The commercial real estate industry is a sector that has witnessed mass disruption in the past decade. From the 2008 stock market crash to the current emerging prevalence of hybrid work, real estate professionals have had no choice but to adapt to ever-changing market conditions.

So, if you're still dusting your commercial properties off if they survived the first initial wave of the WFH movement, now you must safeguard them from the recession.

Along with a looming recession, for the foreseeable future WFH corporate models aren't going anywhere.These two factors go hand in hand to increase the potential for savings in your commercial real estate portfolio. So read on to cut the recession-induced dread and learn some actionable insights you can use to cut CRE costs in this unique time.

Commercial Real Estate Market Changes

Real estate was hit hard by the pandemic, with the office sector obviously experiencing the most disruption over other property types. Companies were already looking to shed extra space, and now that it’s nearly unanimous among CFOs that we're entering a recession, the demand to tighten corporate spending (especially in real estate) is even more pressing.

Al Brooks, Head of Commercial Real Estate for JPMorgan Chase clocked the likelihood of a recession in 2023 at more than 50%. While this may sound scary, it's nothing you probably didn't already know. And 50% is actually a conservative estimate. In an economic real estate poll by Morrison Foerster, 89% of respondents believed that we're either in a recession now or will be by the end of 2023.

So, what steps can corporations take to preserve their EBITDA in a recession? Take a hard look at your commercial real estate, which is typically an organization's second most significant cost.

The WFH movement allows companies a unique opportunity to save millions by reducing their physical footprints. However, not everyone is ready to eschew their offices. Commercial real estate remains a strong recruitment and retention tool. So rather than go totally remote, you can still cut costs while making your corporate properties appeal to employees. Here's how. We call it the 3R’s of CRE:

- Right-size

- Renegotiate

- Relocate

1. Relocate Your Commercial Real Estate

Extreme inflation has driven a lot of recession fears. However, since the WFH revolution has made Americans more mobile, many employees are not putting up high costs where they were located. Additionally, in a war for the best talent, many potential future employees will certainly put where they are working (geographically) at the top of their list, often above pay.

46 million people moved to a different ZIP code between February 2021 and February 2022 — the most of any 12-month period since 2010 — according to a new census bureau analysis by Moody's Analytics shared with Axios and first reported by the Wall Street Journal.

These migration patterns suggest that the tide has already turned. In a mass exodus, Americans are leaving traditional hubs of culture and industry and moving to business-friendly states and cities where they can afford a better quality of life. As a result, states with low tax rates and living costs have witnessed massive population growth. And businesses are following the moving trends.

Companies are wise to follow job growth. This is especially true since commercial real estate is a significant retention tool for talent bases. So, in business- friendly locations not only are you benefitting from a robust job market, but you can slash your overhead costs. CRE pieces in areas of higher rents like NYC, San Francisco, and Boston can go for $90 per square foot. Compare this to Tennessee, Texas, and Florida where the price for Class A office space is $50 to $70 less than that.

Let's run an example just to understand how much you can save (by only relocating): You signed your lease when prices were lower, so your base rent is $80 per square foot. If you moved your current building to Memphis, Tennessee, you could expect nearly $15 million in a five-year term, so double that for a ten-year lease!

So, relocating is an excellent opportunity to take millions off the top of your lease prices. And when is the best time to make tough decisions regarding how your current leases are affecting your bottom line? You guessed it- a recession.

A recession is the time to reassess your office needs. Plain and simple. If you still want space, you can save millions by moving to a more affordable region where talent bases are getting stronger by the day.

2. Right-size Your CRE

So, it's no secret that working from home has fundamentally altered the role of commercial real estate in work. From the rise of co-working spaces even to emerging technologies like the Metaverse, traditional office properties are no longer necessary for productive collaboration.

Businesses continue to offer remote or hybrid-friendly work environments. As such, companies have witnessed dramatic nosedives in the utilization of their corporate spaces. Unfortunately, for many, this doesn't change the fact that an office lease was signed. But, as discussed, commercial property owners have no choice but to be flexible with their tenants. So, if you're one of the few who plans to retain a physical office presence and want to sign on for a longer term, you may be able to renegotiate your space requirements.

Remember, commercial leasing revenue has fallen 17% since pre-pandemic numbers, according to Bloomberg. However, this number doesn't speak to how bad it will get in the next few years for landlords. Only 30% of tenants have had the option to renew pre-pandemic leases. So, you can be sure that there's another wave of businesses planning to ditch their offices entirely. And this new wave has CRE owners more on edge than ever, increasing the likelihood of footprint negotiation.

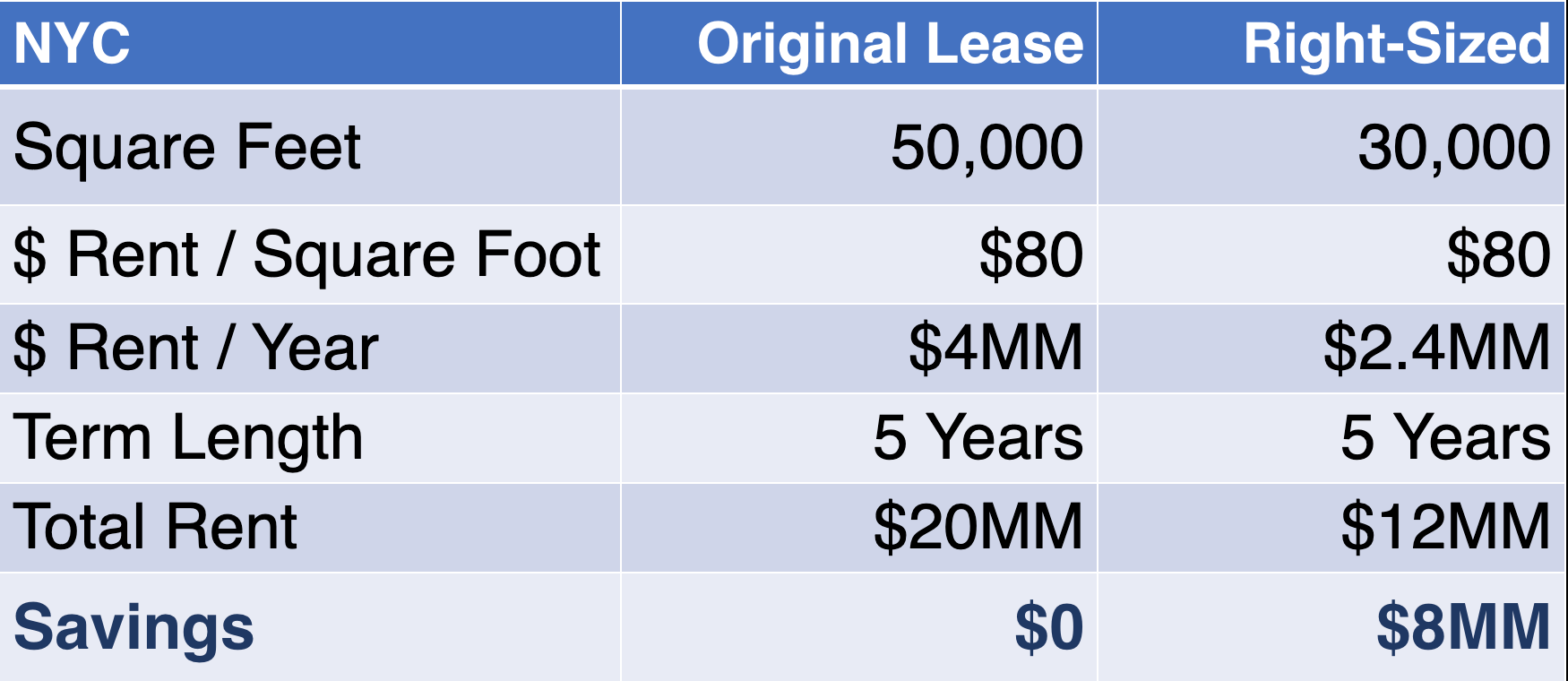

Let's see how much the same tenant could save when remaining in NY and reducing their footprint:

So, the answer to achieve economic growth despite the recession and WFH movement is to rid yourself of the strain of wasted space on your EBITDA. If you have more space than you need (which is more likely than not right now), you can take action to reduce the size of your footprint and reel back all the money lost to underused offices.

3. Renegotiate Commercial Real Estate During Recession

The current economic downtown has led to an increase in the vacancy rate for office space. This means that there are more options available, and landlords are more willing to negotiate. If you're looking to reduce costs, this is a good time to do so.

If you're happy with your current office space but are looking to save money, renegotiating your lease is a great option. This is especially true if you are approaching an option to renew. With 70% of tenants who signed pre-pandemic commercial leases yet to approach renewals, commercial real estate markets are soon to be even more saturated with tenants pulling out of their leases.

This will undoubtedly drive down the already dwindling office demand further. Market data from GlobeST points out that, "the net demand for office spaces decreased relative to supply, and the vacancy rate rose to 12.4% in the third quarter of 2022 from 12.3% in the previous quarter. Meanwhile, the office sector has the highest vacancy rate across all sectors of the commercial real estate market.”

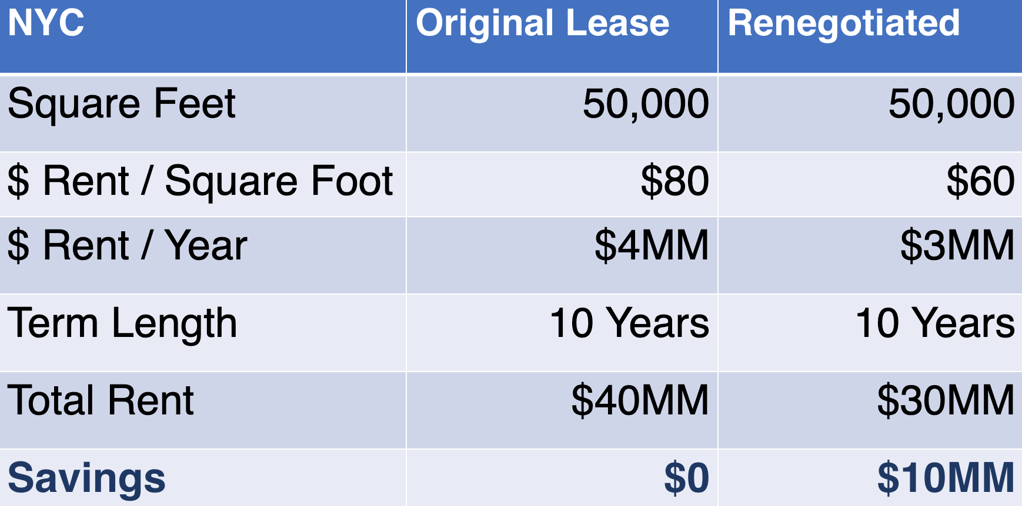

If you signed your lease in a period of high demand, you have the most to benefit from the climbing office space vacancies. Not only are you paying a high base rent determined by a period of increased demand, but the compounding escalations of previous years as well! However, never forget that you have the power to renegotiate and now is the best time to do so. Your building owner will likely bend over backward if you're willing to take on a bigger space or a longer term in this fiscal environment. So, use this to your advantage and reset your rents to current market value. You have the potential to save millions over a term.

Following the example from above: If you want to stay in NYC and renegotiate, you have the potential to significantly cut costs. But, remember your landlord won't compromise if it's not worth their while so expect to sign on for a longer term potentially.

Prepare Your CRE for a Recession with a Tenant Rep

Smart real estate moves will continue to play a critical role in the preservation of corporate EBITDA going into the recession. As discussed, as a corporate tenant you possess the potential for tremendous growth despite how the market appears. There's never been a better time to reassess your commercial real estate in conjunction with the evolving opportunities that present themselves. And, you don't have to do it alone.

Tenant Reps are CRE experts who only protect the interests of corporate tenants. At iOptimize Realty® we are true Tenant Reps. This means we never work for landlords, and we have a sole fiduciary to you, the corporate client. We employ extensive due diligence and market knowledge to capitalize on commercial real estate trends so you can retain a positive outlook (even in a recession). A Tenant Rep will analyze your portfolio and identify where there is room to relocate, right-size, and renegotiate your leases.

Ready to save millions as we enter a recession? Talk to a Tenant Rep today.

Let's face it. What's one of the biggest corporate fears about a recession? Layoffs. Luckily, smart CRE moves can avoid the dreaded money-saving method. Read how: Optimizing your CRE will Curb Recession Layoffs.