Times are tough, and businesses are downsizing all over the country. If you're still going into the office (or especially if you're not), your property's space utilization is likely a top-of-mind concern in your day-to-day. However, as you know, downsizing and underutilization are not only temporal issues. Commercial real estate spending and decisions have long-term implications on an organization's EBITDA.

Companies everywhere have been lugging around the weight of underutilized space on their budget. And with office vacancy rates higher than ever, you're likely one of them. Unfortunately, this problem is far too common among corporate tenants. But, if you're swimming in space, all is not lost. We're here to throw you a life preserver.

Shedding your wasted space will improve the portfolio's efficiency, dramatically reducing your overhead. As Tenant Reps, we're ready to teach you how to do this. So, read on. We will discuss some options that you can explore to help ease the burden of too much office space.

Right-size Your Space

Hybrid and WFH working schedules have changed the way corporations utilize their real estate. It's likely that about half of your employees are still working from home with no plan of returning. According to McKinsey’s American Opportunity Survey, 58% of Americans have the option to work hybrid. Obviously, this means a lot of extra space, as a good chunk of your workforce sits in their home offices. This extra corporate space does two things:

- Drain your EBITDA of unnecessary CRE $

- Affords you the opportunity to reduce your office footprint

So, the issue is obviously two-sided. While the underutilized space is currently an issue, it can turn into one of your greatest money-saving weapons in your arsenal as we enter a recession.

This is especially true since the oncoming recession is making your executives throw around that dirty L- word, "Layoffs." The issue with layoffs in the scope of underutilized office space is that it will further worsen your utilization crisis. If you already bleeding money on an underused office, cutting your workforce will leave you with more wasted space. Food for thought.

(Read more about Using Smart CRE Moves to Curb Recession Layoffs.)

But, whether your numbers are being cut or not, you can analyze where there is inefficiency in your portfolio and capitalize on it.

|

Commercial real estate is likely your second-highest corporate cost. We don't need to tell you how much weight savings here can carry. |

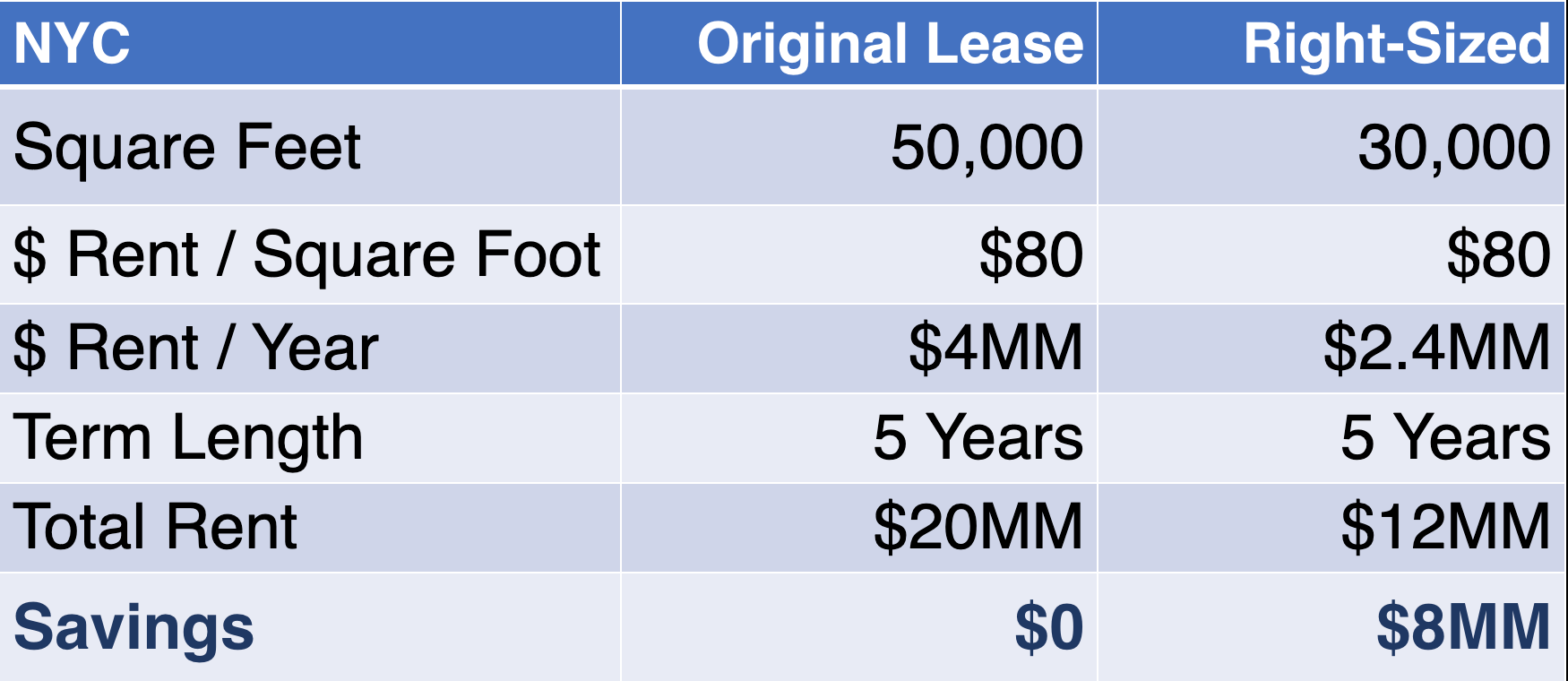

Many companies are implementing "Right-sizing" strategies in order to get rid of extra space and achieve CRE savings in the process. This is the strategy of assessing your current and future needs and then adjusting your space accordingly. It's important to do this correctly so that you optimize your space for the maximum benefit. The best thing you can do right now is to get specific about how much space you need. Because once you have your ideal space utilization, you now have an actionable figure.

How to Right-size the Right Way

The first thing you can do is find your ideal square footage requirements. To do this, consider the current size of your team. However, it may be best to think in terms of seats rather than current employees. Whether you want to consider the estimated seat count needed or the number of physical employees, devote about 200-250 square feet to each seat. Once you multiply the necessary square footage by the number of employees expected in the office, you have your optimal space utilization. Once you have your ideal utilization, compare it to your current usage. Then you can get down and dirty, reflecting on how to reduce the divide between those figures.

Right-sizing works because it is a tangible strategy to identify where money is being wasted and capitalize on it. Once you have a detailed understanding of your portfolio, you can begin to implement solutions.

Opportunity to Right-size from Record Office Vacancies

And these solutions can't come sooner since so many corporations are now confronting the issue of paying for the space they no longer need. This issue is gaining much steam in the media and attention in the corporate world. According to the Commercial Observer, vacancy rates in top markets are higher than ever, "The effect of companies shrinking or decamping to cheaper areas has reverberated throughout the New York City office market...

|

"Office vacancies in Manhattan reached 16 percent, its highest level in two decades, in the second quarter of 2022." |

This means, especially now more than ever, landlords are willing to negotiate your footprint in line with your right-sized figure. Oftentimes property owners are motivated to work with companies that are downsizing as they may see it as an opportunity to secure a long-term tenant. Giving them some uncertainty in this time can go a long way to securing your best interest. Never underestimate the power of negotiation or renegotiation, especially since the chips fall in your favor, as the increasing vacant rate is a looming threat for landlords.

Look at Opportunities in Your Portfolio

Right-sizing is so efficient because it doesn't exist in a void. If you are an organization with 25 - 50+ locations, the likelihood of having wasted space is greatly elevated. As such, right-sizing brings the most potential for savings when it's conducted on multiple properties.

This is where your company's portfolio analysis comes into play. It will key you in on your biggest money-wasters, which properties are being utilized, and how utilization varies among regional differences.

Regions and Relocating

It's important to break down your locations by region and analyze the data accordingly. Maybe one property is witnessing higher utilization than another. This will clue you into which offices are worth renewing and which are best to ditch when your leases expire. More importantly, it will show you the regions where you're getting the most bang for your buck. Maybe this means letting expensive metropolitan leases expire while keeping efficient suburban spenders.

According to the Commercial Observer, this tactic is becoming more prevalent as, "Law and finance firms are increasingly moving to the suburbs of Connecticut, New Jersey, and Long Island, both to serve remote workers and to save money on pricey Manhattan office space. That correlated with a 3X increase in people moving from New York City to the tri-state area’s suburbs over the course of 2020 and 2021."

This comes back to the fact that optimizing your space doesn’t just mean cutting square footage (even though it’s a great way to reduce your budget). Instead, optimizing can mean combining satellite locations or renovating existing properties to make them more productive. If there are multiple underutilized offices within a region, it may be worth combining them into one larger office. Not only does this save you the cost of rent, but it can also make your employees more productive.

Combining locations is an easy way to increase space utilization and reduce wasted space. And, when done correctly, it can be a huge money saver for your company. Not only will you slash your rent and utilities, but it also allows employees still commuting to collaborate more easily.

Sublease Your Extra Space

The other option you have is to sublease any underutilized properties you have in your portfolio. If you are not interested in renewing a lease or don't have the option to renegotiate, subleasing unused spaces can be a viable solution. This can be done internally or externally and is a great way to generate some extra revenue.

Be aware though, that subleasing comes with some caveats:

- There has been an increase in sublease space since 2020. As a result, it will likely be difficult for you to find a tenant. For example, in the Twin Cities, sublease availability has increased by 4X, according to the Business Journals. With the market so inundated, finding a great sub-tenant can be an impossible task.

- Subleasing space comes with more responsibility. You essentially become a landlord. You are responsible for finding a tenant, negotiating the lease, and making any necessary repairs or renovations. It's important to do your due diligence when vetting potential tenants, as you want to make sure they will take care of your property and pay their rent on time. If you're already managing an extensive portfolio, you're adding more to your plate.

- You also need to be careful of the terms of your lease agreement. Some landlords put a clause in the contract that prohibits subleasing or limits how much space can be sublet. You may not have the right to sublease that you thought you did. That is why it is so important to have the right sublease clause. Read more about that in this article: Why a Properly Negotiated Sublease Clause is Critical to Your Lease.

Even if you do have a sublease clause in your lease, it most likely stipulates that you can't profit from a sublease arrangement. You will not be able to make back all rent money with subleasing, especially since the sublease market is so competitive right now. You'll likely be listing your space for FAR under market value (which is probably already under what it was when you signed your lease) to lure in new tenants.

If you have too much office space, subleasing is worth considering, but be realistic. Don't expect it to bring on a windfall of financial success.

Stop Wasting CRE $ With a Tenant Rep

As we mentioned before, implementing Right-sizing strategies is a great way to reduce waste and save on corporate real estate costs. This can be done in a variety of ways, so it's important to tailor the strategy to fit your specific needs.

Choosing what to do with your office space during these unprecedented times can be difficult. While there are many things to consider, we hope you leave knowing that you can take advantage of this unique time to cut down the clunkiness of your portfolio. And you never have to do it alone.

If you need help deciding, Right-sizing, subleasing, or negotiating your lease, our team of experts is here to help. At iOptimize Realty®, we are true Tenant Reps with 30+ years of experience optimizing the portfolios and individual properties of corporate tenants. This means we're no rookies when it comes to navigating CRE in times of financial disruption and hardship. We've seen how much tenants can benefit from streamlining their portfolios. You could be wasting millions of dollars that can easily be reclaimed. Therefore you want to speak to a Tenant Rep sooner rather than later. We'll point to areas of waste within your CRE portfolio where potential savings add up as you cut down on extraneous space per location.

Don’t wait until it's too late, and take a good look at your real estate today. Know that you never have to do it alone. A Tenant Rep is a reliable and invaluable asset to achieve your optimal CRE performance. Want to stop wasting money NOW!

Schedule a no-obligation, quick call with us, and we can help you ASAP, and it costs you nothing!