In this article, you'll learn:

- Why sublease clauses are critical for protecting tenants during market shifts.

- How rising sublease space is driving down office and industrial rents.

- The negotiation power tenants gain from increased sublease availability.

- How Tenant Reps can help you leverage the sublease market to reduce costs.

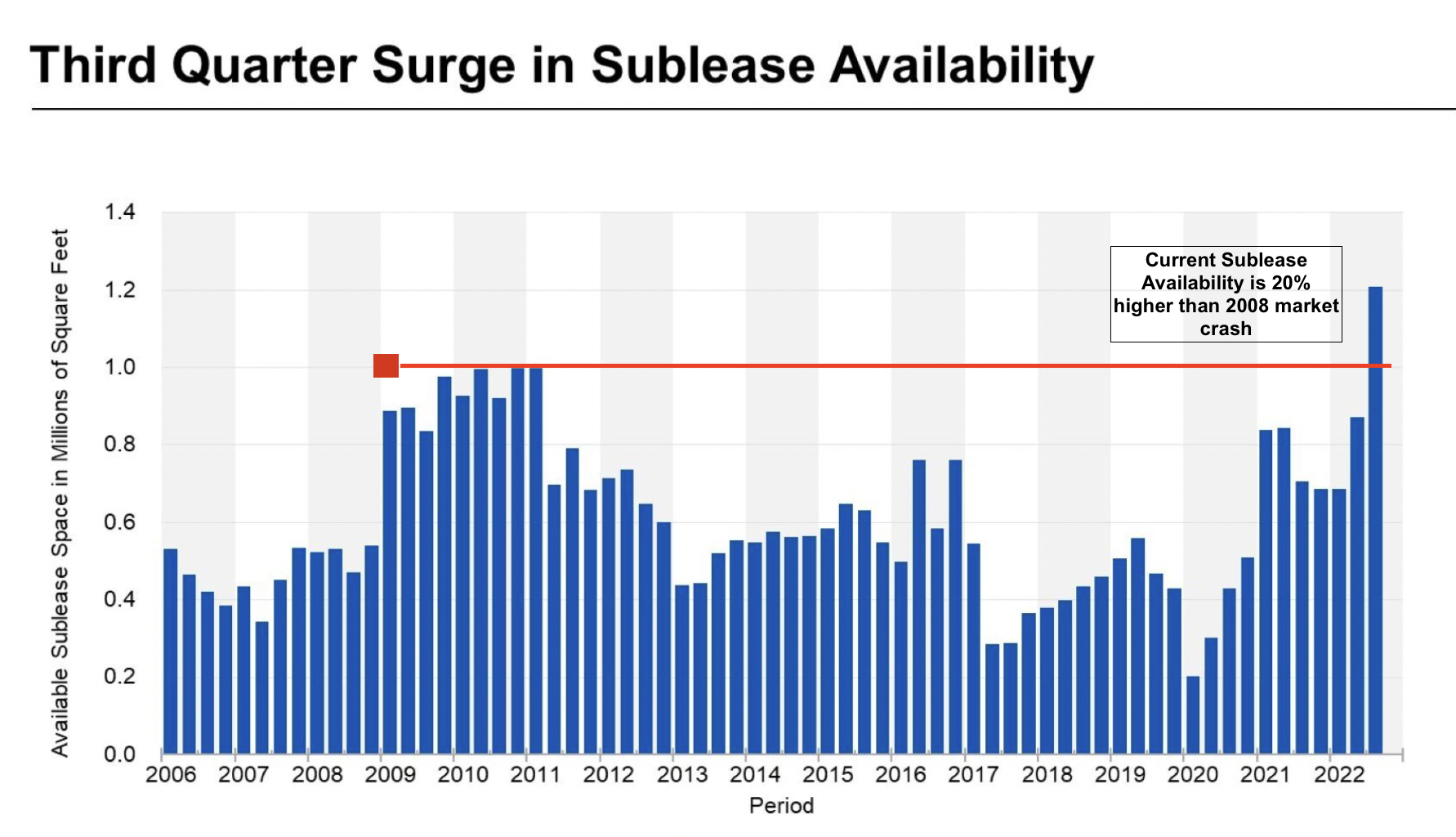

While subleasing was always one of the most critical terms to get right in your commercial lease, now there’s more pressure. The boom in sublease space across the top 53 office markets in the US is significantly driving down the cost of commercial properties, and this has inordinately affected commercial landlords. Now, the burden is on commercial tenants to make sure they don’t take on the brunt of this crisis with poorly negotiated sublease clauses.

However, with so much sublease space available, it is a great time for tenants to capitalize on the market and negotiate for lower rents, better concessions, and more favorable terms. Learn why.

Check Your Sublease Clause (And Check it Twice)

The inevitability of change in any business situation makes contingency planning a vital component to consider when signing sublease and / or assignment clauses. In the event of the unexpected, a weak clause makes it difficult, if not impossible to sublease your property. This case will most assuredly circumvent your profitability and ability to function. Now you're stuck with a space without the ability to mitigate your loss.

The pandemic and Work From Home (WFH) revolution was a reminder, if anything was, that disaster can strike, and businesses need to pre-implement safeguards to minimize nearly inevitable negative effects. While subleasing was never the perfect solution, it helped tenants partially mitigate the unforeseen financial hole incurred from underutilized offices.

Even before the pandemic, the sublease clause was already one of the most dangerous clauses in a lease. The sublease clause is an opportunity to save money while adapting to your company’s changing demand for space and external disrupter events.

But typically, leases are written with the initial bias towards the landlord. Legal jargon landmines are laid out everywhere, ready to take out the budget of unsuspecting tenants. Certain stipulations (or omissions) can limit your right to exercise your sublease. Learn Why a Properly Negotiated Sublease Clause is Critical to Your Commercial Lease.

Essentially though, creating a strong sublease clause is one of the most effective ways a company can protect itself moving forward. It also increases the likelihood of a financially beneficial sublease agreement.

But now, even more pressure is applied on the importance of properly defining your sublease clause because of the sheer volume of sublease space flooding the commercial market. Landlords are becoming increasingly careful about how they write sublease clauses, driven by the boom’s cataclysmic effect on the valuation office rents.

|

Across the Top 53 Office Markets in the US, sublease space totaled 160 million square feet. -Propmodo |

With so many offices available for sublease, the abundance is cannibalizing the rest of the office market and driving down the cost of even first-gen office space significantly.

Subleases Driving Down Cost of CRE

While already struggling to find new or renewing long-term tenants, property owners now need to compete with subleases. In fact, they have to heavily discount the space in order to move it. And while it's almost never the case where a tenant could conceivably make profit on the sublease, what landlords are now fearful of is sublease space within their own buildings competing with their efforts to lease other vacant space within their building.

As a result, subleases are further driving down the market rate of Class A office space. Unfortunately, this stress has finally reached a breaking point, causing major landlords to default. Read about it: Office Landlord Debts and Defaults are on the Rise.

But, for those who believed record sublease rates were a problem just for the office sector, we have bad news. Trouble is now rippling through the industrial market as demand reached its peak and has since declined.

According to Propmodo “Amazon, the largest corporate owner of industrial space in the country, closed several of its facilities last year, postponed the openings of new warehouses, and reportedly put 48 spaces on the sublease market.”

This comes at a time of new concern for the new industrial market. While it was able to remain afloat, even prosperous during the pandemic, due to e-commerce demand, there are now more facilities than tenants looking for warehouse space. Rise in subleased warehouse space is also a byproduct of rising interest rates, ramped-up construction, and overall shifts in consumer attitudes.

Sublease Demand Across Office and Industrial Markets

So, the office and industrial markets have appeared to play off the inverse of each other. When office demand was at record lows, warehouse demand was at its highest levels. Now that office occupancy levels have more or less evened out, there is concern in the warehouse market reflected by rising subleases.

National Office Subleasing Rates the Third Quarter of 2022

National Office Subleasing Rates the Third Quarter of 2022

This exact circumstance is what keyed into many professionals the truth of how far the office market would plummet.

|

The relative calm in the office leasing market was not mirrored by the sublease market, which saw inventory ratchet up to record highs. -Propmodo |

But now, there’s something interesting happening in the office leasing environment. Truthfully, we may have seen the worst of the office sublease market. According to a study titled, “The Office Apocalypse”, predicted that as much as 70% of leases signed pre-pandemic have not reached the end of their term. So, tenants who may have been stuck with space were subleasing rather than terminating or defaulting on their agreements.

This means that as expiring leases flood the market in the coming years, it represents a spot of hope for corporate landlords that prices will stabilize as occupancy rates (sort of) have. Let’s talk about what this means for you as a tenant.

What Sublease Availability Means for Tenants

With so much sublease space on the market, it’s making commercial landlords more competitive to lure in tenants (especially for long-term leases).

This means that corporate tenants have more power to negotiate for lower rents, better concessions, and more favorable terms. If you are looking for new space, you can capitalize on this market. Use the record-high sublease availability as a negotiating chip. If one landlord doesn’t want to offer you a premium for your tenancy, another will.

|

“Competing with sublease space means offering concessions because lowering rents can have a negative impact on building valuation and, worse case, even trigger loan covenants. Historically high concessions have pushed net effective rents to 14.7 percent below pre-pandemic levels.” -Propmodo |

No matter whether you are a warehouse or office tenant, you can take advantage of the sublease availability. For office tenants, time is certainly more of the essence. The sublease cycle is approaching its culmination likely as pre-pandemic leases reach their expiration and companies trend towards streamlined utilization metrics in new leases. This means that in all likelihood you have the next year or so to take advantage of record-low office prices.

For industrial tenants, the tide is beginning to turn. Since warehouse demand is beginning to wane and sublease rates go up, this could represent a new opportunity. The warehouse market was extremely tight since the pandemic. This is one of many signifiers that things are changing. Landlords are considering how they can be more attractive to potential tenants. Learn How to Negotiate Your Best Warehouse Lease in a Tight Market.

If you are several years into a lease, you have the potential to renegotiate the existing terms and clauses. Your landlord may be willing to offer you more concessions if you sign on for a longer period. Your tenancy represents guaranteed income... so they may be willing to sweeten your deal if you extend your stay. This is especially true because a long-term tenant is a lot more attractive than a transitory sublease.

How Tenant Reps Help You Take Advantage of Subleases

At iOptimize Realty,® we are True Tenant Reps™ with 30+ years of experience market intelligence, analyzing trends to direct our corporate clients to big savings. We have seen how sublease space has evolved and left room for the right tenant to dramatically reduce their overhead. Don’t become complacent in a space that is actively losing money.

There’s never been a more critical time to negotiate and streamline your portfolio. And when you go into renegotiation, you want to trust your knowledge and level of preparation. Working with a Tenant Rep is as if your company had a surrogate real estate department. You can offload your CRE responsibilities and stresses to trusted hands that only have your best interests in mind. As experts in negotiation, Tenant Reps are empowered to secure you the best possible solution for your commercial renegotiation.

Work with a True Tenant Rep™ at iOptimize Realty, ® to renegotiate your commercial lease and dramatically improve your workspaces and bottom line.

Wondering where to begin?

Related Content

- What the Sublease Boom Means for Corporate Tenants

- Commercial Tenants: Reminder to Review Your Sublease Clauses

- Why a Properly Negotiated Sublease Clause is so Critical to Your Commercial Lease

- Signing a New Office Lease? Beware the Following Office Lease Clauses