In this article, you'll learn:

- Key lease clauses to scrutinize when signing a new office lease.

- Importance of a strong sublease clause to protect against unused space.

- The impact of usage clauses on your ability to sublease effectively.

- How self-help and right of offset clauses safeguard tenants in volatile markets.

The importance of a good lease is more critical for tenants now than ever before. Because we are not dealing with any old leasing environment. We’re navigating in a post-Office Apocalypse commercial real estate industry where knowledgeable tenants can drive once-in-an-era advantageous deals if they do it right, and on the other hand landlords are defaulting left and right. That means prospective tenants are in a precarious position, dangling between great deals and the potential that they may eventually be too good to be true.

So, to stay on top, learn the top clauses you should be aware of right now. Don’t take any chances with the following clauses, and get deep into the language your landlord uses when outlining your rights.

The Sublease Clause

Without the protection of a good sublease clause, a lot of tenants would be lost right now.

The sublease clause has been first and foremost in the last few years in a landscape where many office spaces are underutilized. A sublease clause offers an added layer of protection and flexibility for tenants, allowing them to mitigate risks and make the most of their leased space.

Because without one, there’s no financial safeguard against the strain of wasted space on a company’s EBITDA. And while subleasing isn’t the most lucrative option regardless, having a thorough sublease clause ironed out in your lease can never hurt. Because while you can’t profit or necessarily break even by subleasing space, having the option is an integral money-saving tool. Just ask Meta, Google, Twitter, etc who have collectively subleased over a million square feet of office space in the last few years.

But typically, leases are written with the initial bias towards the landlord. Legal jargon landmines are laid out everywhere, ready to take out the budget of unsuspecting tenants. Certain stipulations (or omissions) can limit your right to exercise your sublease. And in the event of the unexpected, a weak clause makes it difficult, if not impossible to sublease your property. This case will most assuredly circumvent your profitability and ability to function. Now you're stuck with a space without the ability to mitigate your loss.

The Office Apocalypse is an ongoing painful reminder that disaster can strike, and businesses need to pre-implement safeguards to minimize nearly inevitable negative effects. While subleasing was never the perfect solution to hybrid schedules, it helped tenants partially mitigate the unforeseen financial hole incurred from underutilized offices.

Essentially though, creating a strong sublease clause is one of the most effective ways a company can protect itself moving forward.

The Usage Clause

The usage clause holds significant importance for office tenants considering subleasing. If not properly vetted, it can serve as a potential roadblock that hinders your ability to sublease your space.

This is because the usage clause defines the permissible activities and purposes for which you can utilize your leased space. In its broadest form, the clause allows for "any lawful use," providing flexibility for various types of businesses within the building. But typically in an office lease, the basic usage is outlined for "general office purposes."

However, neglecting to carefully review and understand the usage clause can lead to challenges during your tenancy. It has the potential to restrict your flexibility in key areas such as who you are allowed to sublease your space to.

For instance, if you are a law firm and your lease specifies that the office’s use is for that, you can only sublease your space to other law firms. This limits your net of prospective tenants to an extremely small pool, thus complicating your ability to exercise the clause.

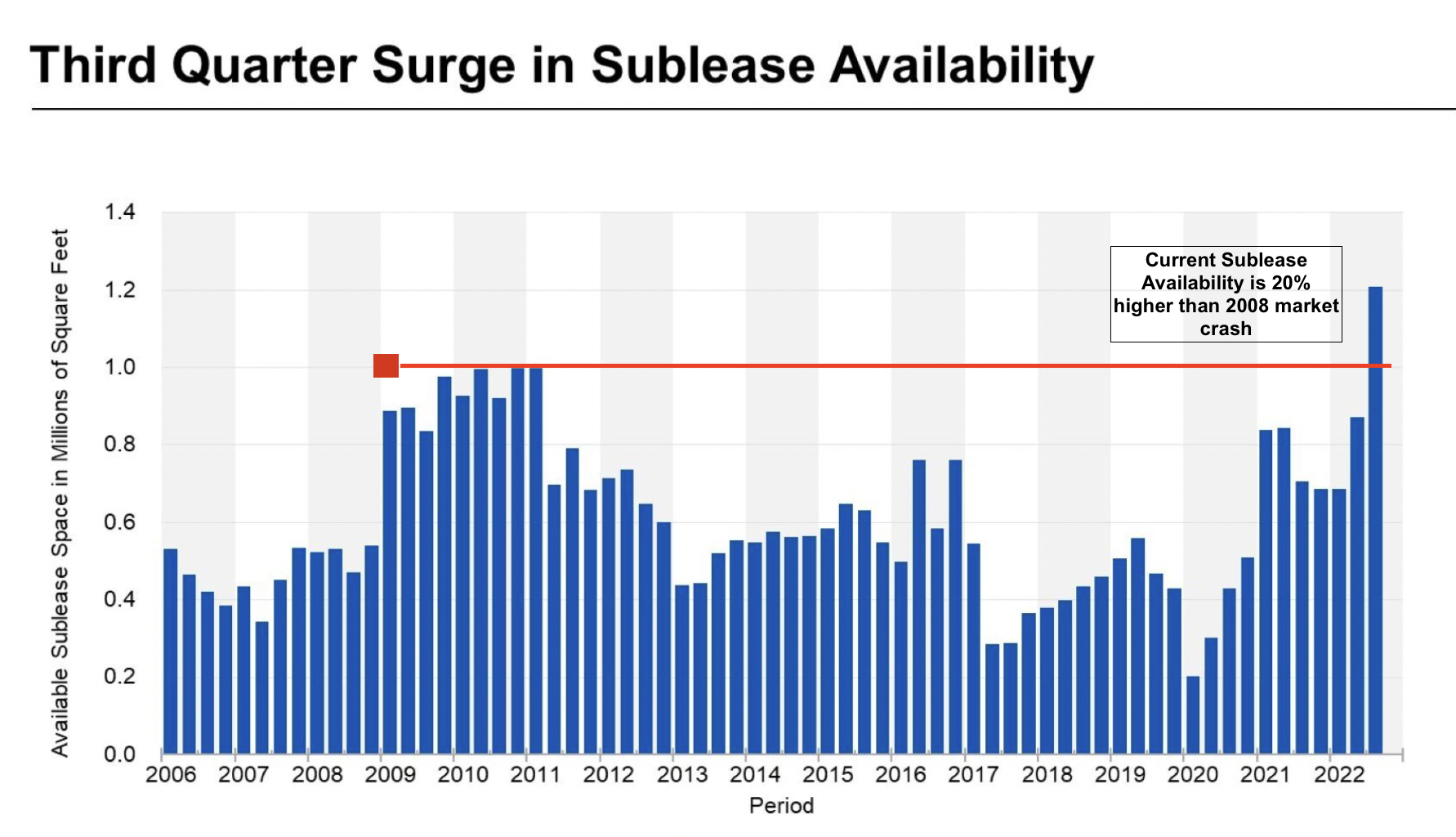

So make sure you pay special attention to your usage clause, or it may come back to bite you in a way you didn’t expect. Because when finding a new tenant or sub-tenant in this environment is already so complicated, you really don’t want to limit your prospective pool even further. Consider the sheer availability of sublease space and you'll understand what you're pitted against if looking for a prospective sub-tenant when so few companies are looking to take on more space.

Just for context for those who want to know, sublease availability in the third quarter of 2022 made the crisis after 2008 seem mild by comparison.

2009 or 2023? Commercial Tenants Beware.

2009 or 2023? Commercial Tenants Beware.

The Right of Offset

Now, the following clause is a special mention, because the leasing environment has gotten so dangerous for tenants and landlords alike. Landlords are seeing worse ROIs than ever because in order to land credit-worthy tenants in long-term leases in their properties, they need to offer lower base rents, more concessions, etc. On top of this, even if they do find a tenant with an extremely attractive deal, the rest of their building or properties may still sit empty.

All this concludes in an extremely volatile environment where landlords can’t pay their mortgages and are defaulting or handing their keys back to the bank rather than fighting a battle where they stand to lose even more.

So in this new market, including a "self-help" right clause in your lease is crucial for tenants to safeguard their interests and ensure the continuity of essential services. This clause empowers tenants to step in and maintain critical services at the landlord's expense, particularly in situations where the building is in receivership or the landlord fails to fulfill their responsibilities.

In receivership scenarios, office cleaning, HVAC maintenance, and other services may suffer due to the receiver's primary responsibility of paying the mortgage. By having a self-help clause, tenants can address these service deficiencies and protect their working environment.

Moreover, the "right of offset" provides an additional layer of protection for tenants. This allows tenants to deduct their out-of-pocket costs incurred due to the landlord's failure to meet their obligations from the rent. To exercise this right, it is essential to maintain detailed records of lease-related documents, rent receipts, and correspondence with the landlord, as this evidence can support your rights as a tenant in case of a landlord default.

By incorporating these clauses into the lease agreement, corporate tenants can ensure their protection even in challenging situations where a receiver becomes involved. The receiver must adhere to the lease terms, giving tenants the legal backing they need. Without these clauses, tenants will most assuredly face the burden of paying for additional expenses while still being responsible for the full rent.

It's important to note that landlords may resist the inclusion of self-help and right of offset clauses, as it diminishes their control. However, in the current market conditions, tenants hold a stronger negotiating position. Depending on the value of your tenancy and the overall circumstances, your tenant representative should advocate for these provisions on your behalf.

It is also important to note that with this clause, as well as the others mentioned in this list to consult a qualified commercial real estate attorney licensed in the state you are looking to business.

In these extraordinary times, tenants have an opportunity to assert their interests and negotiate favorable lease terms. Protecting your rights through self-help and right of offset clauses ensures that you can maintain essential services and mitigate potential financial burdens resulting from a landlord's failure to fulfill their obligations. Learn The Other Methods Tenants Can Protect Their Interests as Landlords Default.

Rent Escalation

Getting particular on your rent escalation clause is perhaps the smartest thing you can do for several reasons.

First, no matter the type of rent escalation, they are all cumulative. This means that the rental rate for each consecutive year of the lease is escalated based on the previous year's rate, not the base rate from the first year of the lease term.

Below are the four types of commercial rent escalations:

Now, this really comes into play with escalations that are not-fixed. With rent bumps or fixed percentage escalations, the rent will raise by the same rate each year with no surprises. However, if you were unfortunate enough to have an escalation according to the Consumer Price Index (CPI) in your lease, you probably didn't have a Tenant Representative to look over your lease... in fact, you probably worked with the landlord's broker.

|

With CPI escalations, your rent is now tied to the volatile swings of inflation and if it skyrockets, so will your rent payments. |

And since rent escalations are cumulative, that means you’ll be feeling the pain from a bad year for the rest of your lease’s term. Even if the CPI comes down in subsequent years, it still has established higher annual rents for the remaining years.

Since inflation is so high right now, landlords will likely be looking to sign on tenants with escalations according the CPI. Glossing over this could be the biggest, most costly mistake you make as a tenant. Read more in The Perils of a Bad Lease Escalation.

OpEx and Expense Stops

Expense stops are a critical and dangerous part of your lease because operating expenses can become one of the most expensive lease features.

As such, tenants must exercise caution when reviewing commercial leases, particularly regarding the operating expense (OpEx) clause. It is crucial to ensure that the OpEx clause is detailed and comprehensive to avoid any ambiguity or potential errors.

To address these concerns effectively, tenants should thoroughly consider the following aspects when discussing operating expenses:

- Clearly identify the costs that will be passed on to the tenant.

- Understand how the expenses will be calculated.

- Determine the tenant's share of the expenses.

- Evaluate any expense controls or caps that may be in place.

- Establish the timing for paying expense increases.

Remember, your company will be responsible for these expenses for the lifetime of your lease so it is crucial to minimize any room for error. This includes paying attention to the landlord's expense stop estimate.

In many cases, especially in multi-tenant buildings, landlords include the base year of operating expenses in a full-service office lease. The expense stop represents the portion of these expenses covered by the landlord, with any costs exceeding the expense stop being passed through to the tenant.

Tenants should be mindful that landlords are unlikely to reassess or adjust the expense stop once it is determined. This is significant because the base-year expenses remain fixed throughout the lease term, and tenants will be accountable for any operating expenses exceeding the expense stop.

Your landlord will maintain the original expense stop, whether prices remain the same or go up. As a result, the gross rental rate dedicated to covering operating costs will remain the same. By doing so, they are protecting themselves from inflation while leaving you vulnerable to it. In this case, your operating expenses are likely to grow over your lease term. That’s why it is one of the most dangerous clauses if negotiated improperly, read more about How to Negotiate an OpEx Clause that Benefits your Budget.

How a Tenant Rep Can Protect You From Dangerous Clauses

Lease clauses can be complex and pose various challenges. The list of potential pitfalls discussed here only scratches the surface of the many areas where an unprepared party can be taken advantage of.

Navigating lease clauses requires a skilled and knowledgeable negotiator who can adeptly advocate for your interests. Fortunately, tenant representatives are real estate experts specializing in working exclusively with tenants.

At iOptimize Realty®, we are True Tenant Reps™ with over three decades of experience safeguarding our corporate clients. We have successfully negotiated numerous leases in favor of our clients, equipping us with comprehensive knowledge of what to watch out for to ensure there are no room for errors.

By partnering with iOptimize Realty®, you can benefit from our expertise and have peace of mind knowing that your lease negotiations are in the hands of seasoned professionals who prioritize your best interests. Learn the methods True Tenant Reps™ to find the best properties, terms, and price every time in the free course below.