In this article, you'll learn:

- How San Francisco's corporate income tax raises business costs.

- The impact of California’s personal income tax on professionals.

- Why elevated sales tax increases overall business expenses.

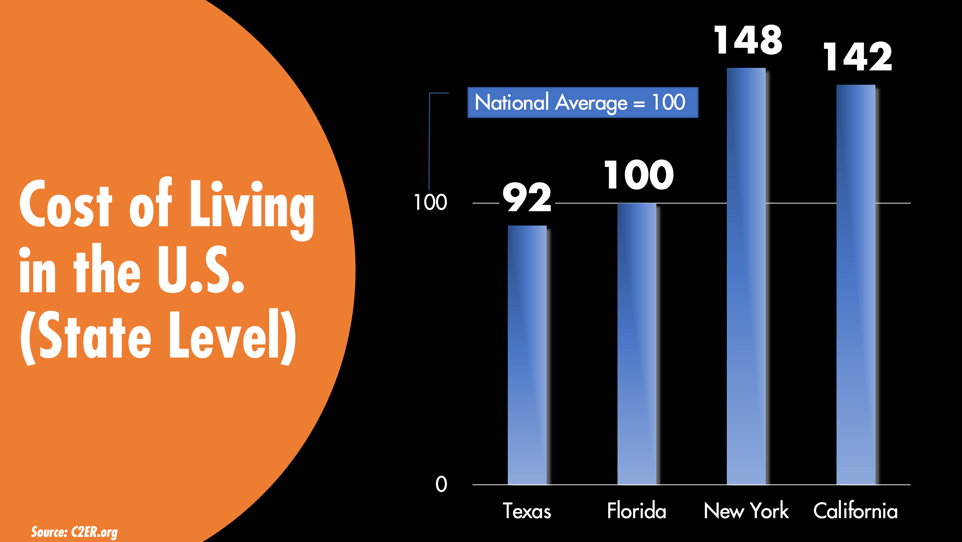

California is expensive and it's no secret. The increased demand for space raises the price tag on everything else. If you are running a business, these elevated expenses will quickly add up, making it a potential nightmare for corporate success.

In terms of financial sensibility, there is none. The area's high cost of living drives up taxes, payroll, occupancy, and labor costs. Does this sound familiar?

Everyone knows that San Francisco taxes are high, but do you know just how extreme they are? When you view its rates compared to other regions, you can fully understand what a problem they are. Moving out of the city into the suburbs or even across the country will slash your organization’s overhead, in just taxes alone.

As tenant reps, we have witnessed this dynamic firsthand. We are present in the real estate market 24/7, which gives us the knowledge of where and how the market is trending. We have found that corporations are removing themselves from San Francisco and transferring to areas like Florida and Texas. In the process, they are dramatically increasing the quality of life of their employees while improving their bottom line.

We are not advocating for you to move to Florida or anywhere else. It may not be the right option for everyone. However, by laying out the data for you to review, you can come to that decision independently. So, to highlight how much you could save if you move out of San Francisco, let’s look at just its tax rates and how they compare to some of the popular destination cities. As you can imagine, taxes are the tip of the iceberg, and you have countless opportunities to cut your expenses if you move outside of California.

The options for savings are out there. It is up to you to capitalize on them.

Why Explore my Options Now?

Now more than ever, you have the freedom to assess your commercial real estate practices. Definitions of work are becoming far more flexible. Along with it have gone our definition of appropriate working spaces. There has been a fundamental shift in our perception of what is required to work professionally.

On a mass scale, tenants are now considering if they need their physical working spaces. If you do, you can now rethink where these physical spaces should be. The online work phenomenon has opened up a world of possibilities where people can connect and collaborate even from different time zones. This is especially true for tech-based organizations, which have found a foothold in the Bay Area.

So you now have a unique opportunity to get a head start on things. The earlier you move to other regions, the larger talent pools you will find. As more corporations take advantage of the lower price of alternative areas, prices will go up across the board. It is time to strike while the demand is still relatively low.

Maybe the office in the Bay Area initially made sense. Does it still? The chances are that you are suffering from a greatly excessive overhead working in San Francisco.

The work from home revolution has shifted the market’s power balance in the hands of tenants. As a result, landlords are more willing than ever to concede to the terms you want for reduced prices. It is time to discover how you can benefit.

Where Should I Look to Move?

You have countless options of areas that will enable you to slash your overhead costs.

For instance, you can move to the suburbs. They are often not taxed at elevated city rates. However, if you want to maintain that city feel and are willing to undergo a significant geographic shift, states on the sun-belt have significantly reduced tax costs.

You will save money if you move to the suburbs, but it won’t be to the degree of what you will experience in other regions.

Let’s look at Jacksonville, Florida, and Houston, Texas, to compare statistics.

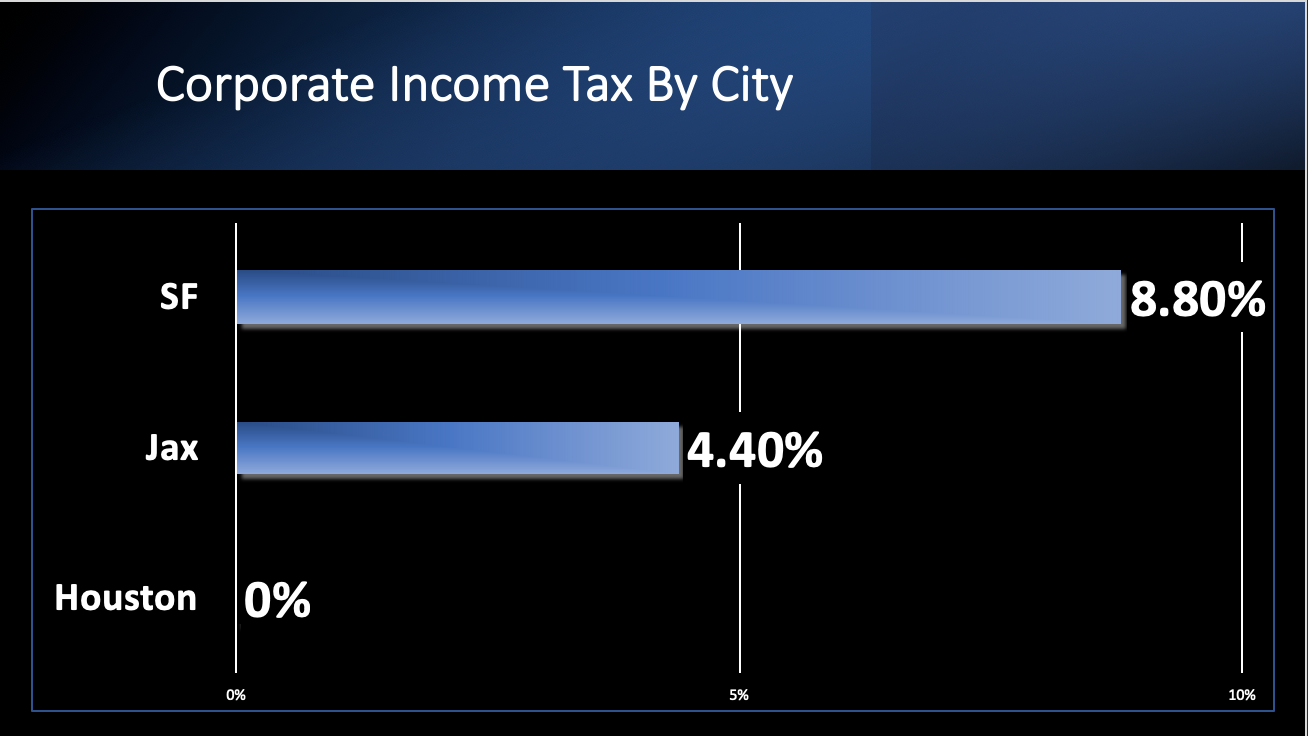

1. High Corporate Income Tax

California has one of the highest corporate income tax rates in the country at 8.84 percent. It is superseded by cities like Chicago at 9.5 percent and Philadelphia at 9.99 percent. These rates are staggering especially when they’re placed in context. Currently, there are regions of this country where organizations do not pay a dime in corporate income tax.

Nevada, Ohio, Texas, and Washington are not required to pay corporate income tax. This factor makes these states extremely attractive to businesses looking to improve their bottom line. For this reason, Texas is quickly becoming one of the most popular spots for large organizations to relocate to.

The Lone Star State’s Low Prices

Software giants Oracle and Hewlett Packard have already begun moving their headquarters to Texas. They are not alone. Elon Musk reported in December of 2021 that the Tesla headquarters would be shifted from Palo Alto, California to Austin, Texas. These moves are characteristic of a grander shift away from the regulations of the Bay Area.

The market is competitive, and businesses are looking to save. Companies that move to regions of lower tax overhead costs are finding that they have an edge over businesses that are stuck in areas that are expensive to work and live.

The Wall Street of The South

States with zero corporate income tax are not the only places where companies can lessen the load of their overhead expenses. While Floridians do have to pay corporate income tax, it is at a reduced rate. If you move your business from San Francisco to Florida, the percentage you pay in corporate income taxes will be cut in half.

Like Texas, Florida is quickly becoming a hub of business and industry. With over 300 hedge funds, private equity, and financial services firms having moved to Florida, it has developed a reputation as “The Wall Street of The South.”

You are not limited to these regions, but the savings are out there and many businesses have already jumped on the opportunity to capitalize on them. Let’s look at the difference in numbers for the corporate income tax of San Francisco compared to popular cities in Florida and Texas.

Data According to the Tax Foundation

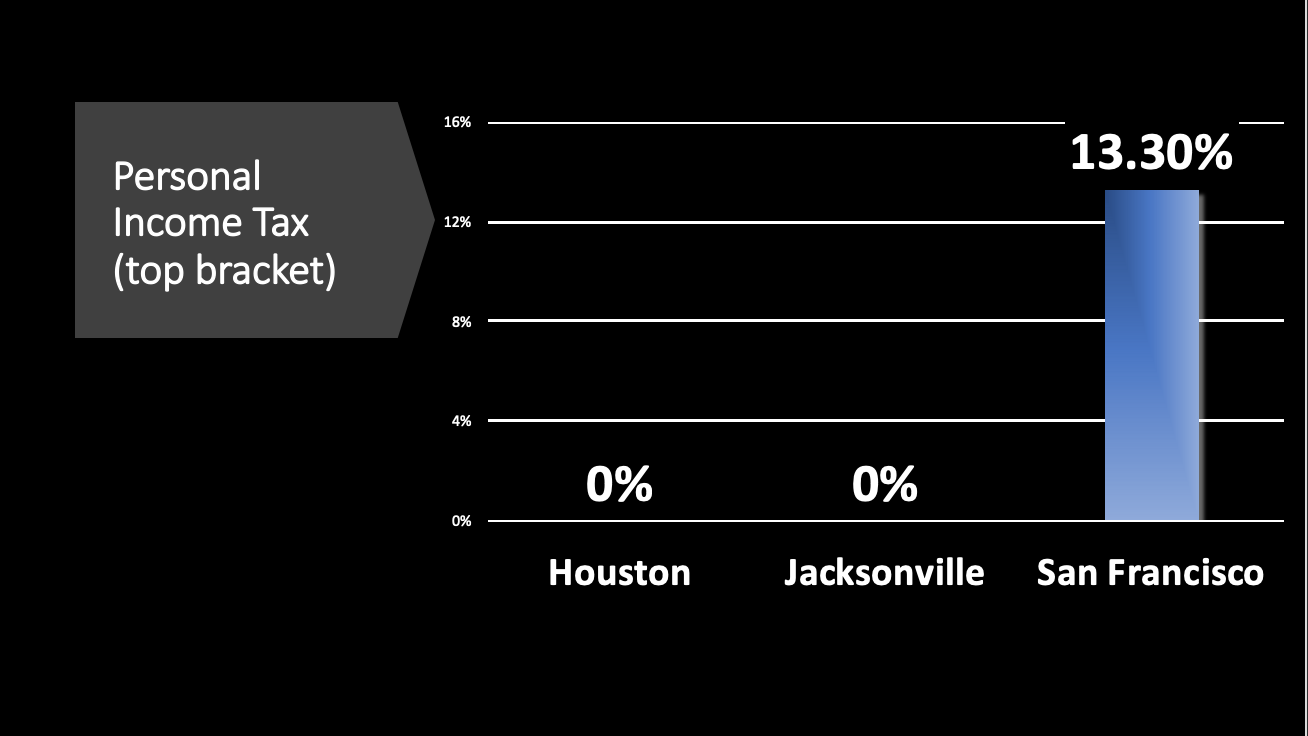

2. Expensive Personal Income Tax

If you want the money you earn to remain in your pocket, San Francisco is not the place for you. California currently has one of the highest taxes in the country for the top bracket of earners. If you are a corporate professional, you very well may fall into this bracket. Although your main concern for moving could be your organization's financial well-being, it wouldn’t hurt to reap the benefits in your personal life.

Places like Florida, Texas, Tennessee, and Nevada all charge a zero percent income tax rate. Think about this compared to what California’s current percent is: about 13. Going from thirteen to zero percent is a massive change. This is an opportunity to build significant gains across personal and organizational scales.

Data According to the Tax Foundation

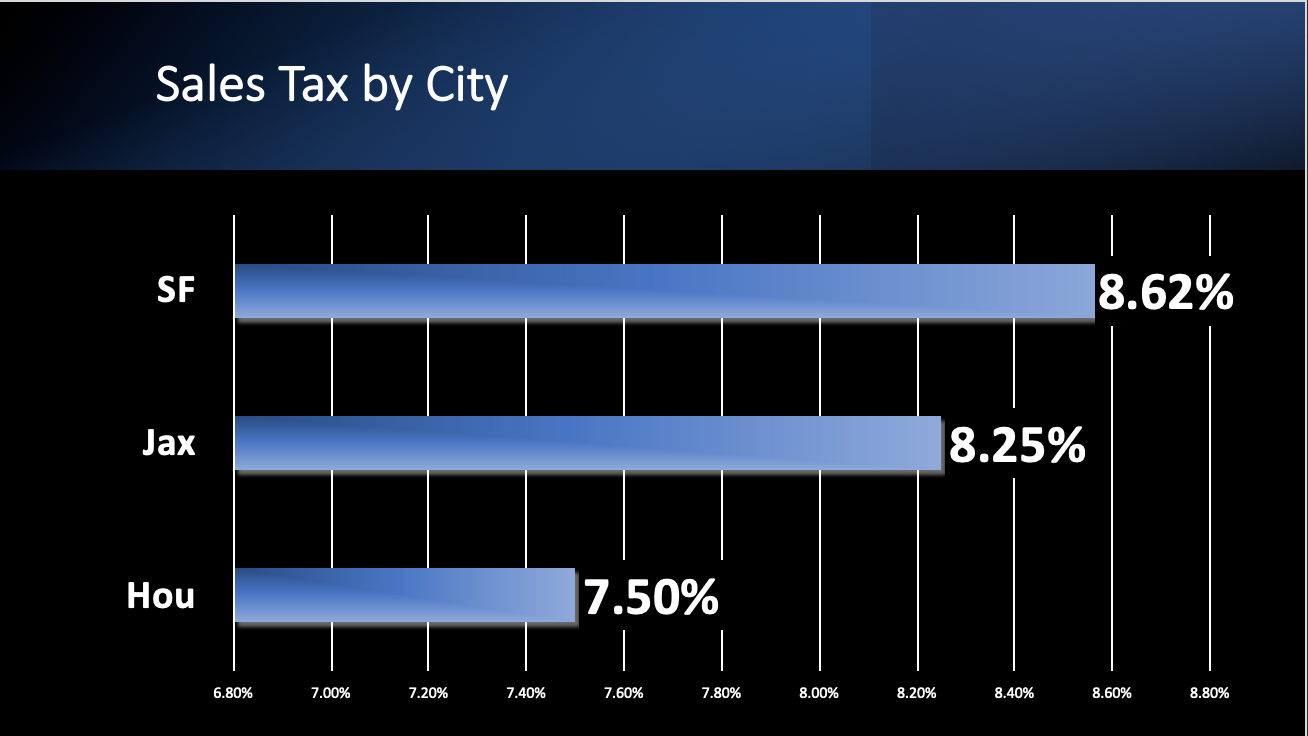

3. Elevated Sales Tax

While the difference in percentage for sales tax from California to Florida and Texas is not quite as staggering as other taxes, it still is higher. This is indicative of the fact that you’re looking at higher costs across the board in California, in taxes alone.

Due to the demand on the supply chain, the higher taxes influence the price of everything else, making it more expensive. You are also feeling the weight of more rent, gas, and payroll costs in addition to the taxes. The higher sales tax is characteristic of the area’s extreme cost of living which raises the price of goods and services across the board.

For businesses, elevations in sales tax add up quickly.

Also, in regions where sales tax rates are higher, consumers have less freedom to spend freely. In addition, with such high costs, the power of the dollar is not as strong as it is in other parts of the country. Therefore, moving out of California will not only save you in terms of cost of living, but you stand to financially benefit when people have more economic freedom to spend their money as they please.

Data According to the Tax Foundation

How To Avoid California Expenses

You have a unique opportunity now to reconsider your organization’s demand for space. If you even need space, you now have the option to reassess what location would best match your organization’s projections for its most optimal performance.

This can mean many things, but improving efficiency and profit margins can be achieved quickly if you reduce your overhead costs. Moving out of San Francisco will give you the ability to do this.

The opportunity is yours, and it is up to you to capitalize on it.

If you want help weighing all the factors of this process, tenant reps can help. As experts of market intelligence, they are available to help you with anything from coming to a decision or conducting a substantial, cross-country move. Through only representing tenants, they keep your best interest in mind when finding the best property and price for your unique needs.

Want to learn about working with a tenant rep? Check out this article!

Wondering where to begin?

Related Content

- 3 Reasons NY Taxes Are Bleeding Your Company's Budget Dry

- 5 Benefits of Moving Your Company to a Business-Friendly Red State

- 3 Reasons Business-Friendly Cities Increase Corporate Profits

- Should I Move My Business to Texas? 5 Key Considerations