In this article, you'll learn:

- The dangers of CPI rent escalations and their impact on costs.

- How fixed percentage increases offer predictability in leases.

- Hybrid escalation systems that combine fixed rates and CPI.

- The advantages of negotiating rent bumps for flexibility.

The "Rent Escalation Clause" is one of many lease clauses that can cost your company millions. In the world of commercial real estate, there is a myriad of lease clause pitfalls corporate professionals can fall into that may lead higher-ups to say ..."And, who did this lease?".

There are four basic types of rent escalations:

Of the four, the CPI and variations of it are the most dangerous.

As Tenant Reps, we know when landlords try to pull the wool over our client’s eyes. Our market knowledge stops their tactics dead in their tracks to lead you to informed, optimal CRE decisions.

Let's look at an example of how dangerous poorly negotiated lease clauses can be by discussing rent escalation.

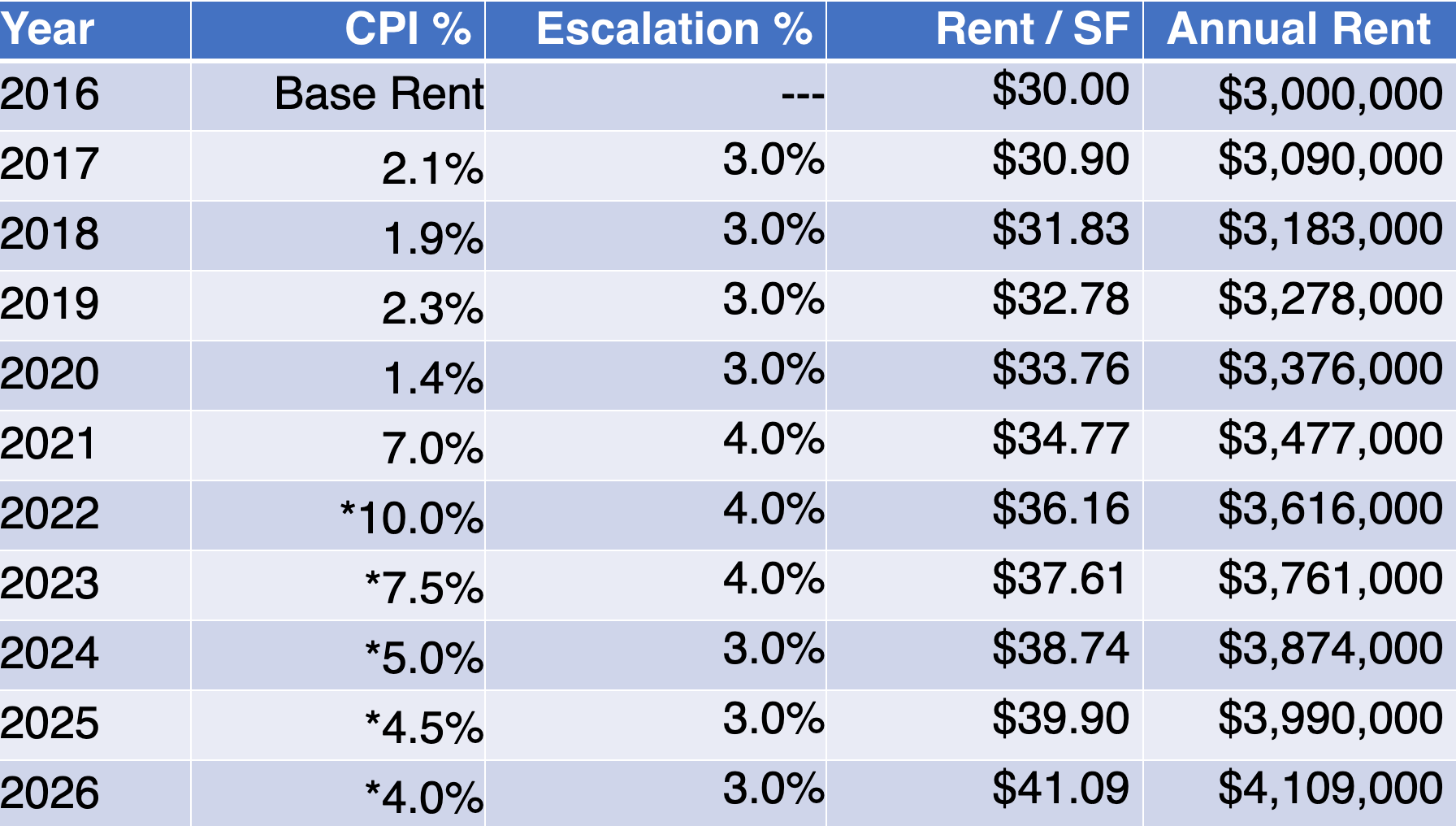

The Dangers of a CPI Escalation

Landlord Sam offered you a lease with a rent increase based upon CPI. But, landlord Sam says, "It's just to keep the rent up with inflation."

Well, this suggestion may not sound too unfair because rent escalations exist in the first place to prevent the erosion of the landlord's cash flow due to inflation.

When inflation ran around 2% per year, year after year, escalations according to CPI didn't seem unreasonable. But, if you signed a lease with this type of rent escalation, then Landlord Sam went away, clicking his heels, and gave a good attaboy to his broker. While you have just inherited the risk of future bad events.

Why was this such a mistake?

Because runaway inflation will cost your company dearly. To explain what went wrong (and what you could have done instead), let’s compare the different rent escalations.

First, no matter the type of rent escalation, they are all cumulative. This means that the rental rate for each consecutive year of the lease is escalated based on the previous year's rate, not the base rate from the first year of the lease term.

Consumer Price Index (CPI)

As most know, the CPI is an index that measures the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care.

There are different CPI indexes, and the landlord may want to furthermore choose one that benefits them best. Unfortunately, this leaves your company extremely vulnerable to the negative side effects of inflation.

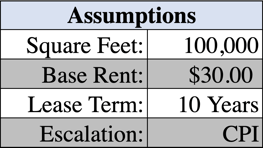

(* Estimated)

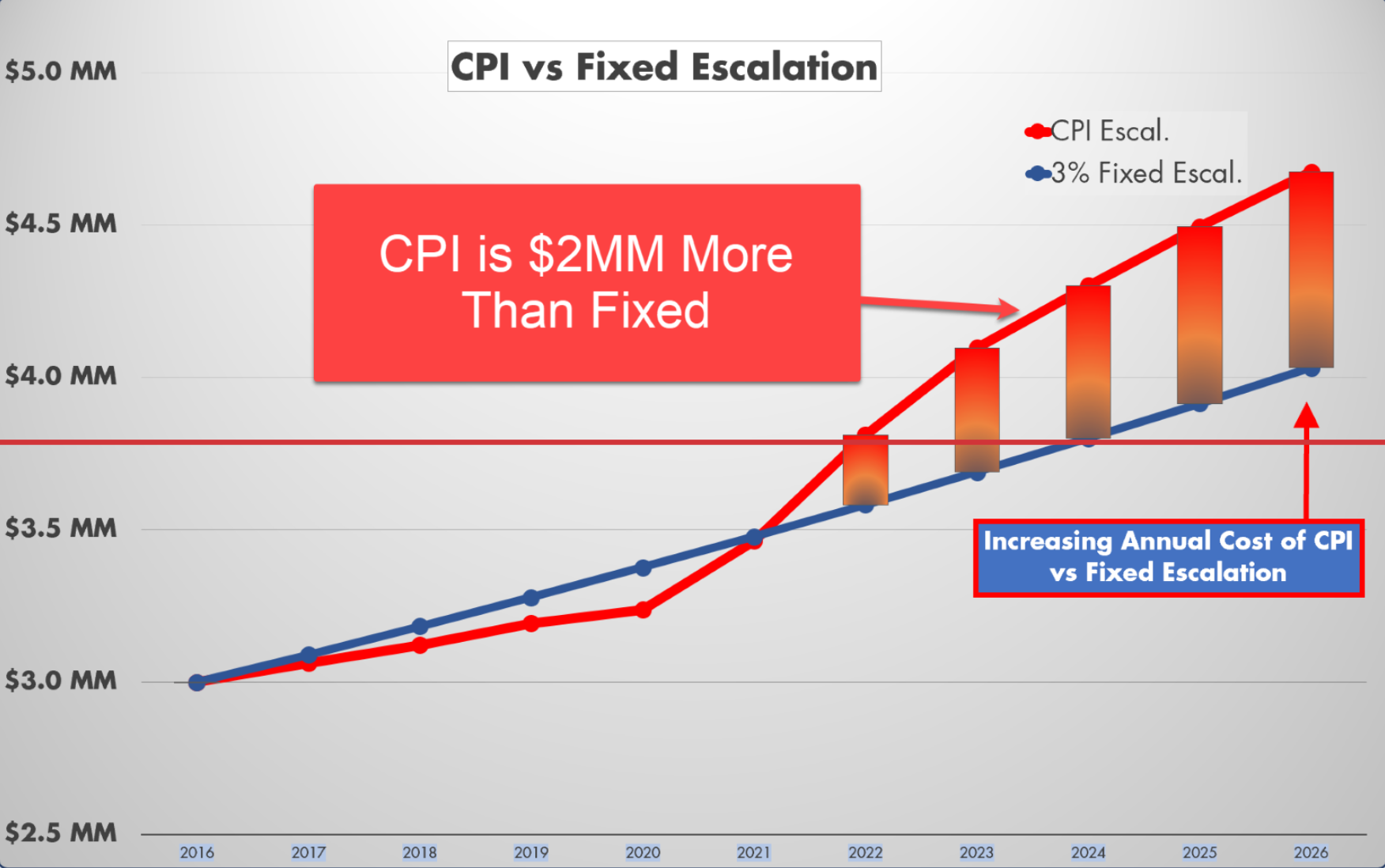

In our example, initially, the rent escalates at a slower rate than a fixed escalation of 3%. However, it is not long before the tables turn, and your CRE budget is suffering as your landlord benefits while your company has inherited the risk.

And remember that it is compounding, so even if the CPI comes down in subsequent years, it still has established higher annual rents for the remaining years.

Fixed Percentage Increases

Fixed escalation percentages are predictable and, therefore, are the most suggested by Tenant Reps who know their stuff at the negotiating table. Their clients know what they will be paying throughout the entire lease.

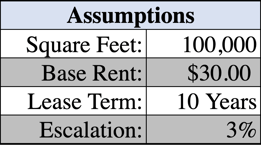

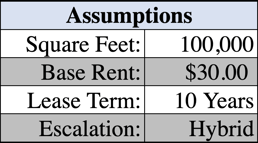

Here's an example of a Fixed Percentage Escalation in a lease:

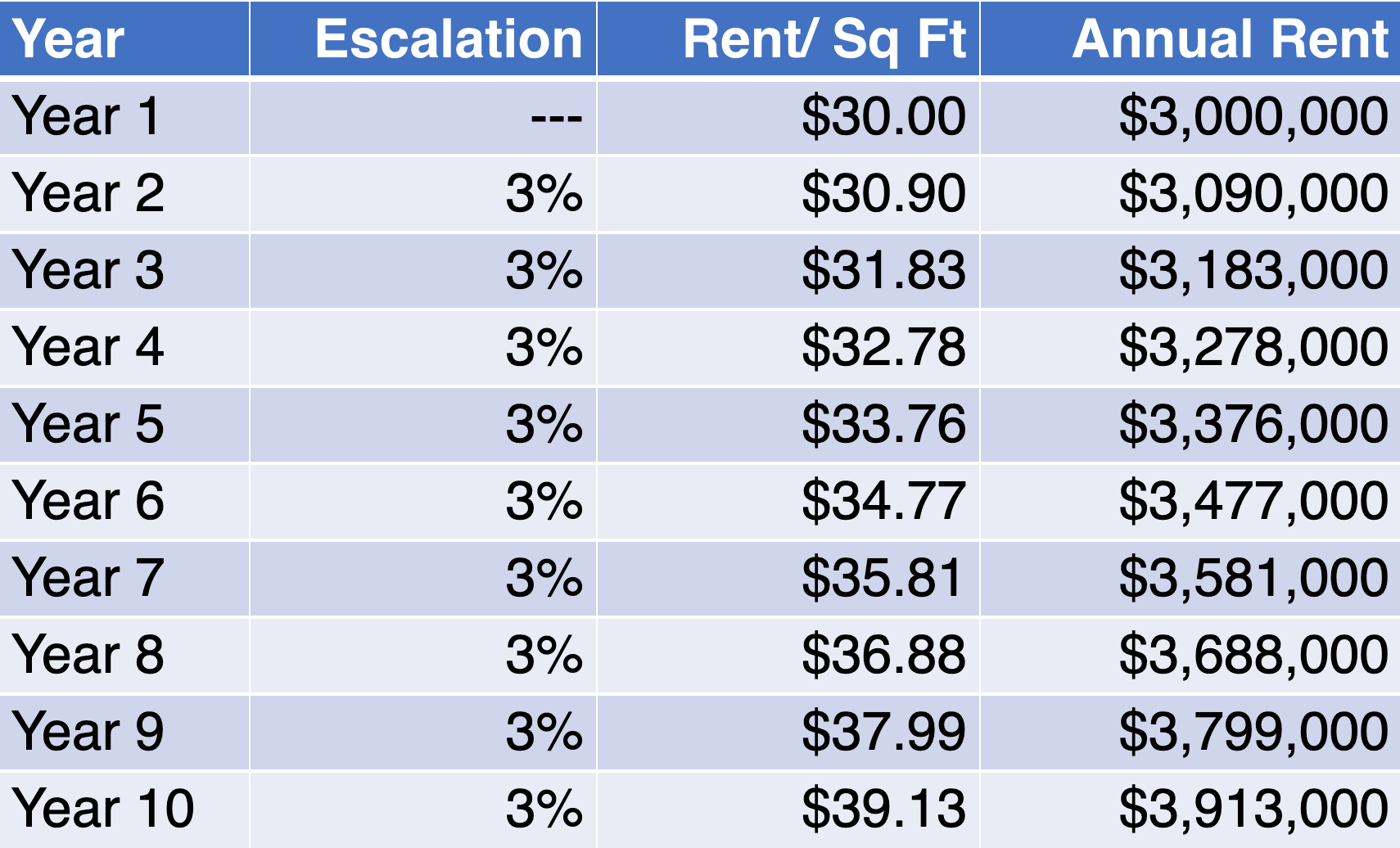

A $2MM Total Savings:

As you can see in the table below, when you total up all the years, the Fixed Escalation saved your company approximately $2 million over the lease term.

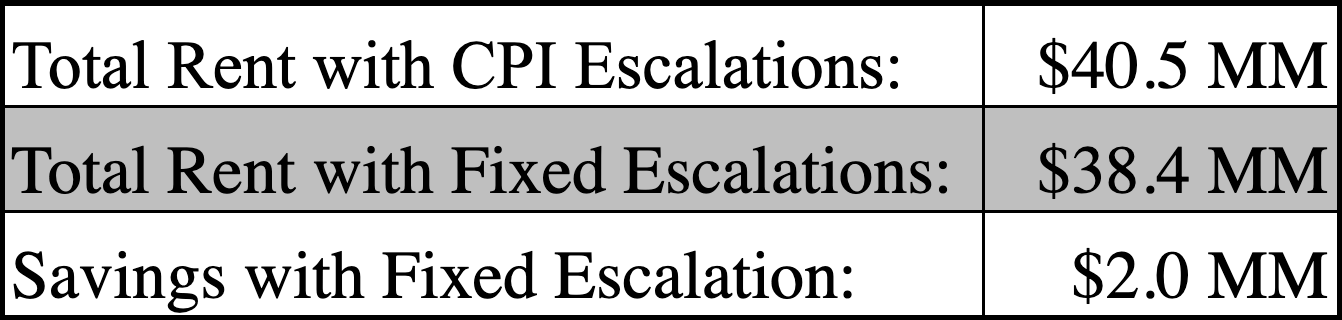

Hybrid – Fixed & CPI

Hybrid systems operate by combining fixed percentage escalations and CPI escalations. As a result, they can be useful when the lease term is long and, though try as your Tenant Rep might, they cannot lock in a fixed rate for the duration of a lease.

For instance, let’s say it’s a 15-year lease. The landlord may not agree to a low fixed rate for that much lease term because they are taking too much risk. A possible solution could be to have a bracketed fixed rate that goes up a small amount if CPI hits certain benchmarks. It could then go back down if the CPI goes below that benchmark rate.

For example:

- You pay 3% compounding, yearly escalations if inflation rates are below 6%

- If inflation exceeds 6% by your renewal date, your escalation rate is 4%

- If inflation goes back down, your escalation will become 3% again

This escalation will generally allow you to maintain close to a set rent schedule while playing ball with your landlord. While your escalation rate may go up in a specific year, you have the comfort of knowing exactly what your exposure is, and it is not floating at the full rate of the CPI increase.

Conceding to an escalation partially according to the CPI will limit your exposure to fluctuating inflation rates and may lend you some perks in other areas of negotiation.

(* Estimated)

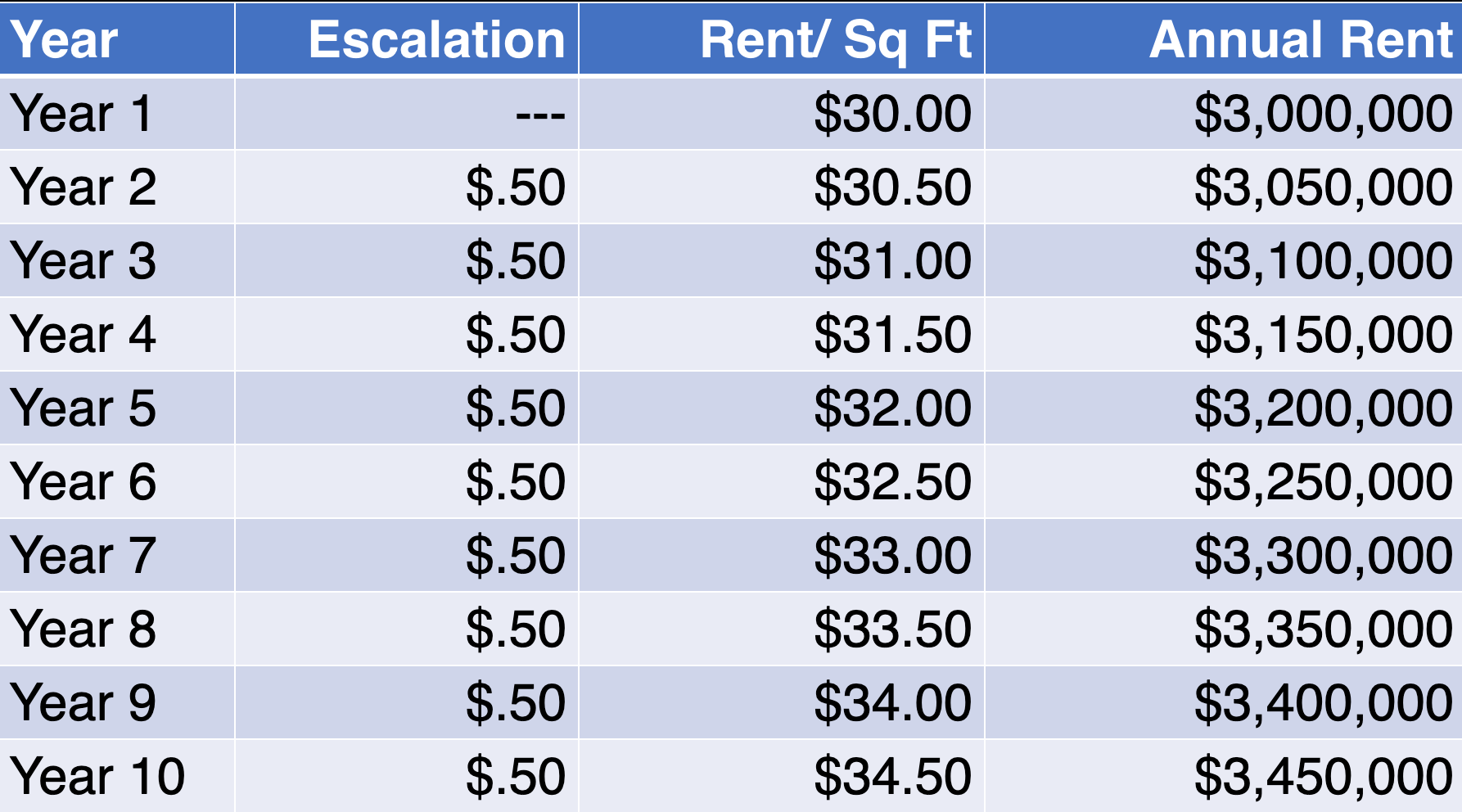

Rent Bumps

Rent bumps behave closely to the fixed percentage escalations. However, rather than your rent payments increasing by a percentage, they go up by a specific dollar amount per square foot.

Let's look at an example schedule of how the rent bumps will look.

As you can see, the benefit of rent bumps is their predictability. Like with percentage increases, your organization will have a clear schedule of its increased financial responsibilities.

Rent bumps are more common in warehouse leases. They are also associated with more flexibility in how often they occur.

On occasion, rent bumps can be negotiated to increase less frequently. For example, some leases with rent bumps go up every other year rather than annually.

It all depends on your specific situation, but the likelihood of this occurring increases when the demand for space is low.

When more tenants are looking for space, your landlord will have less incentive to offer you perks like less frequent rent escalations to get you in their property. This also goes for the determined amount your rent will increase per year.

How to Negotiate Your Ideal Escalation

It is essential to keep in mind how valuable your tenancy is. If your landlord needs a reminder, you can leverage your worth as a corporate tenant by creating competition for your tenancy.

Your landlord will be more likely to concede to escalations that benefit you if they know your business is a hot commodity- and it is.

If you need help in the negotiation process, don't worry. Tenant Reps are experts in leveraging the value of their corporate clients' tenancy to land them the optimal terms.

Learn more about the benefits of using a Tenant Rep

If you're ready to speak to one of our Tenant Rep experts, click below!

Wondering where to begin?

Related Content

- How To Navigate Commercial Rent Escalation Clauses

- Escalation Clause in Your Commercial Lease

- What To Know About Rent Escalation Clauses in Your Office Leases

- The 5 Most Dangerous Clauses in Your Commercial Lease