Commercial real estate exposure poses one of the greatest threats to the stability of regional banks since the 2008 financial crisis. The collapse of the office market has pushed commercial real estate debt to a critical threshold.

Because with shrinking tenant demand, 1 in 3 office landlords are at risk of defaulting on loans they can no longer service.

Now, if nothing changes, major financial institutions may be forced to absorb the bad debt from the commercial real estate loans. And while lowering interest rates may provide temporary relief for the commercial property sector, CRE exposure remains a significant threat.

So read on to learn:

- Why non-recourse loans could lead to a bank bailout

- Which 5 banks have the largest commercial real estate exposure

- Why this should be so disturbing for average Americans

|

"The top five banks had a combined commercial real estate loan volume of nearly $500 billion as of June 30. Loan volume increased at several of the following 20 banks over the previous year, with one reporting a rise of 22.0%." -American Banker |

Remember, this commercial real estate market is symptomatic of a post-apocalyptic office market. CRE risks have never been more acute. Corporate tenants can download the free copy of surviving the office apocalypse today to learn how to navigate this new environment.

Commercial Real Estate Loans

Risk from exposure to the commercial property market is climbing, and much of this is concentrated among several major financial institutions.

Major banks are reporting increases in provisions for potential loan losses, while smaller banks with concentrated CRE loans face the greatest threat to financial stability.

Analysts predict that growing risks in the CRE market could trigger a wave of defaults, leading to potential bank bailouts as lenders struggle to absorb the fallout from their extensive CRE exposures.

As this crisis unfolds, greater scrutiny is being placed on the balance sheets of banks with high exposure to commercial real estate.

Hundreds of billions of dollars in loans backed by commercial properties could come under further stress, leading to significant potential losses across the banking sector.

The federal reserve system is closely monitoring these developments, as record stock prices for some larger banks may mask the underlying CRE risks tied to their loan portfolios. It's worth mentioning that while office gets a lot of notoriety, banks’ exposure to CRE refers to multiple property types, from multifamily to industrial.

Commercial Property Loans are Non-Recourse

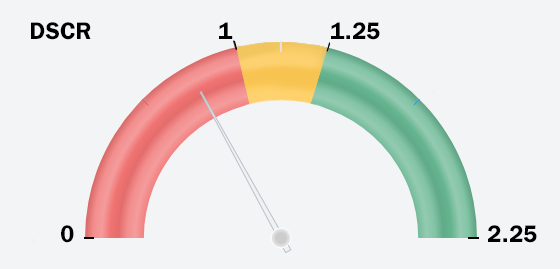

Typically, lenders assess key financial metrics like Debt Service Coverage Ratio (DSCR), Capitalization Rate (Cap Rate), and Loan-to-Value (LTV) ratio to determine borrower eligibility for commercial property loans. In the current climate, however, even properties with favorable metrics are struggling due to the sector's deepening problems.

Banks typically require a DSCR of 1.25x to 1.35x, but with CRE exposures now seen as the largest loan category for many institutions, including Wells Fargo and First Republic, the ability of borrowers to meet these thresholds is in doubt.

Banks are also tightening LTV requirements to cover themselves and minimize CRE exposure, now demanding more equity from commercial real estate landlords. Where they once accepted 70% / 30% or 80% / 20% LTV ratios, they now require an LTV of 60% / 40% or 50% / 50%, reflecting growing caution amid weakening commercial real estate markets.

All pointing to warning signals reflecting the growing fear of delinquent commercial property loans, specifically for office space.

The tightening of LTV requirements by banks in these cases is primarily due to the non-recourse nature of many commercial real estate loans.

The prevalence of non-recourse loans in the CRE market significantly heightens the threat of a potential bank bailout. Not to mention a bank bailout will only increase the U.S. deficit.

Since these loans allow borrowers to walk away from underperforming properties without facing additional financial liabilities, banks are left holding the asset as their sole recourse. When property values decline, particularly among office buildings, the collateral often falls short of covering the outstanding loan amounts. This is especially true considering NYC office buildings are being sold for a shattering 97% discount.

A stark example of this in action is Brookfield’s recent default on $1 billion in loans tied to office properties. This high-profile failure reflects a troubling trend: landlords are increasingly opting to return the keys to lenders rather than injecting more capital into distressed assets.

While major firms like Brookfield, with its $924 billion portfolio, can weather such setbacks, the broader financial system is far more vulnerable. And whether or not these major landlords can pay the debt service, they are choosing to pass the burden onto banks.

As defaults continue to rise, the risk of contagion grows, threatening not just lenders but the stability of the CRE market and potentially sparking a ripple effect that could require government intervention or even a bank bailout.

As these defaults pile up, the pressure on major financial institutions and smaller banks alike is intensifying.

The risk exposure from these CRE loans could force central banks to intervene, potentially requiring another bank bailout. With many banks already grappling with significant commercial property exposure, the cascading defaults could mirror the financial turmoil seen during the 2008 crisis, placing taxpayers at risk of footing the bill.

Banks With Highest Commercial Real Estate Exposure

In the wake of this discussion on bank stability, it's key to examine the major players. So, let's look at which major banks have the highest CRE lending ratios in their loan portfolios.

1. JP Morgan

As one of the largest banks in the world, JP Morgan Chase has significant exposure to the CRE market. With 12.6% of its total loan portfolio tied to commercial real estate, the bank's involvement in this sector leaves it particularly vulnerable to the ongoing challenges in the CRE market, especially with the office space crisis worsening.

In accordance with this, it has increased loan loss provisions in anticipation of defaults, especially in high-vacancy cities like New York and Chicago, where office space demand has plummeted. To manage this, JP Morgan is tightening lending standards, reducing loan-to-value ratios, and exploring options to sell or restructure high-risk loans, though the situation could still impact its future earnings and the broader financial system.

|

"JPMorgan Chase, America’s largest bank, has 12.6% of its loan portfolio in commercial real estate." -Visual Capitalist |

While the bank has seen its stock price rise by 27% in 2023, driven by strategic moves like acquiring First Republic, its heavy CRE exposure makes it vulnerable to rising vacancy rates and falling property values.

This is especially true as delinquent commercial property loans and defaults mount. The bank’s exposure to CRE loans will be under even greater scrutiny if the commercial real estate downturn worsens. But for now, the roughly $1.4 trillion loan portfolio will stand.

2. Wells Fargo

Wells Fargo holds the second-largest exposure to CMBS loans. With $137 billion in CRE loans, Wells Fargo’s commercial real estate exposure comprises 15.5% of its total loans and 8% of its total assets.

The bank saw a 4.4% year-over-year decline in its CRE loan portfolio, likely reflecting a cautious approach to the mounting risks in the commercial property sector.

With $1.7 trillion in total assets, Wells Fargo’s size allows it to manage significant CRE risks, but its high exposure means the bank remains vulnerable to the increasing strain in the market, particularly as commercial property loans are coming due in large numbers.

As commercial properties, especially office buildings, continue to face high vacancy rates and falling values, Wells Fargo's exposure puts it under pressure. Its leverage ratio of 8.68% underscores its capacity to manage its risk exposure, but the sustained troubles in the CRE market could still present challenges for the bank moving forward.

3. Bank of America

Bank of America ranks third in CMBS exposure, with $86.57 billion in commercial real estate loans. Unlike its competitors, the bank saw an 11.4% year-over-year growth in its CRE loan portfolio, reflecting a growing focus on commercial property lending. Of course, new loans for commercial properties were overwhelmingly not for office space.

These loans now account for 8.2% of the bank’s total loans and 3.4% of its total assets.

With $2.55 trillion in total assets, Bank of America continues to play a significant role in the commercial real estate sector. The bank’s decision to expand its CRE exposure amid market uncertainty demonstrates its confidence in navigating CRE risks, though its leverage ratio of 7.63% underscores the need for prudent risk management as challenges in the sector persist.

4. US Bank

In fourth place for CMBS exposure is U.S. Bank, with $54.17 billion in commercial real estate (CRE) loans. Although the bank experienced a 4% year-over-year decline in its CRE loan portfolio, CRE loans still make up 14.3% of its total loans and 8.1% of its total assets.

With $664.92 billion in total assets and a leverage ratio of 9.2%, the risk of a bailout is not on the horizon. But knowing which major players have the most exposure is worth keeping an eye on.

5. PNC Bank

Rounding out the top five is PNC Bank, which holds $48.18 billion in CRE loans. Like U.S. Bank, PNC saw a 3.7% year-over-year decline in its CRE portfolio.

CRE loans account for 14.9% of the bank’s total loans and 8.7% of its total assets, indicating significant commercial property exposure. With $552.53 billion in total assets and a leverage ratio of 8.71%, PNC is well-positioned, but its reduced CRE lending signals growing caution amid the challenging commercial real estate market.

Takeaways for Tenants

The commercial real estate market is on the verge of a financial reckoning. Banks like JP Morgan, Wells Fargo, Bank of America, U.S. Bank, and PNC Bank hold massive commercial real estate loan portfolios, exceeding $500 billion collectively.

As defaults pile up and property values nosedive, these financial institutions are increasingly vulnerable to a devastating domino effect.

The cracks are already showing—rising vacancies, falling rents, and landlords handing back keys are just the start. With the stakes this high, the risk of a major financial crisis, possibly triggering bank bailouts, is real.

In this evolving market, corporate tenants need strategies to navigate these uncertainties. Prepare for the fallout by downloading Surviving the Office Apocalypse and learn how to secure your business in this collapsing market.