and advocacy of a True Tenant Rep™ come into play.

When it comes to safeguarding a tenant's interests, especially in complex lease negotiations or situations involving a landlord's financial instability impacting services, relying on a true tenant representative becomes paramount. A genuine tenant representative possesses specialized expertise and a singular focus on advocating for the tenant's best interests throughout the leasing process.

Unlike other real estate professionals, a dedicated tenant representative works exclusively for tenants, avoiding conflicts of interest inherent in dual agency or landlord representation. Their primary goal is to secure advantageous lease terms and protect tenants from unforeseen risks or pitfalls, such as a landlord's financial constraints affecting property services.

If you didn't learn this information from your broker, why don't you ask us more? Contact a True Tenant Rep™

We are happy to share our expertise with tenants, and you can subscribe to our blog to get tips delivered to you.