Manhattan office space prices are breaking the bank. And as the world continues to shift to a digital working model, expensive CRE (Corporate Real Estate) is becoming an unjustifiable cost for businesses.

Read on to learn about:

- The highest-priced office space in Manhattan ($300 per square foot)

- Why businesses are leaving Manhattan

- Opportunities tenants have to save big

The Manhattan Rent Crisis

CRE prices in Manhattan are expensive, really expensive. With Class A office rents regularly going for $70 to $90 per square foot, NYC’s prices loom over the rest of the nation.

At $90 per square foot with a necessary 100,000 square feet, your first year alone will cost you $9 million. Now, let’s say that despite runaway inflation, you have a relatively good escalation rate of 3%. So, over the next ten years your lease will cost you $106 million, not including increases in operating expenses (which could easily add millions more).

With such an extreme cost, one might think that it’s hard to surpass. However, the $90 per square foot seems like nothing compared to the rumored rates popping up in Midtown’s newest and tallest skyscraper. The 93-story, 1,401-foot-tall behemoth lies at the corner of 42nd Street and Vanderbilt Avenue, accessible through Grand Central Station. Employees even have access to private entrances marked “Tenants Only.” The extreme price includes floor-to-ceiling windows in offices, reservable showers, and an entire floor of amenities including a restaurant with Michelin-starred chef.

Premium office in 1 Vanderbilt, with sweeping city views... You decide, is it worth the cost?

Premium office in 1 Vanderbilt, with sweeping city views... You decide, is it worth the cost?

Such a premier location is sure to come at a cost, but hold on to your hats, it may be more than you think. Prices range from $130 per square foot to above, an unbelievable, $300 per square foot. According to Business Insider, “A 72nd-floor office is listed for $312 a foot, or $3.3 million a year.”

Companies taking up space in NYC’s most expensive real estate are making an extreme statement during a WFH (Work from Home) revolution, that they can still afford it. They include:

- TD Bank

- Carlyle Group, private equity firm

- Walker & Dunlap

- McDermott Will & Emery, corporate law firm

This is a bold and public use of corporate funds by these companies to separate themselves from the pack. Even more so that the overall corporate tide is turning away from heavily in-person work models.

|

“More than a third of companies expect to reduce the size of their office space in the next five years, including 86% of accounting firms, 43% of public relations businesses, and 38% of tech companies.” Forbes |

Many companies are using the WFH revolution to cut costs by shrinking their footprint, which is a stark contrast to paying $300 per square foot in an elite Manhattan office. This only makes a far more pronounced statement that they can afford to invest in in-person collaboration whether it’s here to stay or not.

It also comes as Manhattan offices largely sit empty. Major organizations are going to great lengths to cut down their space. Meta decided against a planned 300,000 square foot expansion. It also stopped all plans to build new offices in Hudson Yards. While at the same time, Amazon retreated from a deal with JPMorgan to sublease the NYC space they are attempting to discard.

According to the NYC Housing and Vacancy Survey, there is currently and 13% vacancy rate and a 50% usage rate of Manhattan offices. So essentially, half of the world’s most expensive corporate real estate is sitting empty. We are talking billions of lost revenues to underutilized space. Something has got to give.

When you compare this rate to average rent rates around the country, it’s hard to understand why any business would put up with this cost. This is especially true as Manhattan’s reputation has taken large hits in the past few years due to notorious, skyrocketing crime. Part of these criminal outbursts are a result of the widespread frustration of the city’s expenses.

|

“The murder rate today looks much like it did in 2009, when the city was clawing its way back from the last national economic collapse.” Bloomberg |

Of course the irony of paying $300 per square foot for rent is that crime and homelessness are going up. As a result, in the last two years, NYC lost 5,200 private businesses. However, it doesn’t end there. According to Forbes, 1 in 5 financial firms are plotting moves out of Manhattan. With the most expensive rental rate in the country coupled with deteriorating conditions, it’s a no-brainer that companies want to pull away.

But, where are they going?

Well, for starters, many are moving to the sunbelt, which is a region of low cost and high opportunity for businesses. In business-friendly states, CRE is listed for a fraction of the cost of traditional business hubs like NYC. In Texas, Florida, Tennessee, etc. Corporate tenants can scoop up premium Class A offices (even in metropolitan areas) for cents on the dollar. Relocating is a smart move for companies that still believe in the value of in-person collaboration but no longer see the ROI for an expensive corner office in Manhattan. If you have underutilized properties, which you likely do, moving to a region with a lower cost of living will allow you to retain the size of your footprint but still dramatically reduce costs for a ten-year lease.

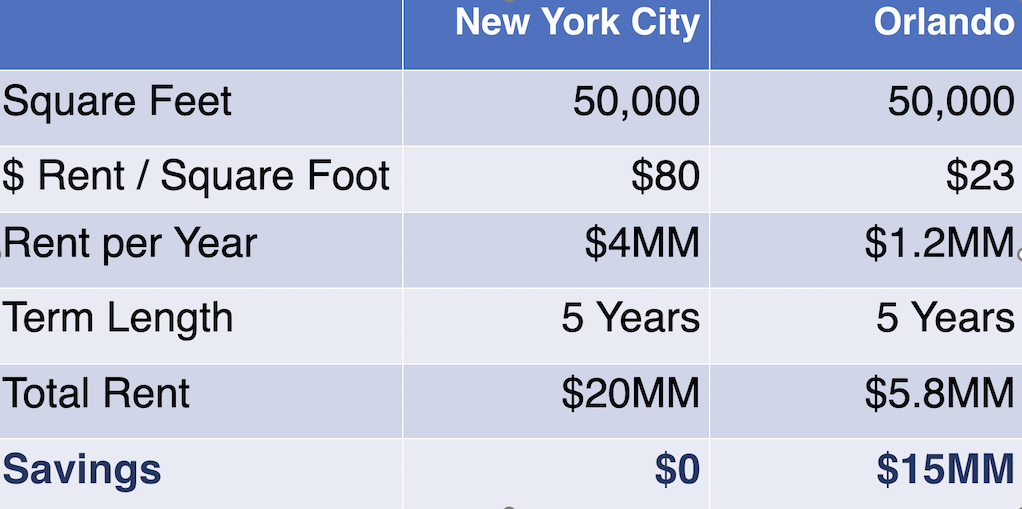

For example, let’s say you get a good deal for a NYC lease- at $80 per square foot. Remember to put this in perspective- $80 per square feet is a good deal in Manhattan right now. On the other hand, cities in the sunbelt like Orlando, Florida are being listed in the twenties per square foot. Think of what taking that extra multi-million dollar load off your EBITDA can do for your organization.

The point is that tenants looking to save, have the opportunity to do so.

Save Big on Manhattan CRE With a Tenant Rep

If you want to be in NYC, a Tenant Rep can help you get a great price and the best terms. This is NOT the time to be using the landlord's broker. Right now, there’s incredible leverage for tenants wanting to expand their footprints. Since so many companies are slashing their space, this introduces a window of opportunity for those looking to retain their offices but still cut costs. For example, true Tenant Reps know that there is currently 232 million square feet of surplus commercial real estate up for sub-leasing, which is twice the level of pre-pandemic norms.

With so much sublease space available, it is driving down the market value of comparable properties to stay competitive. So, your Tenant Rep will utilize this and other factors to get you a better deal. You have the potential to reduce your current rent to market value, receive more concessions, and improve your bottom line.

Whether you want just get a much better renewal deal in NYC or want to consider moving to a more cost effective area, the true Tenant Reps at iOptimize Realty® have the experience and market knowledge to make it happen for you. And we make it easy by taking on 90% of the tasks. We’ll even fly you around to tour sites in our own jet. You can’t get much easier than that. We typically save upward of 30% of our client’s total cost of occupancy. Businesses looking to move can receive a premium for their tenancy, effectively taking millions off the top of their CRE costs- we have seen it happen. And you can achieve it too.

Moving to a cost-effective region will give you more financial freedom, and many businesses are taking advantage of this opportunity- especially as About 91% of C-Suite professionals recently polled believe the U.S. is in a recession. Corporate spending has never been more scrutinized, so don’t take any chances. Now is not the the time to be cavalier about your CRE needs.

Call us today if you have any questions. We are here to help corporate tenants.

Wondering where to begin?

Related Content

- Is Your NYC Office Space a Liability? The CRE Migration to the Suburbs

- Should You Renew or Relocate Your CRE in the Recession?

- Miami is a CRE Hotspot: What Corporate Tenants Need to Know

- City Commuting Just Got More Complicated: How it will Affect Your CRE