If you’re looking into signing a new commercial lease or just refreshing your CRE knowledge, it is critical to understand the typical costs that go into leasing space.

If you don’t know understand what costs go into a commercial lease, your company could potentially lose millions of dollars during negotiations with the landlord. There are a lot of areas where corporate tenants commonly get taken advantage of and being informed can stop this from happening.

As tenant reps, we have spent over three decades helping our clients outline, negotiate, and sign lease agreements that benefit them. As a result, we know what to expect with commercial leases, what may be hidden, and what may be omitted by landlords during the negotiation process.

So, to prepare you to make informed decisions, we have outlined the most significant costs you should expect when leasing commercial space, including:

Rent

Rent is the first and most obvious cost that goes into your lease. The exact price will be expressed per square foot and is dependent on many factors, including:

- How the market looks when you sign your lease

- The condition of the building

- The building’s class

- Geographic location

- Negotiations with the landlord

For example, Class A office space prices are highly variable across the United States. If you are in a business-friendly area like Jacksonville, Florida, you could be paying $27 per square foot. On the other hand, if you are in a city like Manhattan, your rent could be as much as $80 per square foot.

The price of rent is the most negotiable factor in commercial leases. That is why it is so critical to come prepared to negotiate with an expert, like a tenant rep.

Rent Escalation

Another factor that will become a part of your rent payment is rent escalations. Typically, they will begin after your base year and increase annually.

Rent escalations usually appear in the following forms:

- Bumps- Set dollar amount escalations

- Percentage Increases- Set percentage escalations

- Consumer Price Index (CPI)- Percentage escalation based on inflation

- Hybrid- Combination of CPI and Percentage increases

Every type of escalation is compounding. This means that whether the rate goes up by a set dollar amount or percentage, it is escalated based on the previous year’s rate, not the first year of the term. Therefore, these cumulative costs will become part of your overall rent payments.

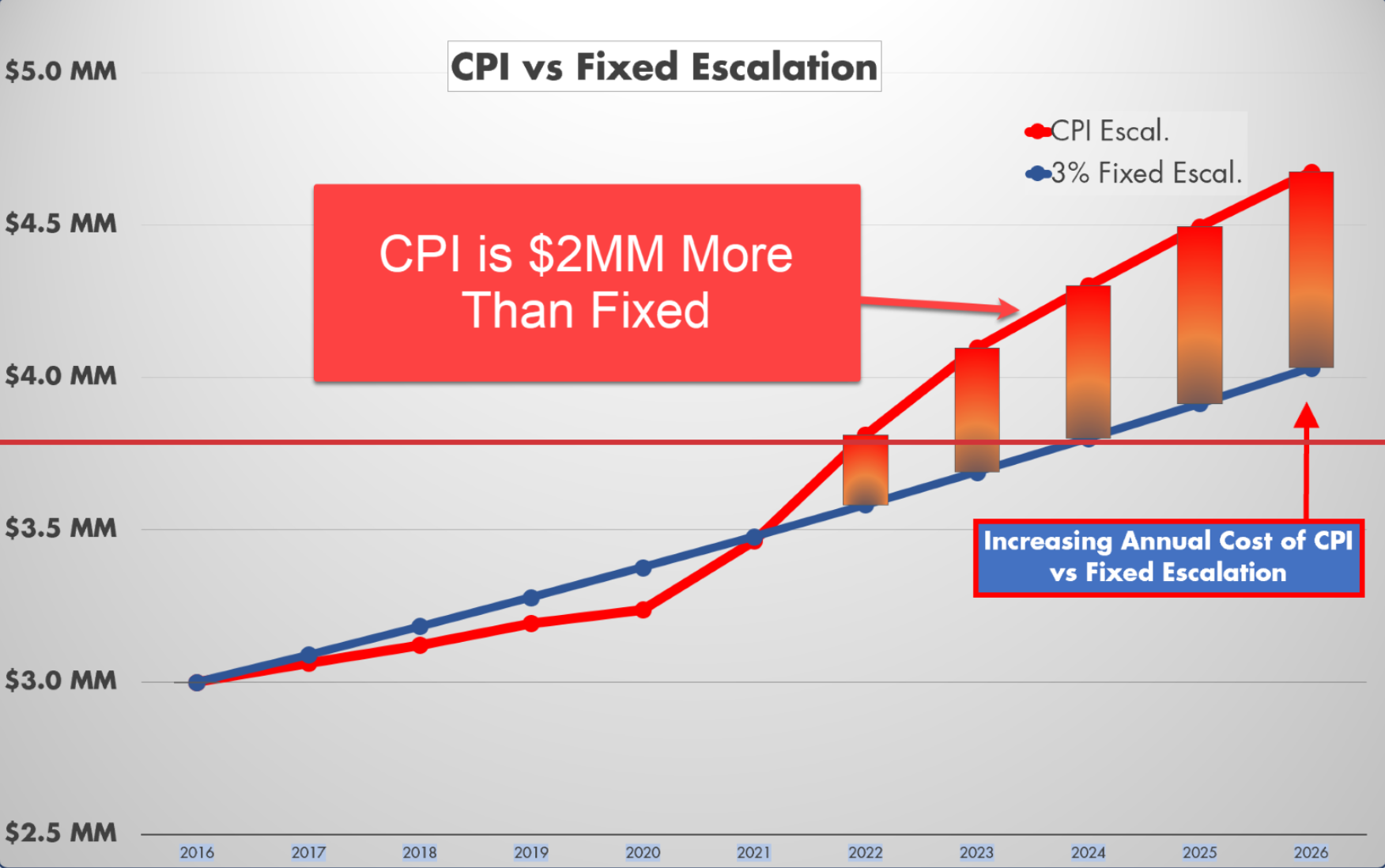

Be aware that you may find yourself victim to excessive costs if you agree to the wrong escalation. For example, if your landlord suggests an escalation according to the CPI, you could be vulnerable to the adverse side effects of inflation. If inflation spikes one year, so will your escalations. Even if it goes down in future years, you will still feel the effect since escalations are compounding.

Let’s look at how volatile and expensive CPI escalations can get with a mock payment schedule, on a 10 year lease term.

*Estimated

It can be difficult to know which escalation will best serve your business. While you probably won’t get out of paying escalations, working with a tenant rep will help you decide on the most cost-effective option.

For example, tenant reps will often caution their clients against CPI escalations. Instead, they may advise you for a predictable escalation according to a set percentage. That way, your company will have a clear timetable of their increasing financial responsibility as nothing will be left to chance.

If your rent escalates according to the CPI it could cost your company potentially millions more than fixed increases.

Rent Abatement

Another negotiable factor with rent is rent abatement. With this, you may be able to receive a period of free rent as a concession from your landlord. The period will vary depending on your agreement.

Why would your landlord give you free rent?

Well, it’s not really free rent. Rent abatement periods are great for reducing your costs in the first year of a new lease.

However, it is common for these payments to be added to the end of a lease. These additional payments are then subjected to the compounding escalations of previous years. Therefore, rent abatement may save you money initially but cost you big at the end of your lease.

Tenant Improvement Costs

If you’re moving into a new space or negotiating for a renewal, you can receive funding from your landlord to cover the costs of any necessary renovations. Why would they be willing to do this? Making improvements to their building will benefit them in the long run.

After you leave, they will have a recently renovated property with which they can entice new tenants. Building out the space is an investment for the landlord as the nicer their space is, the more money they can ask tenants for in the future.

The exact amount of tenant improvement costs will vary according to your situation. Your landlord will likely be willing to provide more money if the building is in a shell state, as more work is necessary before you can move in. It also depends on the renovations you want to conduct and how personalized you want your space to be.

Your landlord may concede to pay for a portion of the costs. However, if their allocation does not account for all the expenses necessary to get the renovations you want, you will be responsible for paying the difference.

The tenant improvement allowance is a significant reason you should work with representation. Determining the tenant improvement allowance is a main point of negotiation. If you work with a skilled tenant rep, they may be able to leverage the value of your tenancy to receive more tenant improvement dollars from your landlord.

Know that it all depends on your specific situation, but negotiating a larger tenant improvement allowance could lessen the load of any costs associated with renovation. If you borrow money from the landlord for the out of pocket portion of your renovations, you have the option to amortize payments over the course of your lease.

If this is the case, payments will be subject to escalations. Here is a sample table of amortized tenant improvement payments for a loan.

Operating Expenses

Operating expenses are all costs that go into keeping a building running effectively.

While operating expenses can account for many things, they most typically include:

- Utilities

- Electric

- Water

- Trash Removal

- Security

- Landscaping

- Property Taxes

Operating expenses are largely non-negotiable, but your responsibility to deal directly with these costs depends on your lease type.

For example, with a triple net lease, tenants will pay rent to the landlord and owe operating expenses to their respective vendors. However, in a full service/ gross lease, the landlord will typically charge a higher base rent that includes operational costs.

All in all, the average price you would be paying for the space will usually remain the same across the different types of leases. So just because you are paying more upfront with a gross lease doesn’t mean you’re generally paying more.

You are exposed to the same costs within each lease type; they are just packaged differently.

Common Area Maintenance (CAM)

As part of your operating expenses, you will also be subject to additional CAM charges on top of your base rent.

Common area maintenance charges are related to exactly what they describe: operational costs associated with the upkeep of shared spaces within the building.

Often CAM costs are devoted to things like:

- General maintenance

- Elevators/ Stairwells

- Repairs

- Parking

- Landscaping

CAM charges will appear differently depending on your lease type. The exact costs associated with CAM payments are also essentially untouchable in negotiations.

Properly Negotiate Lease Costs with a Tenant Rep

Today we discussed the foundations of commercial leasing costs. While factors like operating expenses are generally fixed, you have room to negotiate down prices in other areas.

The rent rate you pay, escalations, and tenant improvement allowance are largely negotiable.

If you want to work with an expert during this process, tenant reps are here to help. By solely working with tenants, they ensure that your rights are protected. They know what areas within your lease to target during negotiations to ensure that you receive the best terms at the lowest prices.

Learn more about why you should work with representation during the negotiation process.

Wondering where to begin?

Related Content

- 3 Hidden Commercial Leasing Costs Corporate Tenants Need to Know

- What are the Top Occupancy Costs in an Office Lease?

- 9 Things to Look for in Your Corporate Lease

- How to Control Occupancy Costs in Your Commercial Lease