In this article, you'll learn:

- Which types of office buildings are most vulnerable to high vacancy rates.

- Why suburban and southern office markets are experiencing growth.

- The impact of safety and building size on office occupancy.

- How True Tenant Reps™ help companies navigate the changing office market.

The commercial real estate industry is in a recession. Since 2020, office vacancy rates have been steadily increasing, leaving landlords scrambling to keep their properties occupied. But, there’s nothing random about what the hardest hit buildings have in common:

The office buildings with the highest vacancy rates had certain key factors in common:

- Older or outdated buildings

- Downtown or metro locations

- High-crime regions

- Larger footprints

So, as the recession continues and more landlord defaults are expected, it is essential to determine which office buildings are at higher risk of becoming casualties of the office apocalypse.

Newer and Premium Offices

There is overwhelmingly less investor, tenant, and overall consumer interest in older commercial buildings. In the context of this discussion, this represents properties constructed any time between 1980 and 2009.

But, what is interesting is that a building’s age takes on a different context according to its region...

|

“In less mature markets such as Austin and Phoenix the hardest hit buildings were built after 2009 while in more mature markets like Chicago, the buildings are older.” -GlobeSt |

This means newer and fresher hubs demand newer, fresher office buildings. More contemporary business environments are likely to attract younger demographics who have less patience for outdated facilites. Also, consider the types of businesses that are exploding in Austin. Start-ups and tech firms are far more common than in traditional metros like Chicago. As a result, the buildings overwhelmingly cater to those needs.

Learn about other Top Texas Cities to Locate Your Business in.

Learn about other Top Texas Cities to Locate Your Business in.

But everywhere, the push for better buildings has further devalued Class B properties, as a result there is a bigger delineation in the asset classes. Top talent will not put up with out-of-date offices especially after being given the freedom of workplace flexibility. As a result, the demand between Class A and B properties will likely only grow.

Corporations have become more willing to pay a premium for quality accommodations that they expect from Class A locations. In a talent war, companies with stronger commercial real estate properties stand out. Read more about How to Make Your Office a Safer and More Enticing Environment.

Offices With Suburban Locations

Suburban office markets have experienced a new life since the pandemic as people and businesses alike join in on a “flight to quality.” As a result, some of the hardest hit buildings are in downtown metro areas.

There’s certain reasons why suburban regions have lower overall office vacancy rates. First, consumer bases have majorly shifted to the suburbs. According to GlobeST, “The prime reason is that many workers pivoted to remote work at the start of the pandemic to flee congested downtown areas, which left many downtowns empty. And since that time, many of those areas have experienced only a slow—albeit steady–return to offices.”

Therefore, moving to these suburban areas does not risk losing business. In fact, it’s giving businesses opportunities to pull from newly strong talent pools. Given the freedom of remote work, many white collar workers took advantage of the lower overhead costs of the suburbs. The inflated costs of cities no longer made sense for companies, families, and individuals given the option to be free from a physical office’s radius. The power of the dollar simply goes further in the suburbs. Lower rents are exchanged for better amenities, improved quality of life, and safety.

Suburbs are luring in businesses due to:

- Lower rents

- Ample parking

- Safety

- Shorter commutes

- Revitalized talent bases

- Improved quality of life

The demand balance has shifted, reflected in the steady price growth in suburban CRE as metropolitan markets suffer. And when waning interest is causing landlords to default, it’s best to look where there’s promise.

|

"Price growth among urban properties has significantly trailed that of suburban properties since the pandemic began." -FS Investments |

Offices in Southern Markets

The flight from metros is also part of a greater migration. Since the pandemic, interest in commercial buildings has largely shifted away away from traditional business hubs like New York and California. These regions are noted to stifle commercial success with excessive taxes, strict legislature, and egregious living costs. That is why so many leading companies have been gradually cutting their ties to those locations.

According to GlobeSt, “The Northeast and Pacific regions had larger concentrations of hard hit buildings and a slower return to offices than other areas, again as workers left crowded, expensive markets. “

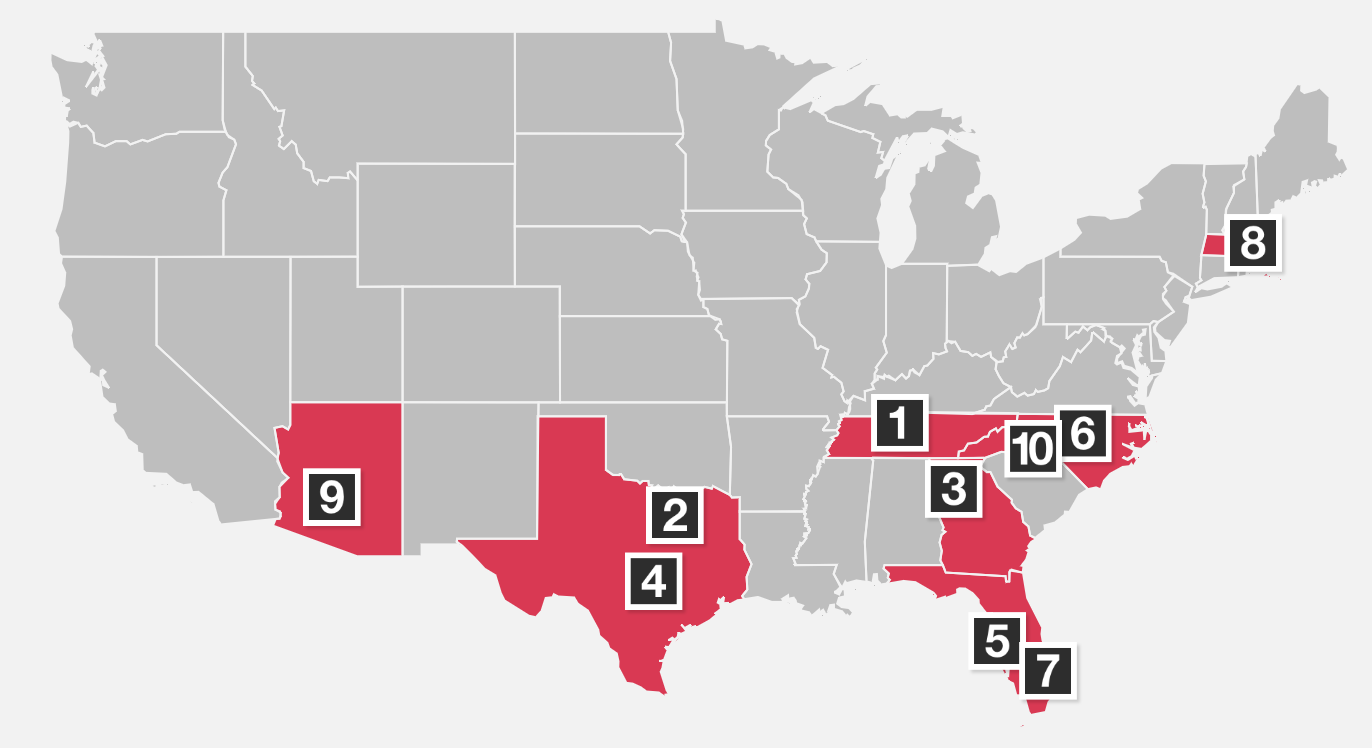

Instead, the office markets experiencing higher rates of success (in terms of occupancy and vacancy rates) are in the Mid-Atlantic and Southeast. These regions contain notable business-friendly states like Florida, Texas, and Tennessee.

The 10 cities with the most inbound migration last year were overwhelmingly southern. PwC.

The 10 cities with the most inbound migration last year were overwhelmingly southern. PwC.

In addition to the lower cost of living and business-friendly environment, The Southern regions also offer a high quality of life with excellent weather, natural scenery, and recreational opportunities. This has been a draw for younger workers who prioritize a healthy work-life balance and access to outdoor activities.

Furthermore, many Southern regions have invested heavily in their infrastructure and amenities to attract businesses and residents. They have built state-of-the-art office buildings with modern amenities, including co-working spaces, outdoor spaces, and easy access to public transportation.

Low Crime Regions

Safety has become a number one driver of where to place an office.

|

“Crime risk index developed revealed that hardest hit buildings nationwide had an average score that was 11% higher than for other buildings in their market, whether downtown or suburban. The crime score was the biggest external driver of what makes a hardest hit building.” |

This is quite similar to the circumstances behind the push to suburbs. As remote working arrangement remains a top motivator for finding a new job, employees are less likely to accept positions that demand commuting. And if people don’t feel safe or comfortable commuting in, forget about it.

An area’s crime risk also goes hand-in-hand with the quality and quantity of local amenities. Closeness to restaurants, shopping centers, or other useful spots is a key external driver behind a building’s suitability. A lack of options in a high-crime environment will significantly drive down occupancies.

Smaller Footprints

The most egregious difference in vacancy rates from 2020 to the last quarter of 2022 occurred in buildings with larger footprints.

|

"Buildings between 100,000 and 300,000 square feet, which represented the smallest group being analyzed, accounted for 84% of hardest hit buildings." |

Larger, multi-tenant office buildings have been put in a particularly vulnerable position. Buildings between 100,000 and 300,000 square feet have seen a significant increase in vacancies in the last three years. The average vacancy rate increased to 57% in the fourth quarter of 2022 from 9% in the first quarter of 2020. With more tenants to potentially vacate, these buildings hold more opportunity for loss. As companies reassess their office needs and potentially downsize, larger buildings may struggle to fill empty space.

This means that larger buildings with even more square footage are experiencing a greater possibility for vacancy.

How to Find Long-Term CRE Success

It is crucial to identify which office buildings are at higher risk of becoming casualties of the office apocalypse. The demand balance is shifting towards suburban and southern regions, which offer lower rents, ample parking, safety, shorter commutes, and improved quality of life. Additionally, smaller footprint buildings and/or buildings with premium features have a lower risk of vacancy. Overall, it is clear that the commercial real estate industry is experiencing significant changes, and landlords and investors must stay aware of these trends to navigate these challenging times.

In the face of these challenges, tenant representatives have become an increasingly valuable resource for companies looking to navigate the office real estate market.

They can provide valuable insights into the local office market and help companies identify properties that meet their specific needs and budget. In the case of the hardest hit office buildings, tenant representatives can be particularly helpful in negotiating favorable lease terms and ensuring that tenants are not taking on unnecessary risks. As the office market continues to evolve into a crisis that resembles 2008, a True Tenant Rep™ is likely to become even more important for companies looking to secure office space that meets their unique requirements.

It's a tenant-favored market right now, but with so much at stake you need to be prepared. Prepare to fully leverage the value of your tenancy by watching the free course below. You'll learn all the factors from the True Tenant Rep™ experts that will help you determine how to find the best properties, terms, and prices.