In this article, you'll learn:

- How Debt Service Coverage Ratio (DSCR) measures landlord financial stability and default risk.

- The impact of low DSCR on property maintenance and lease security.

- Risks associated with cross-collateralization of properties.

- Cities with the highest default risks due to low DSCR, such as Brooklyn and Chicago.

- Tips for tenants to protect their interests in financially unstable markets.

We’ve talked a lot about the risk that the office sector currently poses to the greater economy. And within the office market, there is more pressure than ever.

For tenants, the risk of widespread landlord defaults has never been more acute. So, to avoid getting stuck on a sinking ship, most corporate tenants taking on office leases, are refusing to negotiate with landlords until they see cold, hard proof that their property owner has the finances to back a long-term lease.

In this scope, the spotlight has often fallen on the Debt Service Coverage Ratio (DSCR). This critical metric, among others, is essential for gauging the financial performance of landlords and the stability of commercial real estate markets.

And beyond identifying slipping landlords, DSCR’s can also pinpoint regions where risk is more concentrated. So, let’s briefly discuss what the DSCR is and apply it to a geographical scope. Analysis of DSCR's not only underscore challenges in the office sector but also reveal cities where financial vulnerabilities could have broader economic implications.

What is the DSCR?

The Debt Service Coverage Ratio (DSCR) measures a property's ability to generate enough income to cover its debt. It can be identified by dividing the Net Operating Income (NOI) by the Annual Debt Service. The end number is a window into the financial health and stability of commercial properties.

The Importance of DSCR in Identifying Distress

A healthy DSCR is essential for both landlords and tenants.

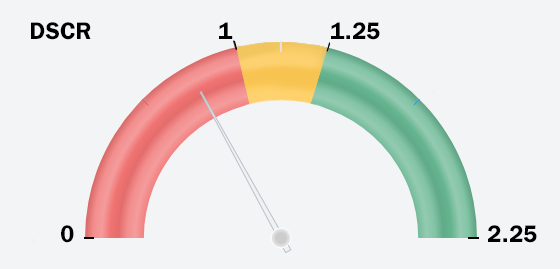

A DSCR above 1 indicates that the property's income exceeds its debt payments, suggesting financial stability. Conversely, a DSCR below 1 signals financial distress, as the property’s income is insufficient to cover its debt obligations.

Lenders typically require a DSCR of at least 1.25, and prefer higher values, such as 1.35 or better, to mitigate risk.

|

“The ratio has been slipping for years as office cash flow fell and expenses rose, while interest rates and debt costs climbed.” -GlobeSt |

By using the DSCR, tenants can identify which landlords are at greater risk of default. Because a low DSCR signals to tenants that the property is at risk of being underwater.

Of course, this raises concerns about the landlord's ability to maintain the property and fulfill financial commitments, often leading to issues like deferred maintenance, rent increases, or even foreclosure.

In today's real estate market, especially with rising vacancy rates in office buildings, maintaining a healthy DSCR is more critical than ever. High vacancy rates can reduce NOI, causing the DSCR to drop below acceptable levels, then leading to a decline in property value and even foreclosure. Properties that fail to meet DSCR requirements risk legal and financial complications, underscoring the importance of this metric.

And in a post-apocalyptic office market, 1 in 3 landlords are at risk of default due to widespread vacancies and low occupancy rates. Therefore, tenants are looking closely at the finances of potential landlords, so they don’t get caught in a long-term lease with a failing landlord.

But it’s not just the single property the tenant may be interested in leasing that they must conduct due diligence for because landlords often cross-collateralize their loans.

Cross-Collateralization and DSCR

Cross-collateralization occurs when multiple properties are used as collateral for a single loan. This means that if one property underperforms or fails to generate sufficient income, it impacts the entire portfolio of properties tied to that loan.

It complicates the assessment of DSCR because it involves multiple properties tied together under a single debt obligation.

So, when considering a lease, tenants must not only evaluate the financial health of the specific property but also consider the overall DSCR of the landlord's portfolio. A low DSCR in one property can affect the stability of all cross-collateralized properties.

This shared risk means that financial issues in one building (that may not even be on your radar) could lead to problems across the entire portfolio, potentially affecting maintenance and services of the building you’re leasing. Read about how to prevent this from happening with The Right of Offset.

Properties under cross-collateralization are more vulnerable to foreclosure if the DSCR requirements are not met. In such cases, tenants might face disruptions or changes in property management if a special servicer or receiver is appointed.

Which Areas are at Most Risk?

So, the same way tenants should identify their landlord’s DSCR across their portfolio, the strategy can be applied to potential geographic areas of interest.

Overwhelmingly, cities with low average DSCR’s are struggling with demand dwindling, expenses rising, and insufficient relief from interest rate adjustments. The financial outlook for their respective office markets is in hotter water, with tenants more likely to experience the issues associated with an at-risk landlord.

Commercial Edge’s May 2024 national office report measured debt service coverage ratios for offices and identified a handful of markets where widespread risk is concentrated. So, when considering the gauge of 1.25 as an acceptable DSCR, 8 cities were either far below or borderline failing that metric:

Cities with DSCR's Below 1.0:

- Brooklyn (0.81)

- Oklahoma City (0.89)

- Chicago (0.9)

- El Paso (0.92)

- Cleveland (0.96)

Cities with DSCR's on the Borderline or Below 1.25:

- Manhattan (1.05)

- St. Louis (1.16)

- Nashville (1.25)

The report also warned that the downward pressure on average DSCR’s in these cities was unlikely to lift in the near future. Still, though, this does not necessarily mean that every property in these areas is on a watchlist. For example, there is still persistent interest in higher class properties.

Top-tier office assets in quality locations continue to be in high demand, driven by a pronounced flight to quality. Amidst market uncertainties, this phenomenon underscores a preference for stability and long-term value, positioning these assets as anchors in fluctuating economic landscapes.

|

"Many properties within markets with low average DSCRs continue to perform well, while properties in markets with a high average DSCR face distress." -Commercial Edge Report |

The hurt in the office market extends beyond cities with the lowest DSCRs. Widespread issues in office space, have significantly affected major tech hubs. Year-over-year vacancy rates surged by 650 basis points (bps) in San Francisco and 400 bps in the Bay Area and Seattle.

Cities heavily reliant on financial services also felt the strain, particularly Dallas, which saw a rise of 390 bps, and Charlotte, up by 380 bps. Even the life sciences sector faced challenges, with Boston experiencing a 230-bps increase in vacancies and San Diego seeing a 370-bps rise.

But average vacancies rose in almost every market across the country. The national vacancy rate has reached an unprecedented, 19%. Of course, with demand overwhelmingly in a tailspin, the under-construction pipeline for office has plunged by more than 50%.

So, while the financial outlook for the markets of low DSCR’s face a great deal of concentrated risk, nowhere is really completely safe. That is, unless you safeguard your own interests with sufficient due diligence.

Expert Due Diligence

While cities with the lowest DSCR's signal potential financial instability in commercial real estate, tenants can take proactive steps to safeguard their interests.

Landlords may be reluctant to disclose DSCR's or agree to lesser-known, tenant-favorable clauses during lease negotiations, posing challenges for tenants seeking advantageous terms. This underscores the critical role of a True Tenant Rep™ in advocating for tenants' interests.

A True Tenant Rep™ offers specialized expertise and focuses solely on securing favorable lease terms for tenants. Unlike dual agents or landlord representatives, they prioritize the tenant's needs and navigate complex negotiations to mitigate risks associated with a landlord's financial instability impacting property services. By partnering with a dedicated tenant representative, tenants can confidently navigate lease agreements, ensuring their interests are protected and lease terms are optimized to their advantage.

And the True Tenant Rep™ experts wrote the handbook for tenants navigating the post-apocalyptic office market. It is the blueprint for coming out on top while escaping the crossfire between banks and failing landlords. Get your free copy today.