In this article, you'll learn:

- How the "Urban Dystopian Spiral" is worsening urban decline through vacancies and rising crime.

- The impact of retail closures in major cities, driven by high theft and low foot traffic.

- How lenient shoplifting laws are accelerating store closures and urban decay.

- The link between rising crime and declining office markets, prompting businesses to relocate.

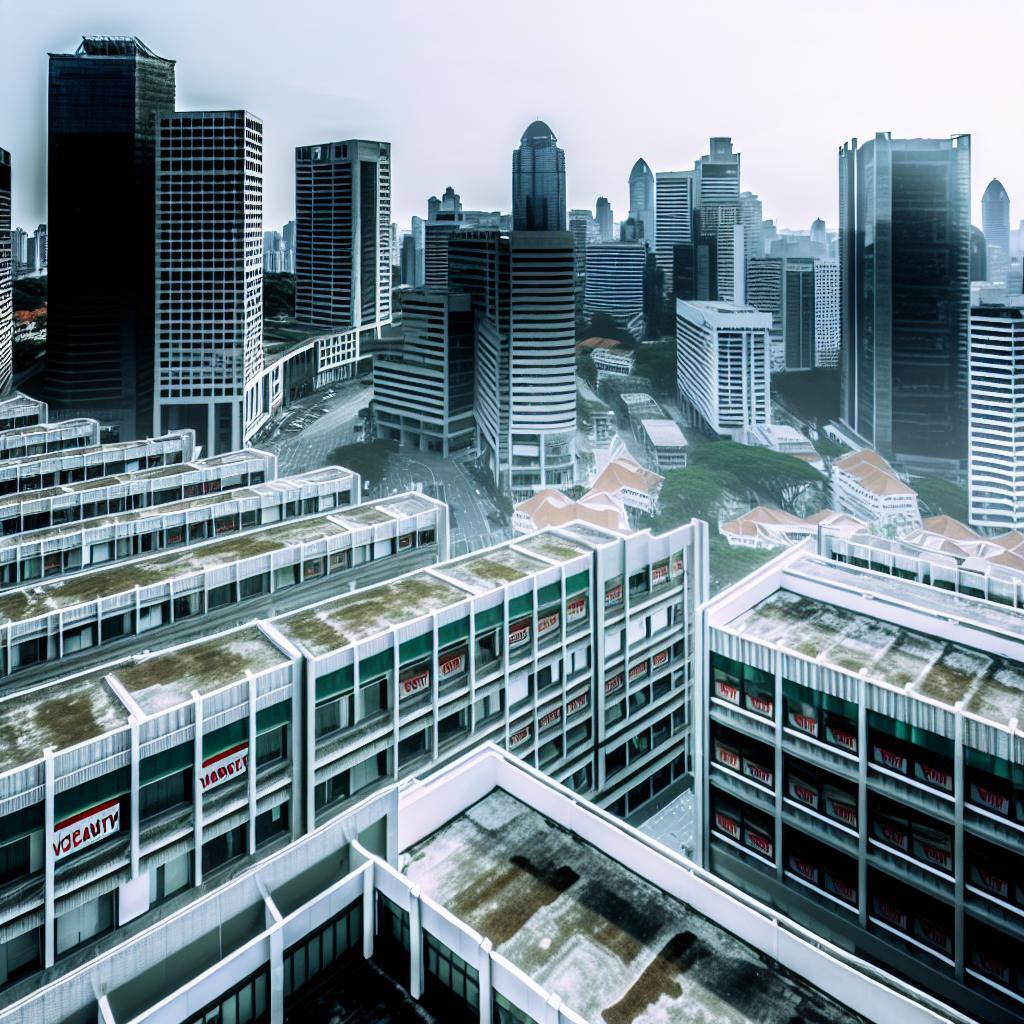

In recent months, massive retailers have announced a wave of store closures concentrated in urban areas such as San Francisco, New York City, Portland, and Seattle.

These closures are symptomatic of what has been termed the "Urban Dystopian Spiral" (UDS) and the "Office Apocalypse."

The combined phenomenon describes the gradual degradation of urban environments, exacerbated by several factors, including the loss of foot traffic revenue, the exodus of remote workers, a drop in real estate value, and the rise of interest rates, living costs, and taxes. (Which is plotted to get a lot worse when stores that provide access to basic goods and services pull their presence.)

UDS is symptomatic of a post-apocalyptic office environment. This marks a completely new territory for corporate tenants to navigate. So to avoid getting caught in the crossfire, receive all the tips and tricks you need to come out on top. Download your copy of Surviving the Office Apocalypse today.

Urban Dystopian Spiral and Rise of Crime

According to McKinsey, 58% of job holders in the United States—that’s about 92 million people can work remotely at least part time.

So, imagine the pullback in economic activity from 92 million people.

The symbiotic relationship between office spaces and local businesses, which historically fueled urban economic growth, is now in jeopardy. Underutilized buildings diminish the vibrancy of urban centers, leading to reduced foot traffic and business activity.

|

“White-collar office workers, who were likely among the highest earners had some of the most “remotable” jobs. As those workers left the office, they stopped patronizing downtown businesses, and their permanent absence reduced demand for retailers in those neighborhoods. -Connor O’Brien of the Economic Innovation Group, said to CNN |

It's a vicious spiral to the bottom because there is insufficient retail to support the needs of corporate tenants thus there are less corporate tenants to support local retail.

Additionally, low demand and occupancy rates have dropped property values precipitously. That lowers the assessed value of the properties; therefore, municipal income from property taxes will be reduced.

For example. the decrease in office attendance has led to a significant drop in office valuations, with estimates suggesting a potential 44% decline in major metros. In NYC, a 44% decline translates to about $50 billion.

The consequences of reduced property taxes are multifaceted. Reduced tax revenue strains the ability of cities to maintain essential public services, potentially leading to a decline in overall quality of life. And thus, we see the rise of crime.

And of course, the areas struggling with the pullback in spending and attendance the most are concentrated in population-dense cities. Because hurt that is associated with lack of foot traffic and interaction will be felt most strongly there.

So, is it just the next logical step in the sequence for stores to close in those areas?

Widespread Retail Closures

In an environment with fewer people to habituate, retailers are pulling back.

And a significant factor driving these closures, as highlighted by retailers like Target, is the “unsustainable business performance” in the areas where the closures are taking place due to high levels of crime and theft.

And this isn’t happening in a void because at the same time that the UDS is worsening, we’re seeing the simultaneous reduction in punishment for shoplifting in cities like San Francisco, New York, and Chicago.

In these urban centers, shoplifting merchandise valued around $1,000 has essentially been decriminalized.

When such acts are considered crimes, they are often treated as misdemeanors that rarely result in prosecution. This leniency has emboldened shoplifters and made it increasingly difficult for retailers to operate sustainably.

For example, in San Francisco, where robberies are up 44%, three of the city's four Targets have closed. The fourth is likely not far behind as it's struggling to keep up with shoplifting, homelessness, and, locking it's items behind plexiglass.

And as retailers struggle with an environment characterized by high theft, closures throw more gasoline on the degradation of urban centers.

The loss of retail presence will further reduce foot traffic, drain local economies and ramp up the UDS negative feedback loop. The combination of economic strain, reduced consumer activity, and heightened crime rates presents a complex challenge for urban revitalization efforts.

Unfortunately, most of these planned closures are in already suffering areas.

An overwhelming majority of the planned closures are already concentrated in food deserts. CVS, Rite Aid, Walgreens, Walmart, and Target are among the giants planning to close locations, essentially making these areas where they’re concentrated also pharmacy deserts.

This is an amplified version of the Urban Dystopian Spiral. Already struggling areas plummet in life-quality when businesses pull their presence and money. Because on top of being food deserts now, they are now being set up to be pharmacy deserts.

And what do you think will happen to the office markets in these areas? Lack of basic supplies and external amenities will make any business district with these conditions a ghost town.

See the following table for a breakdown of the major chains planning to close stores throughout 2024.

The reality is safety and lack of basic amenities have become perhaps the biggest factors when considering where to sign a 10+ year lease.

Because in the shifting priorities of recent years, what has stayed the same is the expectation that people are being taken care of. And the data shows that there is now a tangible divide in the return-to-office rates across areas of high and low crime.

Offices in areas of high or rising crime have seen the most pushback in return-to-office efforts.

|

“Crime risk index developed revealed that hardest hit buildings nationwide had an average score that was 11% higher than for other buildings in their market, whether downtown or suburban. The crime score was the biggest external driver of what makes a hardest hit building.” -GlobeSt |

And now massive retail closures have furthered the negative effect on an already depressed office market. Because the cities with the highest levels of retail theft overwhelmingly have high vacancy rates in the office sector, specifically downtown or business districts.

For example, Starbucks recently closed 7 locations in San Francisco’s mission district. So, inhabitants and office tenants can’t even get a simple cup of coffee.

Note the following table to see the rank of cities with the most organized retail theft and how their office vacancy rates compare:

Takeaways for Office Tenants

With the changing expectations of the last few years has come a massive corporate exodus. Businesses in crime-ridden neighborhoods have reached a breaking point. As a result, they are fleeing their old regions of high cost of living, taxes, and crime.

This is also partly because they are following population migrations since people have more freedom to be mobile with remote work. Employees don't want to put up with dangerous areas and are actively leaving for other jobs that can guarantee safety (which really should be a bare minimum for CRE).

It is critical for business owners to be aware of these trends when making decisions about where to locate their businesses. Because alternatively, the slowing demand gives tenants who do want to be located in these cities a new opportunity to capitalize on the slew of properties hitting the market.

But selecting a safe location is only a small piece of the puzzle when finding the perfect office lease for your business. In this new environment, corporate tenants need more due-dilligence than ever, Because while there is danger around every corner, the savvy tenant can seal the deal of a lifetime. So stop surviving and start thriving in the Office Apocalypse. Download your free handbook today.

Wondering where to begin?

Related Content

- 2024 Mid-Year Office Market Outlook for Corporate Tenants

- How Crime is Linked to the Probability of Default Risk: Office Buildings

- What Will Happen to Offices in Central Business Districts?

- How iOptimize Realty® Helped Coca-Cola