New York is great. But, let’s face it. If you are running a business, it may not be conducive to station your headquarters in Manhattan.

In terms of financial sensibility, there is none. Higher taxes, payroll, and occupancy costs are sure to bleed your budget dry.

Everyone knows that New York taxes are high, but do you know just how extreme they are? When you view New York’s rates compared to other regions, you can fully understand what a problem they are. Moving out of the city into the suburbs or even across the country will slash your organization’s overhead, in just taxes alone.

As tenant reps, we have witnessed this dynamic firsthand. We are present in the real estate market 24/7, which gives us the knowledge of where and how the market is trending. We have found that corporations are removing themselves from Manhattan and transferring to areas like Florida and Texas. In the process, they are dramatically increasing the quality of life of their employees while improving their bottom line.

We are not advocating for you to move to Florida or anywhere else. It may not be the right option for everyone. However, by laying out the data for you to review, you can come to that decision independently.

So, to highlight how much you could save if you move out of New York, let’s look at just its tax rates and how they compare to some of the popular destination cities. As you can imagine, taxes are the tip of the iceberg, and you have countless opportunities to cut your expenses if you move outside of NY.

The options for savings are out there. It is up to you to capitalize on them.

Why Explore My Options Now?

Now more than ever, you have the freedom to assess your commercial real estate practices. Definitions of work are becoming far more flexible. Along with it have gone our definition of appropriate working spaces. There has been a fundamental shift in our perception of what is required to work professionally.

On a mass scale, tenants are now considering if they need their physical working spaces. If you do, you can now rethink where these physical spaces should be. The online work phenomenon has opened up a world of possibilities where people can connect and collaborate even from different time zones.

So you now have a unique opportunity to get a head start on things. The earlier you move to places like Florida and Texas, the larger talent pools you will find. As more corporations take advantage of the lower price of these regions, prices will go up across the board. It is time to strike while the demand is still relatively low.

Maybe the office in Manhattan initially made sense. Does it still? The chances are that you are suffering from a greatly excessive overhead working in NYC.

The work from home revolution has shifted the market’s power balance in the hands of tenants. As a result, landlords are more willing than ever to concede to the terms you want for reduced prices. It is time to discover how you can benefit.

Where Should I Look?

You have countless options of areas that will enable you to slash your overhead costs.

For instance, you can move to the suburbs. They are often not taxed at elevated city rates. However, if you want to maintain that city feel and are willing to undergo a significant geographic shift, states on the sun-belt have significantly reduced tax costs.

You will save money if you move to the suburbs, but it won’t be to the degree of what you will experience in other regions.

Let’s look at Jacksonville, Florida, and Huston, Texas, to compare statistics.

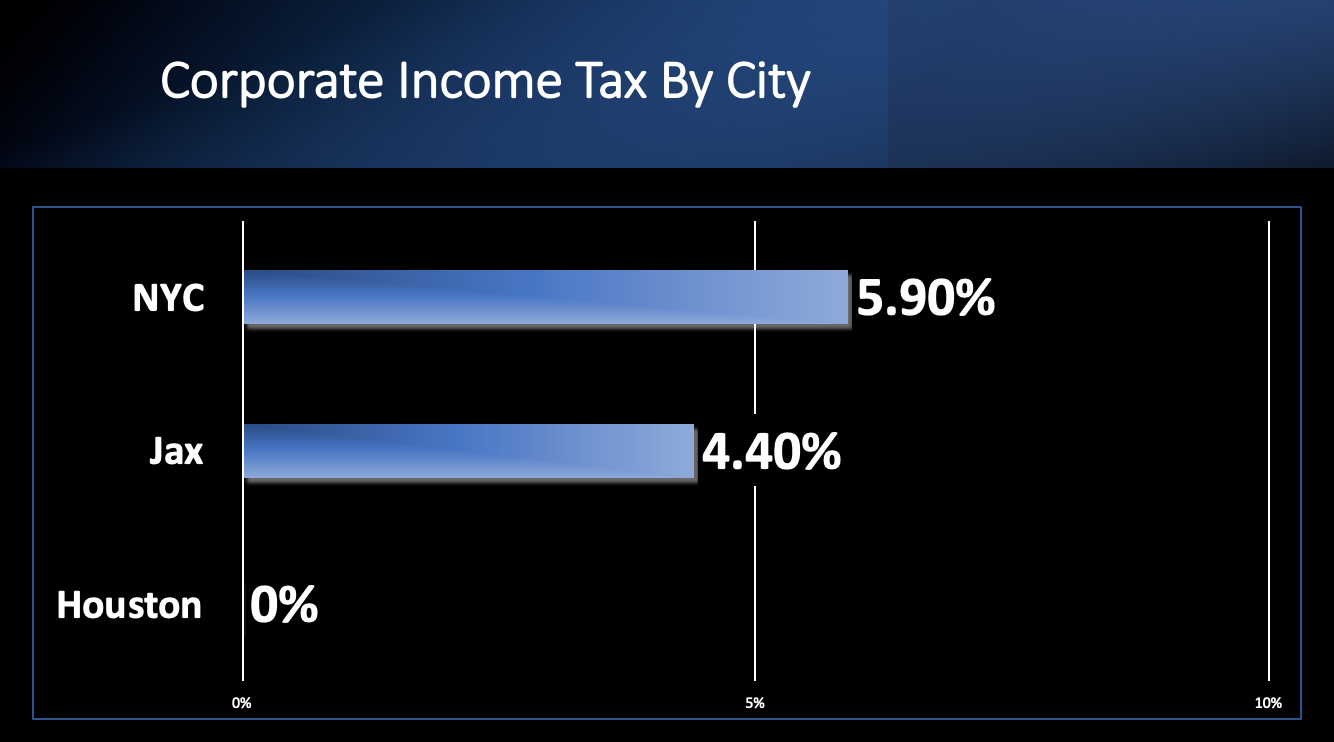

1. Corporate Income Tax

In 2021, the New York tax code underwent significant revisions. Tax rates were raised substantially for corporations, high earners, and commuters. Naturally, big players in the financial industry weren't happy. Wall Street itself underwent a massive overhaul when Goldman Sachs reportedly planned to move its operations to West Palm Beach, Florida.

Virtu Financial, another leading financial services player, expanded its operations to include a Floridian location. This trend doesn’t seem to be a phase, and Floridian municipalities are cooperating with the financial push South.

“There is a real growth trend in the financial sector, and we are currently working with around 50 financial firms planning to make a move to the Palm Beaches,” said Kelly Smallridge, President and CEO of the Business Development Board of Palm Beach County.

The Wall Street of the South

Florida has begun to establish itself as “The Wall Street of the South.” As this reputation is further established, it is sure to further encourage other businesses to make the move themselves. It is already an industry hub, and with New York tax rates steadily climbing, more corporations will likely be seeking an out.

The Push To The Sun-Belt

However, it is not just Florida that will cut your overhead tax costs. You currently stand to save more by moving to Texas. It boasts a zero percent corporate income tax. Going from New York’s rate of almost six percent to zero can significantly increase you company’s bottom line.

It’s not only New Yorkers who can benefit from moving South. Californian-based companies like Tesla, Oracle, and Hewlett Packard have packed up and moved to Texas. All the informed players are running from cities previously considered optimal business locations. Operating within their city limits no longer makes financial sense.

The zero-percent corporate income tax is too lucrative an opportunity to ignore. Las Vegas and Reno, Nevada are other options for cities with zero percent corporate income rates.

The savings are out there if your eyes are open to them. Let’s look at the difference in numbers for the corporate income tax of New York compared to popular cities in New York and Florida.

Data According to the Tax Foundation

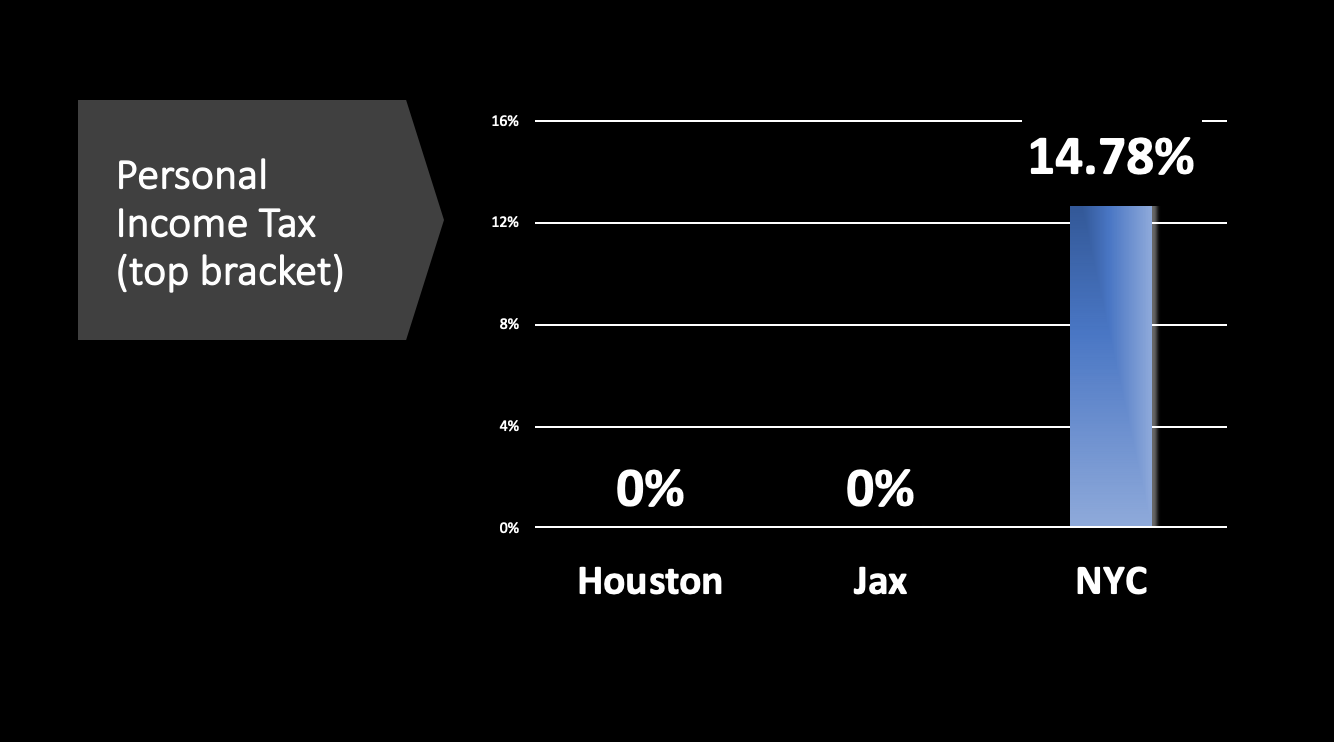

2. Income Tax

If you want the money you earn to remain in your pocket, New York is not the place for you. Manhattan currently has the highest taxes in the country for the top bracket of earners. If you are a corporate professional, you very well may fall into this bracket. Although your main concern for moving could be your organization's financial well-being, it wouldn’t hurt to reap the benefits in your personal life.

Places like Florida, Texas, Tennessee, and Nevada all charge a zero percent income tax rate. Think about this compared to what New York’s current percent is: almost 15. Going from fifteen to zero percent is a massive change. It is no wonder why over 300 hedge funds, private equity, and financial services firms have already moved to Florida.

Data According to the Tax Foundation

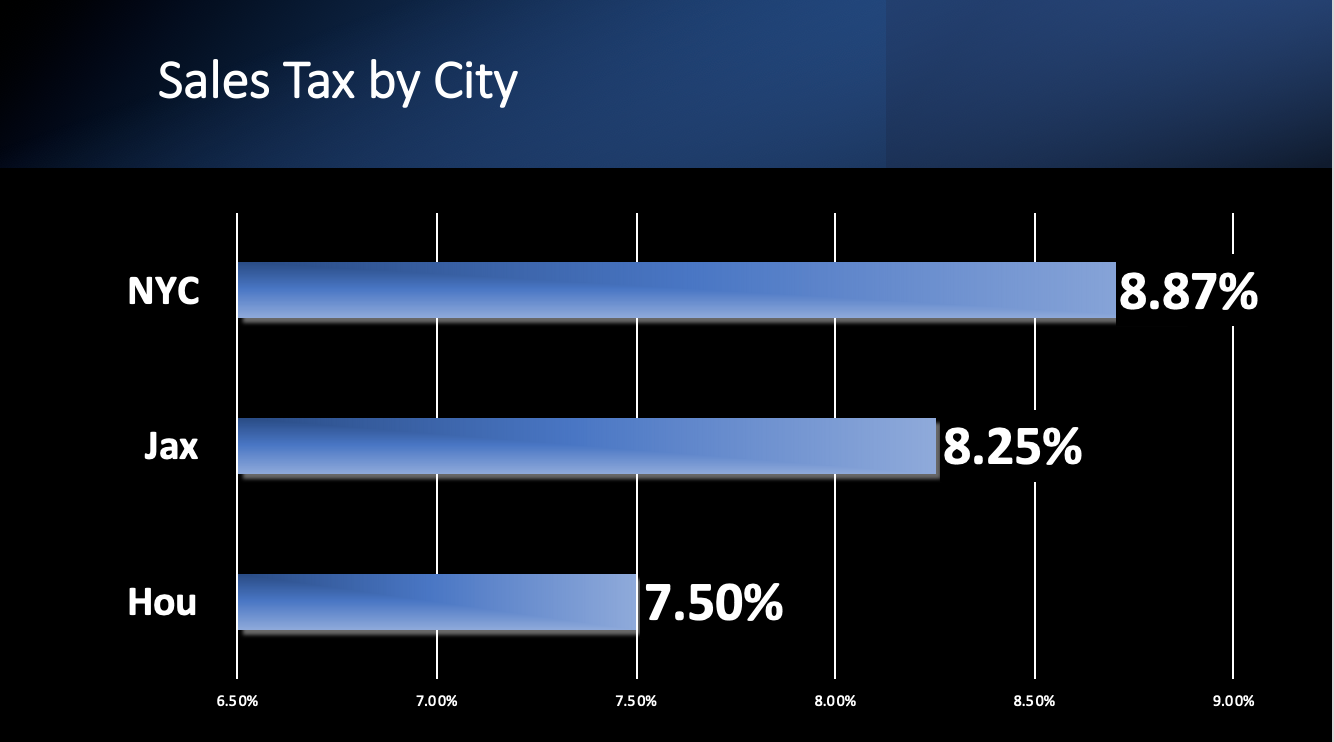

3. Combined Sales Tax Rates

New York taxpayers are suffering. After paying elevated income tax rates, people living and working in Manhattan are subject to additional fees for every purchase. The higher sales tax is characteristic of the area’s extreme cost of living.

In regions where sales tax rates are higher, consumers have less freedom to spend freely. In addition, with such high costs, the power of the dollar is not as strong as it is in other parts of the country. Therefore, moving out of New York will not only save you in terms of cost of living, but you stand to financially benefit when people have more economic freedom to spend their money as they please.

Data According to the Tax Foundation

How To Avoid New York Expenses

You have a unique opportunity now to reconsider your organization’s demand for space. If you even need space, you now have the option to reassess what location would best match your organization’s projections for its most optimal performance.

This can mean many things but improving efficiency and profit margins can be achieved quickly if you reduce your overhead costs. Moving out of New York will give you the ability to do this. The opportunity is yours, and it is up to you to capitalize on it.

If you want help weighing all the factors of this process, tenant reps can help. As experts of market intelligence, they are available to help you with anything from coming to a decision or conducting a substantial, cross-country move. Through only representing tenants, they keep your best interest in mind when finding the best property and price for your unique needs.

Looking to learn more about why you should move out of business-unfriendly areas? Check out this article.

Wondering where to begin?

Related Content

- 3 Ways San Francisco Taxes Make Business More Expensive

- 5 Benefits of Moving Your Company to a Business-Friendly Red State

- The Top 4 Business-Friendly Cities in Florida for Your Corporate Relocation

- Top 5 CRE Mistakes to Look Out For