What was poised to overtake traditional commercial real estate is crashing and burning. Coworking.

And rather than become the standard for office work, shared-flex spaces like WeWork are rapidly losing money.

In this article, you’ll learn:

- How WeWork's claim to fame was taking advantage of COVID’s disruption

- Why the flex space giant is cutting 40 locations

- The lengths WeWork is going to ditch underutilized space

- What this means for you

Flex Space’s Rise and Fall

Back in March, flex space was named “the biggest winners in the shift to hybrid work.” But how the mighty have fallen.

Companies like WeWork promised businesses the ability to be flexible and pause while the outlook of CRE adapts. This was tremendously valuable as many stood unsure of how the role of their corporate spaces would evolve in the future. Flex space is one of several creative occupancy models that have evolved in the wake of the COVID-19 shutdown. They offer a temporary, yet strong solution to companies who believe in in-person collaboration (at least now) and want an option without the commitment of a five- or ten-year lease.

At first glance, the idea is a great one. It grew in popularity across big and small businesses, with WeWork claiming that that 22 percent of Fortune 500 companies have members working in their spaces, according to Propmodo.

In the company’s annual report last year, they reported that they operated and maintained 44.8 million square feet of space in 756 locations in 38 countries, including 19.8 million square feet in North America.

However, according to a report by the New York Times, WeWork has lost more than $12B since the end of 2018. Yikes!

Despite that gloomy outlook, WeWork CEO Sandeep Mathrani remained optimistic that the changing tides would turn out in the company’s favor and as hybrid work persisted, companies would be seeking temporary space. In October 2021, he publicly projected that the company would reach profitability by the end of 2022.... Well, here we are. And what happened? The company has changed its tune, now reporting that it does not plan to reach profitability this year.

Instead, WeWork is bleeding revenue and rapidly shedding its footprint. Stakeholders want answers: why and how is this happening?

WeWork’s CRE Crisis

WeWork is facing the same problem as any other landlord: Companies don’t want to take on office space right now - even if it's temporary.

As a result, demand for office space has fallen in all sectors, and that includes flex space. Office vacancy rates are higher than ever, and do not appear to be returning to pre-pandemic norms any time soon.

|

“Demand didn’t come back as swiftly as we thought, so we decided that to be profitable—and sustainably profitable—we should close locations that are obsolete.” CEO Sandeep Mathrani |

To save money by slashing their footprint, they plan to close 40 locations underutilized locations. The company reported that these spaces were either “obsolete” or in markets marked by “oversupply.” According to GlobeSt, “The average term remaining on the leases is 10 years, and the average occupancy in the locations being vacated is about 42%.” This comes after the company reported a net loss of $1.8B leaving the first three quarters of 2022.

Losing Commercial Space is Expensive

But shedding space now is harder than it sounds. There is no simple solution to ditching office space, especially now as the market is inundated with underutilized offices. On one hand, terminating leases leaves companies with extreme fees, ones that they likely cannot afford as the nation’s CEOs prepare for a recession.

On the other hand, there is subleasing, which brings its own issues. Tenants subleasing their space can’t profit. Landlords don’t want corporate tenants making money from their space. But now? Forget it. Subleasing has been the first line of defense against the fiscal drain of wasted CRE among nearly every company with too much space.

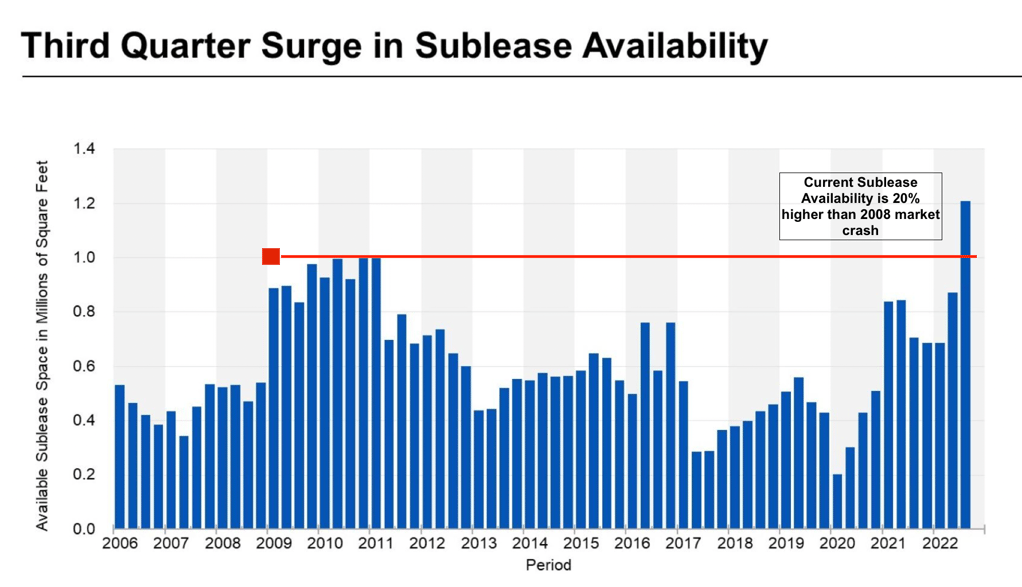

Sublease demand is higher than pandemic levels, according to CoStar.

As a result, sublease availability is higher than ever. According to Elizabeth Ptacek, senior director of market analytics at commercial real estate information and analytics company CoStar, there is currently 232 million square feet of surplus commercial real estate up for sub-leasing, which is twice the level of pre-pandemic norms. Because of this, companies cannot offload sublease space unless it comes for cents on the dollar, making it an extremely expensive solution to underutilized leases. For more on sublease complications, check out: What the Sublease Boom Means for Corporate Tenants.

So, this all culminates in the fact that companies looking to discard space should be prepared to pay a hefty sum to do so. WeWork is now going to great (and expensive) lengths to close those 40 properties.

|

“It will pay about $200M over the next 15 months to exit the leases on spaces it is giving up, hoping to generate cost savings estimated at $140M in EBITDA.” According to GlobeST |

So, now, WeWork is joining other large-scale organizations like Meta that are shelling out hundreds of millions to cut their losses with CRE.

|

Meta expects to spend more than $3 billion to decrease its footprint. To put this in context, that is $9 per person in the US. |

This comes after they already used $413 million to end office leases last quarter and a total of $900 million this quarter.

Fortune 500 companies are racing to end their leases rather than suffer the hemorrhage of unused space on their EBITDA. Commercial real estate is typically the second most significant cost a business takes on, so many organizations are looking here for savings as fears of a recession loom over Corporate America. WeWork, Meta, and other captains of industry are suffering, cutting their numbers and their footprints- but what does this mean for you?

Opportunities Corporate Tenants Have

Wasted space is already a liability, but even more so as CFOs are looking to tighten the belt even further now. No company, despite how massive its breadth may be, is immune to the strain of an office sitting at half occupancy. So, take these massive deals as a signal that companies everywhere are doing anything they can to cut office space, conveniently before the country enters a recession.

How does this affect you?

For one, you are not alone if you have underutilized offices. But, if you are one of the rare few looking to take on new space right now, you have an abundance of options for premium Class A office space listed with far below-market value rents. So, whether you want to sign a new lease or even sublease, there has never been a better time to do so.

|

Property owners will compete for your tenancy, and you will win. |

Savvy tenants in existing leases can also take advantage of this era. Since demand is so low for office space, your landlord will likely do anything to keep you in their space for longer. This means that if you are willing to extend your term, they will likely be open to renegotiating. You can potentially reset your rent to market value, negotiate for better terms, or see if your landlord will offer more concessions. Learn more about why you should renegotiate as we enter a recession.

But the point is that the CRE market is your game if you’re willing to play. But, you need to collaborate with an experienced, true Tenant Rep.

|

Now is not the time to be using the landlord's broker. |

Take Advantage of the Market with a Tenant Rep

If you feel that you could stand to benefit now, you may not know where to start. Don’t worry, that’s what Tenant Reps are here for. At iOptimize Realty®, we are true Tenant Reps that ensure our corporate clients get the optimal properties, terms, and savings. Part of this involves only representing tenants. Our unbiased service and market intelligence regularly saves commercial tenants 30% of their CRE costs and 90% of their time.

We’ve seen how much tenants can benefit from the current market and can’t stand watching them pay over-value for market rents as the prices for neighboring properties plummet. Let us help you experience the true value of your tenancy. Schedule a meeting with a true Tenant Rep today.