Before entering your corporate leasing agreement, certain key factors will require your attention. If you aren’t entirely familiar with the standard clauses, it can seem daunting to represent your company’s real estate demands skillfully.

Luckily you don’t have to do it alone.

We are tenant representatives who specialize in finding corporate tenants the best deals on the market by negotiating on your behalf to get the best terms possible in your leases.

Tenant reps have experience analyzing corporate leases and negotiating beneficial terms for corporate tenants. They understand that the landlord’s first drawn-up lease is a jumping-off point for negotiations.

Whether or not you seek out representation is up to you. Below though, we have outlined the key terms that you should be looking for in your lease agreement either way.

To protect your interests and budget as a corporate tenant, make sure you are knowledgeable about the defined terms below. This is not an entirely comprehensive list, just a space for us to dive into some of the most important lease specifications that you should be aware of.

1. Rentable vs. Usable Space

In most typical office leases, your rent is dictated by the square footage. However, the rent is usually applied to the building’s rentable square feet. This does not necessarily mean that you will be able to utilize every inch that goes into this calculation.

An office’s rentable square feet outlines every aspect of the space’s floor-plan. This includes everything from common areas like hallways and elevators to maintenance spaces like janitorial closets or electrical rooms.

On the other hand, usable square footage is just that- the area of office space that you can inhabit. Be aware of how much usable square feet is outlined in your lease, so you actually have the room you need for your employees.

The difference between the rentable square feet and what is usable is known as the loss factor. The loss factor is the space that you pay for but cannot utilize for employee use. It is often expressed as a percentage. To figure out your building’s loss factor, subtract the usable square feet from the space’s rentable square feet. Then divide the difference by the rentable square feet. That is your loss factor.

The rentable square feet minus the loss factor is delineated as usable space.

Depending on the type of space you are leasing, the expected loss factor can vary. The average loss factor will appear different across warehouse spaces, suites, full floors, full buildings, etc.

2. Important Dates

There are several significant dates to keep an eye out for in your corporate lease. Commercial leases specify certain windows in which provisions of your lease occur. Some may fall on the same day depending on your negotiations, but it is essential to be keenly aware of these dates.

This is because they affect when subsequent rental escalations and renewal clauses begin as well as when your lease ends.

Commencement Date

The commencement day is when the leasing agreement becomes binding. It represents the legal execution of negotiations determined by you and your landlord. Commencement day is not necessarily when you sign your first rent check. In many cases, the landlord will be obligated to finish any construction or tenant improvements before you start making payments.

Delivery Date

This is the day that your landlord will proverbially hand you the keys to your new space. They have concluded any work to the building, obtained any necessary permits, and received any required approval for your tenancy to begin. Essentially, the landlord delivers on any promises by this date, and your ownership begins.

Rent Commencement Date

This date outlines when you, as the tenant, begin your rent payments. If you have negotiated a free rent period, this day specifies when that term begins. The rent commencement date will chiefly influence when and the rate at which rent escalations begin.

Notice of Renewal

As your lease’s term comes to an end, you will receive a notice of renewal. It outlines a time period in which you can renew your lease to remain in your corporate space. The window of time typically varies according to state laws. If you do not bid for renewal before this window closes, then you must move out by the lease’s expiration date.

Lease Expiration Date

The lease expiration date is exactly what it sounds like. This is the last day of the lease, clearly defined within your leasing document. You, as the tenant, must be moved out of the space by this day. If not, you may be subject to hefty fees and additional rent costs. In many cases, if your presence exceeds the expiration date (by even one day), you could stuck paying 200% of the price of your rent.

3. Rent Escalation

Rent escalation is an integral and unavoidable part of negotiating any lease. You need to consider that the market changes. The landscape could appear vastly different in the five or ten years following your rent commencement date. Whether this flux favors you or your landlord, the rent escalation rate ensures that the landlord has certain insurance against inflation. It also serves to offset any additional costs they may incur during a lengthy lease.

Rent escalation rates could be calculated in several ways and often appears outlined in these formats. You, as a tenant, will be aware of what you are expected to pay in addition to the established base rent.

Fixed Increase

Fixed increases are generally a flat dollar rate at which the rent escalates. These typically target the price you pay for a square foot of space. The exact monetary amount will differ depending on the market you’re in, where it’s projected to go, and your negotiations based on these factors. However, the price per square foot will often center around increases anywhere from 50 cents to a dollar each year.

Percentage Increase

If your lease specifies a percentage increase in rent, the amount you pay will escalate based on a predetermined percentage starting with your base rent. For example, if you and your landlord decide on an annual 2% increase, your rent can be expected to be raised to that amount. Often, these increases build up over time, becoming compounding in your payments.

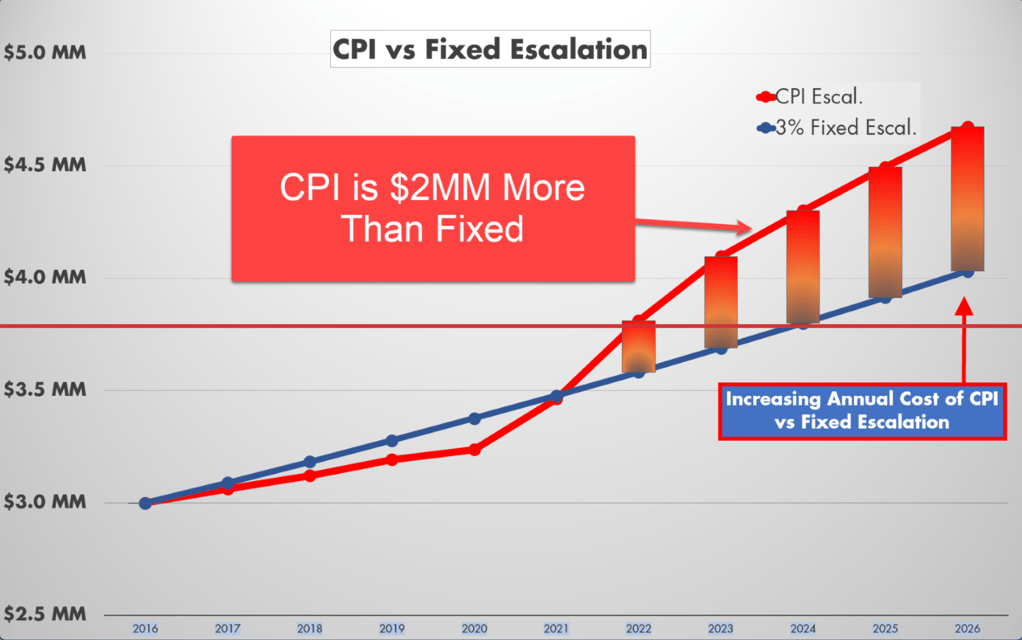

Increase to the Consumer Price Index

In this agreement, the landlord attempts to raise the rent according to the country’s inflation rates. Rent increases paid to the CPI are a type of variable or indexed lease. Therefore, the amount of annual expected increase could vary with this escalation. If the inflation is low, so is the increase on your rent. However, if the CPI spikes, it will be reflected in exaggerated costs for you. Therefore, check if your lease specifies a cap on increases according to inflation rates.

Operating Expense Increase

This escalation is related to the increase in operating expenses the landlord may incur as time goes on. Depending on your specific agreement, you could be responsible for increases in property taxes, maintenance costs, or general operating expenses like security or electricity. Typically this is calculated based on the percentage of the building you occupy if you have a gross or modified gross lease. This escalation could prove to be not only costly but incredibly unpredictable. If you have a triple net lease, you will deal with these escalations directly rather than through your landlord.

4. Rent Table

No matter what type of rent escalation you expect to incur, be sure to look for a rent table in your leasing agreement. It will break down your base rent, rent due dates, and the amount you will pay with any future increases. Therefore, you will not be surprised at your rent price in 5 or 10 years because everything will be outlined in front of you.

Remember, though, that you do have freedom in this process. Skillful negotiation can establish a lower starting rent or period of free rent, so the escalations don’t build up to suffocate you. Negotiation can also determine better terms for you as a tenant to offset some effects of expected cost increases.

If you find that the market around you has changed since you signed your lease and are paying greatly escalated prices- you are also in a place to negotiate. A skilled tenant rep can help reset your costs to market value, so you’re not hemorrhaging money on outdated lease terms.

5. Sublease Clause

Keep an eye out in your lease for any term that defines your right to sublease. Subleasing clauses are great for tenants who want more flexibility. As you know, corporate leases are significant, long-term monetary obligations. Your company's needs can greatly shift in the period of a 10-year lease.

Just think about how different the world appeared in 2012. The perspective and buying attitudes of the average consumer have undergone extreme transformations in the last ten-year period.

Therefore, there is no reason to suspect that there won’t be changes in the market in the next ten years. No matter your reason for wanting to move commercial spaces, a sublease clause will ensure you have some financial insurance. You want to be ensured that you have the freedom to shift your company’s spaces should the need present itself

Terminating a lease can be an extremely pricy endeavor. Sublease clauses give you the right as a tenant to rent the space you don’t want to potential new tenants. Most sublease agreements specify that you, as the original tenant, cannot profit when leasing out your space to a new tenant. Although you may not make all the money back, you still stand to gain a significant percentage of the funds you would have lost without subleasing.

Therefore, you won’t be on the hook for the entirety of the promised costs of the original lease. You still could potentially make the majority of your money back from a new tenant’s lease. If it is not in your lease already, be sure to negotiate for a sublease clause.

6. Tenant Improvement Dollars

Is the property you found the perfect space? Well, if it isn’t, you probably have some room to make adjustments. Tenant improvement allowance will help you renovate the existing space with the features that fit your company’s needs.

Of course, the price of making all these renovations can quickly add up. That is where tenant improvement allowances come in. They are an agreed-upon sum of money the landlord funds for improvements to the space.

The specific amount will vary depending on your needs and how willing the landlord is to pay for them. Typically though, they are made to the square foot. Therefore following negotiations, your landlord may concede to paying $30 per rentable square foot for building improvement costs.

Be aware that the allocation may not cover all the expenses you will encounter. As a result, you may be forced to come out of pocket to solidify your perfect space.

What Will TI Dollars Cover?

Tenant improvements can account for whatever changes you want to make to the property. Whether this is tearing down a wall for more open space or putting up new signage on the building, you have the power to decide how you want your building to look and function.

However, landlords are usually only willing to devote funds for improvements that increase the building’s lasting value. Therefore, they don’t include soft costs like general moving expenses, furniture, and other fixtures. Be sure to check your lease for an outline of the proposed tenant allowance and what it can be spent on.

Tenant improvement allowance is a highly negotiable factor in lease arbitration. Depending on how prepared you are to negotiate, you could increase the allocation dollars and the potential projects they could cover. Skillful negotiation, specifically surrounding the build-out costs, could save you a lot of money.

Often, a compromise must be reached. If the tenant agrees to a longer lease term, landlords may be more willing to pay for major hard costs. Everything depends on what will benefit everyone in your specific situation. – and what each party is willing to forfeit for the sake of negotiation.

Either way, make sure you have a representative on your side who knows your rights and the inherent value of your tenancy, so you don’t have to reach too deep in your pockets to readjust your new space.

7. Expansion Rights

Some leases specify your rights to expand should space within your become available. In multi-tenant buildings, this could mean a floor opening up as an old tenant moves out. Or, if you are the sole tenant, maybe your landlord decides to build new office space, expanding the breadth of their property.

No matter the case, ensure that expansion rights are outlined in your lease so you receive prioritized offers as the original tenant.

Expansion rights allow the tenants to put an offer or claim space that opens up within the property before outside parties can.

Right of First Offer

In this case, the original tenant has the primary right to expand into adjacent spaces. However, before the landlord can advertise the property or reach out to potentially interested third parties, they must offer the space to the current tenant. If the tenant does not wish to expand or cannot agree on terms in negotiations, the landlord can then market the space.

Right of First Refusal Offer

This is another type of preferential treatment the original tenant receives concerning expansion. However, in this case, the landlord has the right to market the space before offering it to the existing tenant. If the landlord comes to terms with a third party, they must offer the agreed-upon terms to the first tenant. If the first tenant wishes to expand with the terms established by the landlord and their third party, they have the right to do so.

If not, they forfeit their right to expansion. This clause essentially allows an original tenant to swoop in on potential deals for adjacent spaces and land them for themselves.

Must Take Clause

With must take clauses, the tenant initially agrees to lease the entirety of the space they foresee needing in the future. Commonly, this occurs when with a quickly-growing company. If you do not currently need extra space but have a clear projection of necessary growth- you should consider working a must-take clause into your lease.

Often payments begin with a portion of the additional space tacked on to the existing rent. This is commonly known as a “ramp-up” period. When this pre-negotiated period concludes, you, as the tenant, will begin to pay for the entirety of the space.

Option to Expand Clause

This clause specifies that the tenant has a continuous first right to lease the remaining space. It works almost as a reservation. If the tenant wishes to expand, they are given a deadline for moving into the new space. However, if the tenant is not prepared to inhabit the area within the given timeline, they will lose the option to expand.

8. Operating Expenses

Depending on your lease, the level of responsibility you have dealing with operating expenses will differ. In some cases, you will pay a lump sum each month. This would include your negotiated rent and any other costs. Therefore, the landlord will pay operational bills to their providers with your funds. However, you are responsible for directly paying some or all of the operating expenses to their providers in other cases.

These costs typically include, but are not limited to:

- Additional storage

- Taxes

- Parking

- HVAC

- Cleaning

- Insurance

- Water and electric

- Security

- Common Area Maintenance (CAM)

Make sure in the lease negotiations that you ask for a breakdown of operating expenses. It is critical to know exactly what is spelled out in your lease regarding your responsibility covering operating expenses. When negotiating, have the landlord or their representation outline any expected costs, so you know what you are paying for and don’t risk being taken advantage of.

9. Amenities

Make sure your lease outlines any promised access to amenities within the building. As discussed earlier, if your building doesn’t have any of the features you want, you may have room to build some or all of them out. You may even get an allowance to do so.

It would be best to keep an eye out in your lease for anything that specifies how much common area maintenance you are responsible for. The level of responsibility varies depending on your type of leasing agreement. Just make sure you have a clear outline of the amenities and the prices you must pay to keep them updated and maintained. Similarly, be sure to know what amenities are potentially shared with other tenants within the building. Pricing for maintenance can greatly depend on this factor.

Deciding on your desired amenities gives you a bit of freedom to craft the type of environment you want to work in. A building’s amenities are vastly influential on the company’s culture. Especially today, businesses are getting more creative than ever with features to their corporate spaces. From rock walls to meditation rooms, everything is possible.

Typically though, amenities could include:

- Dining area/ café

- Gym/ fitness center

- Outdoor space

- Daycare center

- Game rooms

- Conference spaces

- Covered parking

- Lounge

- Security

That Was A Lot

As you can now see, there are an incredible number of factors to analyze when entering a leasing agreement. This process can be highly overwhelming to anyone, especially if real estate is not your first job. It can be exhausting to go through each clause in a lease with a fine-tooth comb. However, it is necessary to consider all these factors (and more) to ensure that you get the best deal.

That is where tenant representatives come in.

They can help ease the process of determining what to look for in your lease. Not only this- they will negotiate with landlords and their brokers on every clause. By doing so, they will help you find the terms that will not only save you money but find you your perfect building with the best features.