When signing a commercial lease, you never want to leave any room for error. Unfortunately for the corporate tenant, there are many potential pitfalls in the pages of an 80+ leasing document.

How do you avoid error when it seems budgetary dangers are lurking around every corner? There is no simple answer, but the solution lies in awareness. Knowing how and what to be prepared for will limit the possibility that you can get taken advantage of.

How do we know this? As tenant reps, we have three decades of experience safeguarding the interests of our corporate clients. We have drafted and negotiated hundreds of leases. As a result, we know the most critical clauses you should be looking out for. These terms can bring on a windfall of financial success if properly negotiated. However, they can also bring on a logistical and budgetary nightmare if not thoroughly analyzed.

So to learn these clauses and what exactly makes them so dangerous individually, read on. By identifying where you can take advantage of, you will be able to make more skillful and confident decisions for your CRE portfolio.

3. The Tenant Improvement Allowance

1. The Sublease Clause

The sublease clause grants you the right to lease out any space you don’t use within your property. Why is this so important? Spatial needs change. Companies should have the ability to adjust their commercial real estate to changing internal and external demands.

While the sublease clause is almost always included within the lease, having it there is not sufficient. The danger lies in how it is written.

For instance, landlords will often give themselves the right to “reasonably” reject a subtenant. What they don’t say is how long they can take to give you an answer. So this seemingly innocuous phraseology, at first blush, may seem reasonable, but an experienced tenant rep will realize your sublease clause can actually preclude you from subleasing in the real world. This is how...you can't hang on to a prospective subtenant indefinitely. They will most assuredly move on to another property. This is something your landlord knows. We’ve seen five-page sublease clauses and two-sentence sublease clauses, which both in effect, negate your ability to successfully sublease your space in the event that you have to downsize or close that office.

|

Companies without a usable sublease clause will suffer if they downsize. |

They will be wasting precious funds on wasted space. And the last thing businesses need in a recession is another hole in the bottom of the bucket.

If COVID proved anything it was how quickly spatial demands for change. For those without the protection of a great sublease clause, it was too late. They paid a heavy price.

Shifting to work-from-home or hybrid models cost companies millions of dollars as their offices sat vacant. When real estate is the second most significant corporate cost, wasted CRE dollars cannot be afforded.

Protect yourself and your ability to adapt by including a detailed sublease clause in your lease.

2. Usage Clause

The usage clause will outline how you are entitled to use your leased space. The usage form's broadest form is “for any lawful use.” This does not implement any restrictions on the type of company operating within the building.

If you do not pay close attention to your usage clause, it can quickly become problematic for your tenancy. It can limit your flexibility regarding:

- Who you can sublease to

- Business lines

- Many more considerations

The usage clause is another clever way that the landlord can thwart your ability to sublease your space. Thus, potentially costing your company many millions of dollars. For example, let’s say you have a 50,000 square foot office and you are an insurance company.

The landlord’s broker may try to slip in that this office is to be used for insurance claims. If in three years, your company has decided to close down this office and sublease it, you will find that you are restricted to sublease to other insurance companies only. This clause negates about 99 percent of all potential sublease tenants. And someone will come asking, "Who underwrote this lease?"

If your office was 50,000 square feet at $50 per square foot, not finding a sublease is costing you $2.5 million per year. Explain that to your boss.

3. Tenant Improvement Allowance

Before you take occupancy in a new space, renovations are almost always required. The construction that the landlord funds is known as the tenant improvement allowance.

|

Any costs that go beyond the landlord's TI $ will be yours. So, knowing where these dollars start and end is critical. |

Since you only possess the leasehold estate, ensure that any capital expenditures fall under your landlord’s budget- not yours’.

When your landlord renovates your building, they increase the property’s value. So even though you may be the initial party to benefit, the landlord can eventually ask for a higher asking price once you leave. Therefore, make sure you are only paying for company-specific enhancements.

It is critical to know the condition for which your allowance begins. For example, if you are leasing the barest condition possible, a cold dark shell, most of the allowance may go to initial construction. It would take more funds to transform the property to a livable condition before you even begin above environmental standard enhancements.

A cold dark shell will take a lot of money and time to become a workable space.

A cold dark shell will take a lot of money and time to become a workable space.

To avoid eating your tenant improvement allowance on construction, ensure it begins at the warm, vanilla shell level. That way the space is already equipped with ceiling, lighting, flooring, HVAC, etc.

A warm vanilla shell condition already equipped with lights, ceilings, floorings, etc.

A warm vanilla shell condition already equipped with lights, ceilings, floorings, etc.

4. Rent Escalation

Your initial base rent will eventually be subject to escalations. The key here is to be aware of how much and how often the rent will increase.

Several types of rent escalations will influence the rate you have to cover. Some escalation types are safer than others, but the following list covers all the types you should know:

- Fixed Percentage Escalation

- Rent Bump

- Escalation, according to the Consumer Price Index (CPI)

- Hybrid (CPI and fixed)

A skilled tenant rep would advise you to opt for a fixed percentage increase. In this case, your rent escalations by a specific, predetermined percentage of your rent (usually around 3%). There is no ambiguity with your financial payments, and you have an accurate budgetary estimate for the totality of your lease’s term.

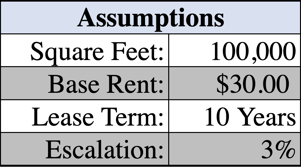

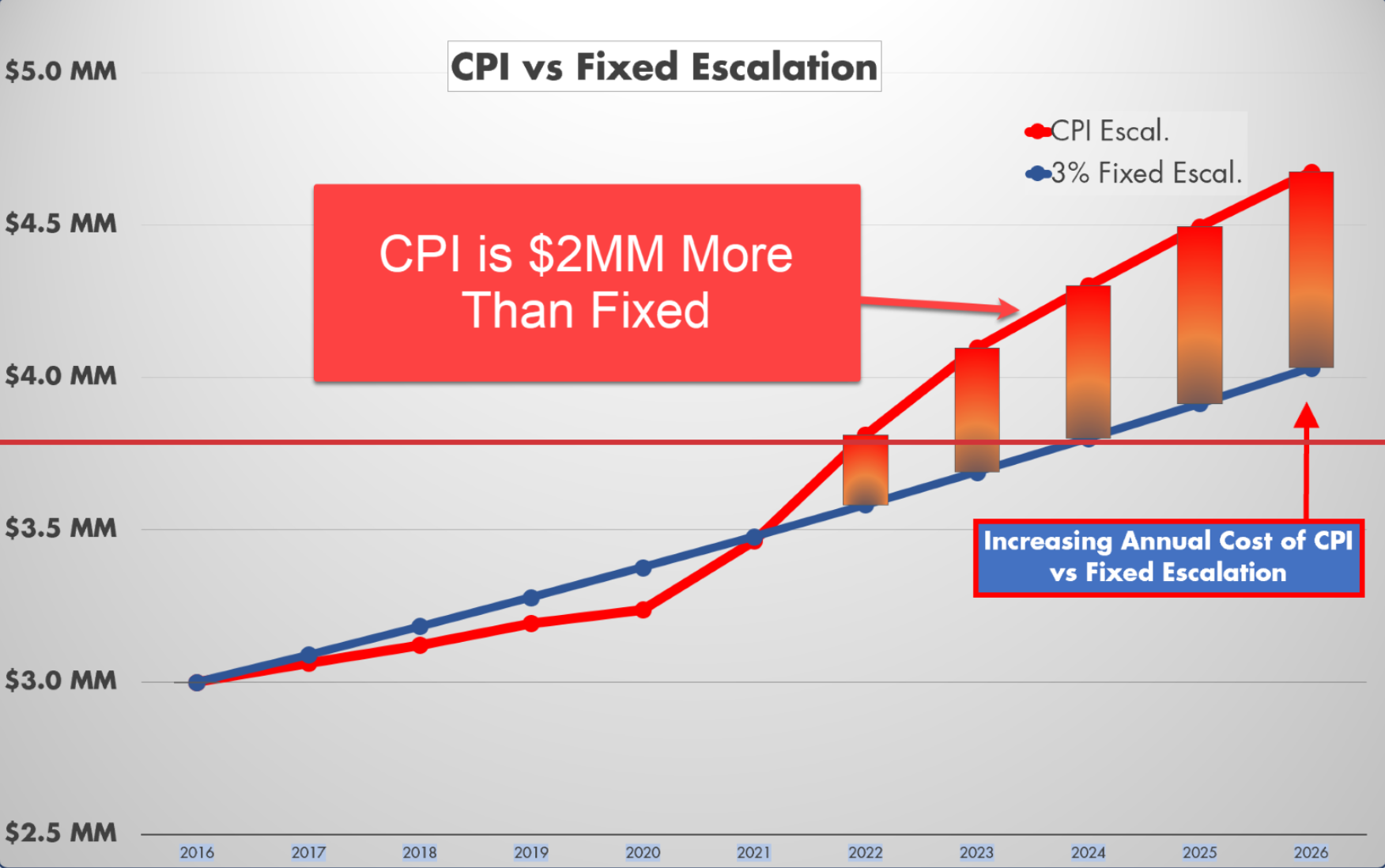

Below is a mock-up payment schedule for a fixed escalation over a ten-year lease.

As you can see, there is no financial ambiguity. The rent increases slowly and steadily.

Rent bumps are similar to fixed percentages but are usually reserved for warehouse spaces. The rent increases by a specific dollar per square foot amount.

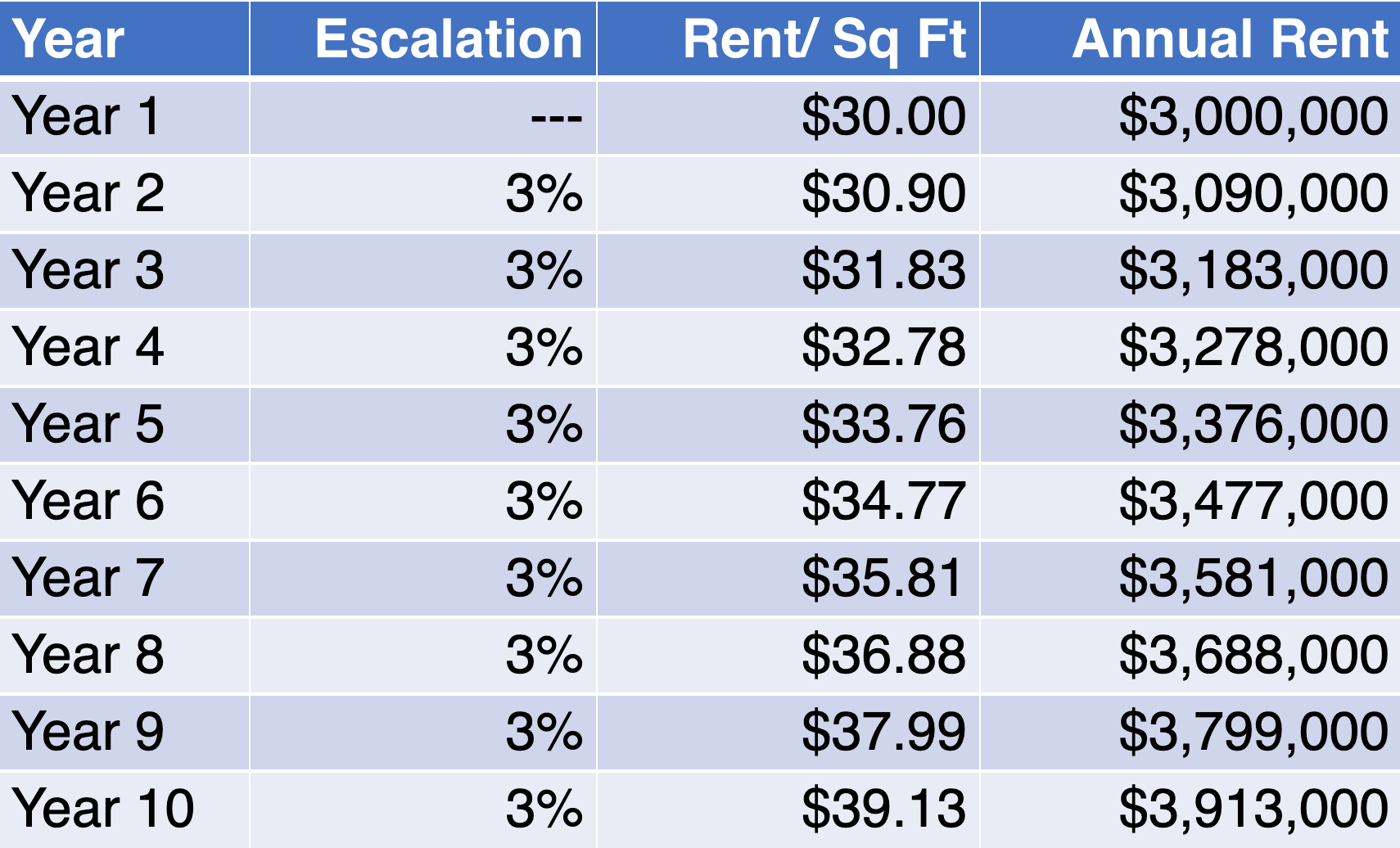

The worst thing you could do is let your landlord convince you to adopt escalations according to the consumer price index. Why? CPI escalations are unpredictable and often exorbitantly expensive. As a result, your company’s budget is vulnerable to volatile inflation increases. If inflation spikes, so do your rent payments, and you could quickly be paying millions more over your lease when compared to the fixed percentage.

Over a ten-year lease, a CPI escalation could cost you millions more than a fixed escalation.

Over a ten-year lease, a CPI escalation could cost you millions more than a fixed escalation.

This is especially pertinent now since inflation is higher than ever. However, know that landlords may want to take advantage of these rates and may be unwilling to settle for a meager 3% increase.

If this occurs, you can negotiate for a hybrid of the fixed and CPI increases. If inflation rates exceed a specific, predetermined number, your 3% escalation may increase to ~4% but will be capped. It is a bracketed fixed rate that goes up a small amount if CPI hits certain benchmarks. If the CPI goes below that benchmark rate, it could then go back down.

As you can see, rent escalation is dangerous because there are several types. If you opt for the wrong escalation, your budget will suffer.

5. Expense Stops

Expense stops are a critical and dangerous part of your lease because operating expenses can become one of the most expensive lease features.

Like with the tenant improvement allowance, your landlord will likely agree to pay a portion of the building’s operating expenses. Any expenses that exceed their expense stop will be passed through to you, the tenant.

|

In the landlord's perfect world, you are responsible for any additional expenses. |

Often the expense stop will be determined from a base year of operating expenses. However, this can quickly get complicated for tenants in new, multi-tenant buildings. If the building is not fully occupied, your landlord will "gross up" the operating expenses to what would be incurred if the building was at 95% capacity.

Your landlord will determine the gross up by increasing the variable components of janitorial and maintenance services, management fees, utilities, and property taxes. Make sure their grossed up calculation is accurate and fair. If not, you could lose money paying over your OpEx share.

Know that your OpEx may likely also be subject to escalations. As a result, the importance of pinning down the budget is heightened.

How a Tenant Rep Can Protect You From Dangerous Clauses

As you now know, many aspects of lease clauses can cause complications. The worst part is that this list does not even begin to cover all the places where an unprepared party can be taken advantage of.

Lease clauses are filled with nuance. It takes an experienced and knowledgeable party to skillfully negotiate so the clauses fall in your favor. Luckily tenant reps are real estate experts who only work with tenants.

At iOptimize Realty®, we are tenant reps with over three decades of experience protecting our corporate clients. We have negotiated hundreds of leases in their favor. As a result, we know everything you should be looking for, so there is no room for error.

Want to learn how you can benefit from working with us yourself?