With high vacancy rates, an increasing number of landlord defaults, and an oversupply of office space, the landscape is ripe for corporate tenants to secure prime properties at a fraction of the price. This environment presents both challenges and opportunities—especially for those who know how to spot distressed properties and leverage the current market conditions to their advantage.

For C-suite executives and directors of real estate, understanding how to navigate this market is critical. While many companies may shy away from distressed assets due to perceived risks, there are significant strategic advantages to be gained. However, to make informed relocation decisions, tenants must go beyond surface-level analysis and take a calculated approach to identifying, evaluating, and negotiating distressed properties.

In this article, you’ll learn how to:

- Define what makes a commercial property distressed.

- Understand the strategic advantages of underperforming properties.

- Identify distressed properties and pinpoint opportunities in today's market.

The key takeaway? With the right knowledge, distressed properties can be more than just a risk—they can be a long-term strategic asset for your business. Let’s dive into how you can capitalize on this market shift and make your next relocation a win for your company.

What Defines a Distressed Commercial Property?

A commercial property is considered "distressed" when its financial or operational challenges render it undervalued or in jeopardy of foreclosure. Common indicators include:

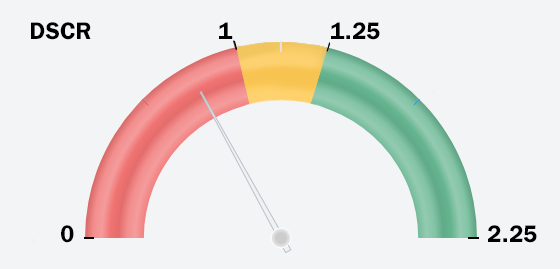

- Loan Delinquencies: Properties with non-performing loans or high Debt Service Coverage Ratios (DSCR). Note the image below. Anything below 1-1.25 signifies high default risk.

- Vacancy Rates: High vacancies signal struggling properties unable to retain tenants.

- Occupancy Rates: Consider this the dormant vacancy rate. Unoccupied or underoccupied space becomes vacant when the lease expires.

- Market Saturation: Oversupply in certain markets results in fire sale opportunities for savvy tenants.

For instance, nearly one-third of national office CMBS (Commercial Mortgage-Backed Securities) loans are currently distressed. In cities like Chicago, this number skyrockets to 75%, creating a buyer’s market for tenants, according to the Commercial Observer.

Of course, these office environments are in a complete recession. For landlords and banks, this means big trouble, which you can read about here: Brookfield Default is $1 Billion of $1 Trillion in CMBS Defaults.

Corporate tenants signing leases with distressed properties are taking a big gamble. It's important to mention that when analyzing a potential landlord's financials, tenants should consider the property owner's entire portfolio. Because, even though the specific property may not be at risk of default, the landlord could have cross-collateralized the loan with another property that is on a watch list. A landlord at any default risk comes with a lot of dangers for tenants.

But on the other end, to play devil’s advocate, the abundance of distressed properties provides tenants playing the long game with numerous strategic advantages:

- Cost Savings: These properties often feature significantly reduced rental rates and generous concession packages, including tenant improvement allowances and extended rent-free periods.

- Customization: Landlords, eager to fill vacancies, are more likely to accommodate tenant-specific buildouts and operational flexibility, tailoring the space to meet precise needs. This is especially true for long-term leases.

- Market Positioning: Relocating to a Class A property at a discounted rate not only enhances a company’s image but also positions it to attract top-tier talent and clientele.

Note that, if you're going to play this game, go in with eyes wide open. You NEED to learn every nuance of how to protect yourself and your portolio. There are certain safeguards every tenant should know, and they are all in the free comprehensive guide, Surviving the Office Apocalypse.

How to Identify Distressed Properties

Whether your goal is to avoid distressed properties, assess the risks within your portfolio, or strategically capitalize on them, knowing how to identify properties on a watchlist is essential for any tenant navigating today’s leasing environment.

But identifying viable distressed properties requires more than a surface-level market scan. It’s a calculated approach that combines thorough data analysis, hands-on market research, and insights from experienced professionals. Here’s how to navigate the process effectively:

1. Leverage CMBS Data

CMBS loans are packaged and sold as securities, backed by income-generating properties. When properties underperform—whether due to rising vacancies, declining rents, or financial mismanagement—their loan performance falters. Platforms like Trepp and KBRA Credit Profile aggregate and analyze this data, making it accessible for strategic decision-making.

Key Metrics to Watch in CMBS Data

- Delinquent Loans:

Properties with overdue payments or loans in special servicing are often signs of financial distress. Special servicers step in when a borrower defaults or signals an inability to meet loan terms, creating leverage for tenants negotiating favorable lease terms. - High Loan-to-Value (LTV) Ratios:

- The LTV ratio compares the loan amount to the property’s appraised value.

- A high LTV (above 70-80%) indicates that the property owner has limited equity, making them more susceptible to financial strain.

- These landlords will be eager to secure tenants to stabilize cash flow and avoid default.

- Declining Capitalization (Cap) Rates:

- Cap rates, calculated by dividing the property’s net operating income (NOI) by its value, are a measure of return.

- Falling cap rates suggest reduced income relative to property value, a red flag for distress.

- Advanced tenants can negotiate lower rents or tenant improvement allowances in exchange for stabilizing the property’s income stream.

- Subpar Debt Yield Thresholds:

- Debt yield measures the NOI against the loan amount, providing a snapshot of a property's ability to cover its debt.

- Properties with low debt yields (typically below 8%) are high-risk for lenders, signaling opportunities for tenants to step in with strong lease agreements that boost NOI.

2. Keep an Eye on Key Market Indicators

Markets in flux often leave clues. Two major signals to watch are:

Vacancy Rates:

Cities like Chicago, San Francisco, and Los Angeles are grappling with record-high vacancy rates. Even offices in traditionally prime locations are struggling to maintain occupancy, signaling potential opportunities for savvy tenants. But beyond just looking at the flat rate, analyze the vacancy composition.

Go beyond aggregate figures. Break down vacancy data by property type, class, current occupancy rates, and submarkets to identify where your leverage lies. Class A office spaces generally have shown moderate vacancies, while Class B and C properties face record-high levels.

Net Absorption Trends:

Negative absorption in markets such as New Jersey highlights an oversupply of commercial space. This imbalance creates leverage for tenants to negotiate better deals. But, even in markets with negative absorption, submarkets may vary dramatically. For instance, while Newark might show declining absorption overall, specific industrial hubs within the region could still see robust demand. Targeting these “micro-opportunities” can position tenants to secure space in competitive areas at discounted rates.

In this analysis, pair net absorption data with broader economic trends. A market with negative absorption but growing population or infrastructure investment might still be a sound long-term choice.

3. Work with Tenant Representatives

Partnering with tenant representatives is one of the most effective strategies for navigating the complexities of distressed commercial properties. These experts possess in-depth market knowledge and specialize in identifying opportunities, securing favorable lease terms, and avoiding common pitfalls. Their experience is invaluable in ensuring you not only capitalize on distressed property opportunities but also maximize long-term value for your business.

With the right market data, such as insights from CMBS platforms, tenant representatives can help craft powerful negotiation strategies. Armed with specific knowledge of a property’s financial challenges, tenants can approach lease negotiations from a position of strength.

By working with experienced tenant representatives, corporate tenants can unlock the full potential of distressed properties, securing favorable terms that enhance their long-term position in the market. With their guidance, you can approach distressed opportunities confidently and strategically.

Navigating the Distressed Property Landscape

Whether you're looking to avoid the pitfalls of distressed properties or capitalize on opportunities for strategic relocation at a fraction of the cost, the key to success lies in informed decision-making and expert guidance. By staying attuned to market indicators, leveraging data like CMBS insights, and partnering with seasoned tenant representatives, you can navigate the complexities of the current commercial real estate landscape with confidence.

In today’s volatile market, there are significant opportunities for tenants who understand how to identify distressed properties and negotiate favorable terms. The right strategies can not only help you secure cost-effective leases but also position your business for long-term growth and stability.

But don't go in without the right knowledge. Arm yourself with all the critical information you need to survive this apocalyptic environment. Download the comprehensive guide, Surviving the Office Apocalypse, today.