In this article, you'll learn:

- Key lease clauses like release upon assignment and rent escalation.

- Risks of personal guaranty, sublease, and termination clauses.

- Protecting your interests with signage, parking, and expense clauses.

- How to avoid common lease traps and strengthen your position.

Signing a commercial lease is a major step for your business. Hopefully, it turns out to be an exciting new opportunity that propels your organization to new levels of success. If the process goes well, you'll have space that better matches your brand, accommodates your growth, saves you capital, and more. However, if you sign a bad lease, you could end up paying too much, find yourself in a bad space, or both for years to come.

Commercial lease documents are complex and lengthy, but it's important that you still carefully read every word to ensure that you completely understand what you're agreeing to. Some clauses in the lease are especially important to take note of as you read the document.

Release Upon Assignment

While you may not have plans to sell your business in the near future, it's important that you're protected in the event that someone makes you a lucrative offer or your life plans change. This clause states that you are no longer responsible for the lease if you exit your business and turn it over to another owner.

Personal Guaranty

A personal guaranty clause states that you are personally responsible for the payment of rent and common area maintenance fees. If you sign a lease with this clause in place, a landlord could take legal action against you personally if your company defaults on the lease.

Usage

Make sure that your company's lines of business fall into the guidelines outlined in the use clause. Also, think carefully about how your business may evolve over time. You don't want the use clause to restrict your company's ability to expand into other sectors.

The Cons

Landlords can use the Usage Clause to narrow the permitted uses of space in such a way that the tenant may not be able to sublease. For example, if an insurance company is renting an office for claims processing, a sharp landlord’s attorney may stimulate that the permitted use for space is “insurance claims processing.” Although this accurately describes the initial tenancy, it quite effectively inhibits the ability of the insurance to sublease to anyone other than a competitor!

The Usage Clause is something we never overlook. We recently represented a lumber company in the acquisition of 150,000 sq. ft. of warehouse space. The landlord’s attorney had inserted in the lease that the usage of the space would be specifically for that of a lumber company. We advised our client that this was totally unacceptable! This was a warehouse- and should we need to sublease, it should be able to be used for any standard warehouse purpose.

We prevailed and the Usage Clause was changed to “warehouse.” The landlord was protected within the rules and regulations of the lease from usages of the space that would devalue the building, such as the use of hazardous materials. Thus, BOTH parties were protected. In YOUR next lease negotiation, make sure to keep an eye out for the Usage Clause

Exclusive Use

This clause prevents the landlord from leasing space in the building to your competitors and can help to protect your business interests.

Signage

Many leases place restrictions on what types of signage a business can use. This clause may give you permission to place a sign outside the building or in the lobby or add your business name to an indoor or outdoor marquee. If you are leasing a large portion of the building, you may be able to negotiate for more visible signage.

Permits

If your potential office space is going to require a complete build-out to suit your business needs, the permits clause is very important for your company. It states that if you are unable to obtain the necessary permits for the project, you can exit the lease.

Rent and Rent Escalations

This portion of the lease tells you how much you will pay monthly for base rent and how and when your rent rate may escalate. Once again, double-check the landlord's arithmetic before signing.

Unless you were lucky enough to negotiate a lease that remains fixed for its entire life, you will have to deal with the provisions of its escalation clause. This clause determines when your lease payments will go up and how much they will cost you. While escalations might seem far away when you first sign your lease, they will come into play eventually.

One of the first things that your lease escalation clause defines is when your lease payments will go up. Many leases in multi-tenant buildings have annual increases tied to the lease's anniversary date. If your rent payments started on March 1, you can expect them to go up on March 1 next year. Leases in single-tenant buildings might have escalations occur at three- or five- year intervals. The only way to be sure, though, is to read your lease.

How Does it Escalate?

Usually, your lease's escalation clause will specify one of these three types of increases:

-

Fixed increase. These increases are for a set dollar amount per foot (or for the entire space). For instance, your $35 per square foot lease might go up by 75 cents per year. Bear in mind that this could mean that the increase goes down on a percentage basis over time

-

Percentage increase. In this structure, your rent escalates by a set percentage. So, if you have a $35 per square foot lease with 2 percent annual increases, it would go up to $35.70 in the next year, then $36.41 the year after that. These increases usually compound, which can add up over time.

-

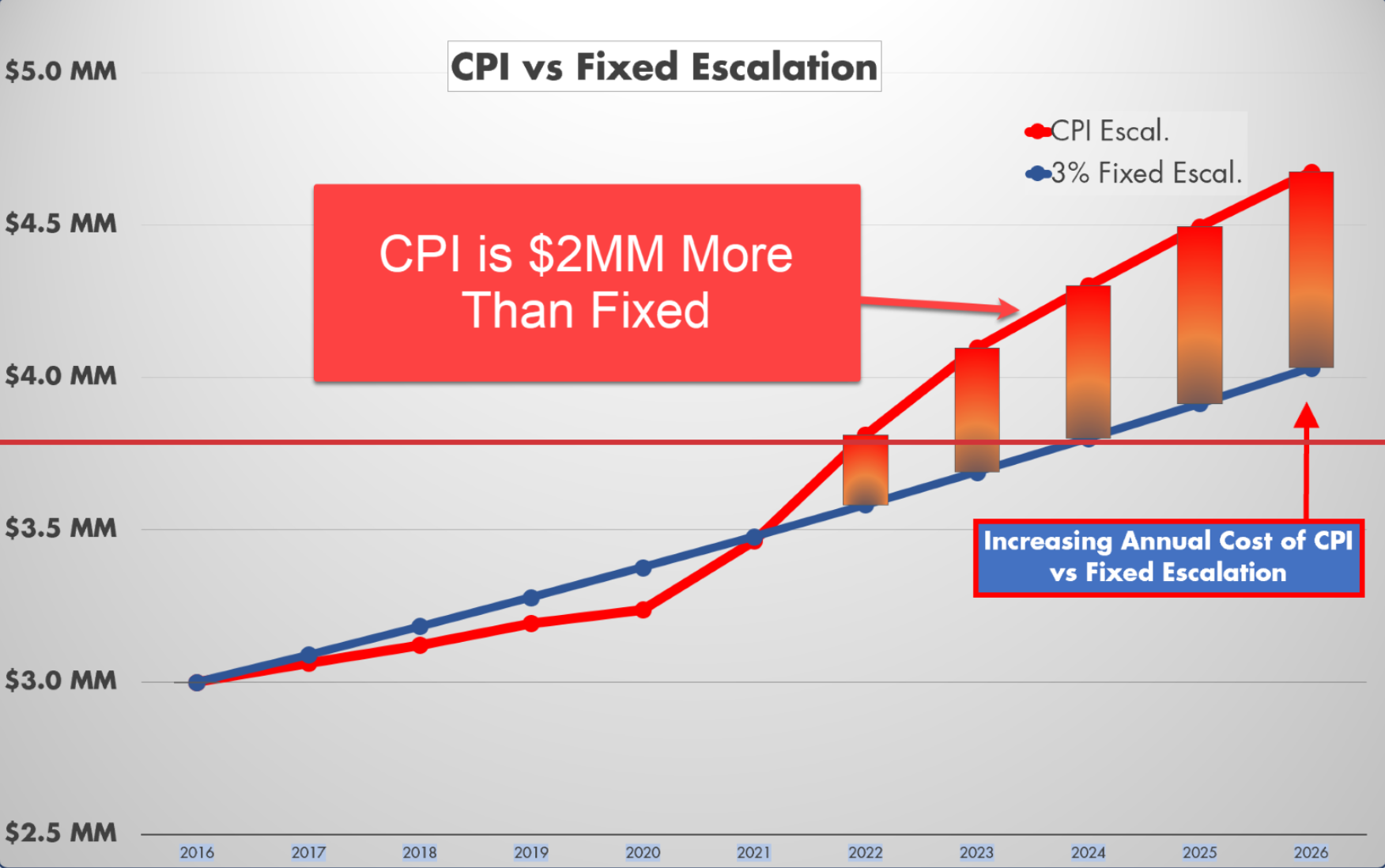

Consumer Price Index (CPI) or other inflation-based increase. When you have a CPI escalation clause, your rent will go up in sync with a pre-defined measure of inflation. If inflation is low, your escalation is small. But if inflation spikes, your rent could spike along with it. If you have this type of escalation in your lease, look carefully to see if there is a cap on how much it can go up in a year.

Expense Stops, Operating Expenses, CAMs, and Reconciliations

The escalation clause isn't the only thing that can make your rent go up. Many leases have mechanisms that make you responsible for some or all of the costs of running the building. While those costs can fluctuate in any direction, they usually go up. The triple-net lease where you pay all of your share of the building's expenses is the best example of this type of arrangement, but it isn't the only one. Read your lease carefully to see if you have these types of provisions in it.

Finally, take a careful look at the renewal options, if any, in your lease. Usually, they will specify some sort of method for resetting your rent. If you have fixed increases, they might continue in the option period. Other lease forms will reset the rent to 95 or 100 percent of fair market value for your suite. While your lease specifies the terms of the option, it's important to remember that the option doesn't stop you from negotiating a better deal. The option is what your landlord has to give you, but it doesn't limit what you can offer.

Right to Sublease

The sublease clause gives you the freedom to rent all or part of your space out to another tenant if your business needs change and you end up with unused square footage before the end of your lease.

The Cons of the Sublease Clause

When tenants and even their attorneys are negotiating to get into space, they typically don’t focus on how to successfully get out of the space- but is something important to think about.

For example, suppose an insurance company takes down 20,000 sq. ft. of office space. At $25/ sq. ft., a five-year term lease would cost $2.5 million without any operating expenses. Also suppose that a year after making this lease commitment, the insurance company merges with another and finds they have redundant office locations. However, the landlord knows full well that this tenant is good for the remaining four years of the lease ($2 million!) and isn’t about to release this tenant from that obligation, especially during this recessionary period when vacancy rates are high.

We represented one of our insurance company clients in a lease with a major New York landlord. You can only imagine how creative his attorney was in coming up with devices that would effectively negate the tenant’s ability to sublease the space and mitigate a potential loss- the sublease clause was five pages long! However, we were able to protect our clients and ensure the ability to sublease should it be needed. These are the things we paid special attention to in the Sublease Clause:

-

Prohibitions against the tenant from soliciting subtenants, adjoining tenants, tenants within the building or even tenants within other buildings that the landlord owns. I’ve seen attorneys willing to give on this point for the sake of horse-trading on another. Your broker should know that the most logical future sublease tenant is an adjoining tenant or someone within the same building.

-

Prohibitions against the tenant soliciting any potential tenant that the landlord is negotiating with. This would be someone coming from the outside who is looking at your building amongst many others. A good tenant representation specialist wants to avail clients of all of the choices within a candidate building. For example, we just saved one of our clients, a household name insurance company, $2.1 million over the direct landlord’s price by securing a 6.5-year sublease.

-

No time limit in which the landlord must respond back to you with the approval of a subtenant. We often see this “standard” Lease Clause statement- “the landlord will not unreasonably withhold consent of a sublease.” Well, there’s nothing within that statement that says how long the landlord has to provide you with this consent! Any good broker will tell you that when you have a good, credit-worthy tenant, speed is critical in concluding the transaction. If there is no time limit set in the Sublease Clause, it is conceivable that a landlord could purposely drag their feet on the approval while you watch your potential subtenant conclude a deal with another hungry landlord.

Default and Remedies

While you don't want to think about your business having to default on a lease, it's important to know how your landlord will notify you of default and what steps they can take to recoup owed rent.

Repairs and Maintenance

More so in industrial leases than an office, you’ll find that the tenant is significantly responsible for the upkeep of the building. While the landlords are typically responsible for the roof, four walls, floor and parking lot, you (the tenant) are responsible for heating, air conditioning and ventilation systems (HVAC), sprinkler systems, plumbing, electrical systems, dock doors, dock levelers, dock locks, dock seals, etc.

The Cons

While this is customary, it can lead to significant cost if there are any unseen and/or undisclosed defects (latent defects). For example, suppose six months into your occupancy of the new space, you perform the required testing of the sprinkler system and find that the sprinkler system cannot pass inspection. You will then be required to make what can be a costly repair- especially since this deals with fire code issues.

Landlords will invariably write the lease so that it is “as is”. It is up to you, the tenant, and your advisors to insist that the landlord warrants the serviceability of any key building components which will later become your responsibility to maintain and repair. With items such as a sprinkler system, you may be able to rely on independent, third-party inspections. On other items, you either have a choice of inspecting the building elements yourself, bringing in an engineer to do the inspections or preferably having the landlord warranting the serviceability of these key building elements.

Repairs and Maintenance Clauses are something YOU need to watch out for to save $$.

Subordination and Non-disturbance Agreement (SNDA)

The SNDA protects you in the event that your landlord loses their building in foreclosure. Basically, it stipulates that as long as you are current and continue to pay your rent, the mortgagee agrees that notwithstanding the foreclosure, your lease will prevail. In times of severe recession, like right now, this is a prudent and necessary insurance policy for the tenant.

This is the one clause within the lease that a third party, the mortgagee, has to become involved and provide you with a Subordination and Non-disturbance Agreement.

Any majority or AAA credit tenant should make this one of their KEY lease checklist items!

Holdover

The Holdover Clause is another one of those clauses that are hard for a tenant to focus on at the inception of the lease. No one likes to think about the possibility of moving out later than the lease stipulates! However, the holdover penalty that most landlords ask for is between 150-200% of the escalated rent, can make for significant penalties.

It is understandable that the landlord wants the tenant to leave on time because once the lease comes to an end, they are trying to secure another tenant for that same space. However, this clause can lead to a subtle, but potentially far more significant, liability for the existing tenant holding over in the space- that of consequential damages.

For example, assume that Tenant "A" is at the end of their lease term, but because their next landlord is late on delivering their new space, they are late in leaving the existing space- thus holding over. Suppose though that the landlord has secured Tenant “B” for space with a $3 million lease. Tenant “B” may have their attorney insist the landlord perform by a certain date, or else Tenant “B” would have the right to cancel their $3 million lease. If you’re Tenant “A”, the Holdover Clause opens the door for consequential damages. It is possible, if not probable, that the landlord will SUE you for the loss of the $3 million tenant.

Typically we are successful in negotiating a fair compromise for our client that allows the landlord to recover some holdover penalty, in a phased-in manner, only after a 30-day grace period. Furthermore, we always seek to limit consequential damages after a 90-day period of holdover. This way, we protect our client’s (the tenant’s) position without putting the landlord in jeopardy.

Protect yourself--- watch out for the Holdover Clause.

6 Clauses You Definitely Want

When negotiating the lease of a new commercial space, there are certain clauses you should definitely seek. Here are three clauses that are extremely tenant-friendly, but are also achievable for tenants in a good negotiating position. Commercial real estate executives looking to negotiate their leases can take advantage of these six clauses.

1. Rent and CAM increase caps

While a flat lease would be a great thing to have, most landlords will not offer them. Landlords typically like leases that have rental increases tied to the Consumer Price Index and that allows CAMs to adjust with the building's actual expenses. In periods where the CPI remains low and where building operating costs also remain low, the risk in having uncapped increases may seem very minor.

It isn't. Given a large amount of monetary stimulus that has already been pumped into the economy, inflation is likely to return. At the same time, many local and state governments have shown a willingness to increase property taxes to close budget shortfalls. Energy prices could also increase if the government chooses to increase regulation or add a carbon tax. All of these could easily lead to skyrocketing occupancy costs.

Instead of asking for a flat lease, tenants should negotiate for capped increases. A lease with rental increases tied to CPI or three percent, whichever is less, allows the tenant to benefit from low inflation while protecting them from high inflation rates. Doing the same with CAMs, although many landlords will request a higher cap, has the same impact. Tenants that live in states like California where property taxes get significantly reassessed on sale may also want to negotiate an exclusion on increases due to a property sale.

2. Liberal Assignment and Subletting Rights

Business is more fluid than ever. Tenants can easily find themselves outgrowing a space or, on the other extreme, choosing to vacate a space and leave a market completely. Many leases contain subleasing clauses that allow tenants to sublease their space to a replacement tenant, but this leaves them responsible for the lease in the event that the replacement tenant defaults. An assignment clause that allows them to assign the lease, and responsibilities for it, to another company of comparable financial strength, is much more desirable. It allows them to be completely free of the space and of responsibility for it. It's a good deal for the landlord, too. The landlord gets a comparable tenant that wants to stay in the building and is more likely to execute renewal options.

3. TI Allowances on Options

Most landlords like to have their tenants exercise their options to renew their lease. Having existing tenants renew leases saves them the cost of finding a leasing agent, the cost of doing new tenant improvements, the cost of vacancy and the risk of having a new tenant that may or may not pay the rent. Furthermore, most options include rent increases which put the landlord in an even better position.

To make options more tenant-friendly, tenants can try to negotiate for a pre-defined TI allowance. Even a small allowance, like five to ten dollars per square foot for office space, can pay for new carpets, painting and the like to keep the space attractive. The landlord still benefits because they lock in a low TI cost and keep a tenant. The tenant benefits because they have a minimum TI allowance that is guaranteed, but can still negotiate for more if the market bears it.

4. Fixed-Rent Renewal Options

Many leases contain renewal options that are set to a percentage, usually 95, of the fair market rent for space at the time of the renewal. Building a renewal clause has two key problems:

-

Determining fair market rent can be a complicated, time-consuming and even expensive process unless the landlord and tenant agree.

-

If rents in the market increase significantly, the tenant could be locked into those rents.

A more tenant-friendly formulation is to set the option rent to be a fixed increase over the rent in place at the time of the renewal. For leases with annual escalators, the increase is usually relatively close to whatever the annual escalation would be. For flat leases, the increase usually works out to two or three percent per year. In either case, this gives the landlord some income growth while protecting the tenant from skyrocketing rents.

5. Prevailing-Party Clauses

A prevailing party clause specifies that in the event of a lawsuit or other legal dispute between a tenant and a landlord, the prevailing party's legal fees get paid by the losing party. This clause tends to dissuade people from launching frivolous lawsuits since it saves the frivolously sued party from having to bear the cost of defending themselves. This is particularly important for tenants since many landlords otherwise sneak in language that makes the tenant responsible for paying their legal fees, while landlords will not pay the tenant's legal fees if the tenant wins. In other words, the clause levels the playing field.

6. Pets-Allowed

Perhaps more unconventional than you would expect, and maybe even a bit crazy, but more and more businesses are allowing employees to bring their pets to work. Many surveys show that this leads to reduced absenteeism, increased collaboration, reduced employee stress levels, and increased productivity. Allowing pets on-site is a cost-free benefit that can also increase retention.

Unfortunately, many leases contain clauses that prevent tenants from having any animals, other than those allowed as service animals under the Americans With Disabilities Act, on the premises. Working with the landlord to allow pets, especially for spaces that do not need to enter or exit indoor common area spaces, is an excellent negotiating point for modern workplaces.

Watch Out For These Traps

Negotiating a commercial office lease is a challenging and time-consuming responsibility. When lease terms look familiar, many tenants take a cursory look at the clauses and sentences. In an attempt to maximize total rent, you should expect the landlord to add language or provisions that serve to meet this objective.

It's critical for you to take the time to carefully read the lease terms and understand every word before signing the document to ensure you're not jeopardizing your best interest. Here are three lease terms you want to avoid or add remedies to counteract them and protect your investment:

Termination for Convenience

One of the most powerful lease terms in any agreement is the Termination for Convenience clause. This provision literally allows a party to end the lease for any cause or without giving a reason for the termination.

For example, if you spend $500,000 building out the corporate office space, and the landlord decides three months into the lease to exercise his right to terminate the agreement, you will have no recourse. It will not only cause you a major headache and inconvenience to relocate your enterprise, but you will undoubtedly incur financial losses.

If you cannot negotiate a deletion of this term, you can include two remedies in the lease: Notice Clause and Net Book Value Protection Clause.

A Notice provision obligates the landlord to give you more than the notice period required by your state. The minimum standard for notice is usually 30 days. You can negotiate more time, such as 60 or 120 days, depending on factors like the term of the lease, the extent of improvements made to space and other items.

The Net Book Value Protection clause allows you to recoup a percentage of the capital invested in the property. A common form of reimbursement is straight-line amortization of improvements you’ve made to the space, possession of fixtures or other compensation to offset your costs.

Recapture Clause

Review the lease terms to ensure it does not contain a recapture clause. Under this provision, if you request the landlord to consent to sublet or assignment, it automatically triggers an option that enables the landlord to terminate your lease. You should have this clause deleted from the contract. At the very least, insert an option that gives you the right to withdraw the request for an assignment if the landlord decides to terminate the lease.

To provide additional protection, insert lease terms that will require the landlord to give you a Notice of Default following an assignment or subletting. This will give you the right to cure the default. However, you won't have a legal obligation to do so if you decide not to regain possession of the premises.

Conclusion

In these uncertain times, tenants have a much stronger negotiating position than they may realize. In most property types and most markets, there are more spaces available than there are tenants to fill them. This creates an excellent opportunity to not only reduce costs of occupancy but also craft a lease that is more tenant-friendly.

Here are a few other articles we know you'll enjoy:

The Perils of a Bad Lease Escalation Clause

What is a Tenant Improvement Allowance?

What is Rent Abatement & What You Should Know